Eighth

Measuring Broadband America

Fixed Broadband Report

A Report on Consumer Fixed Broadband Performance

in the United States

Federal Communications Commission

Office of Engineering and Technology

Table of Contents

- Chart 1: Maximum advertised download speed among the measured service tiers

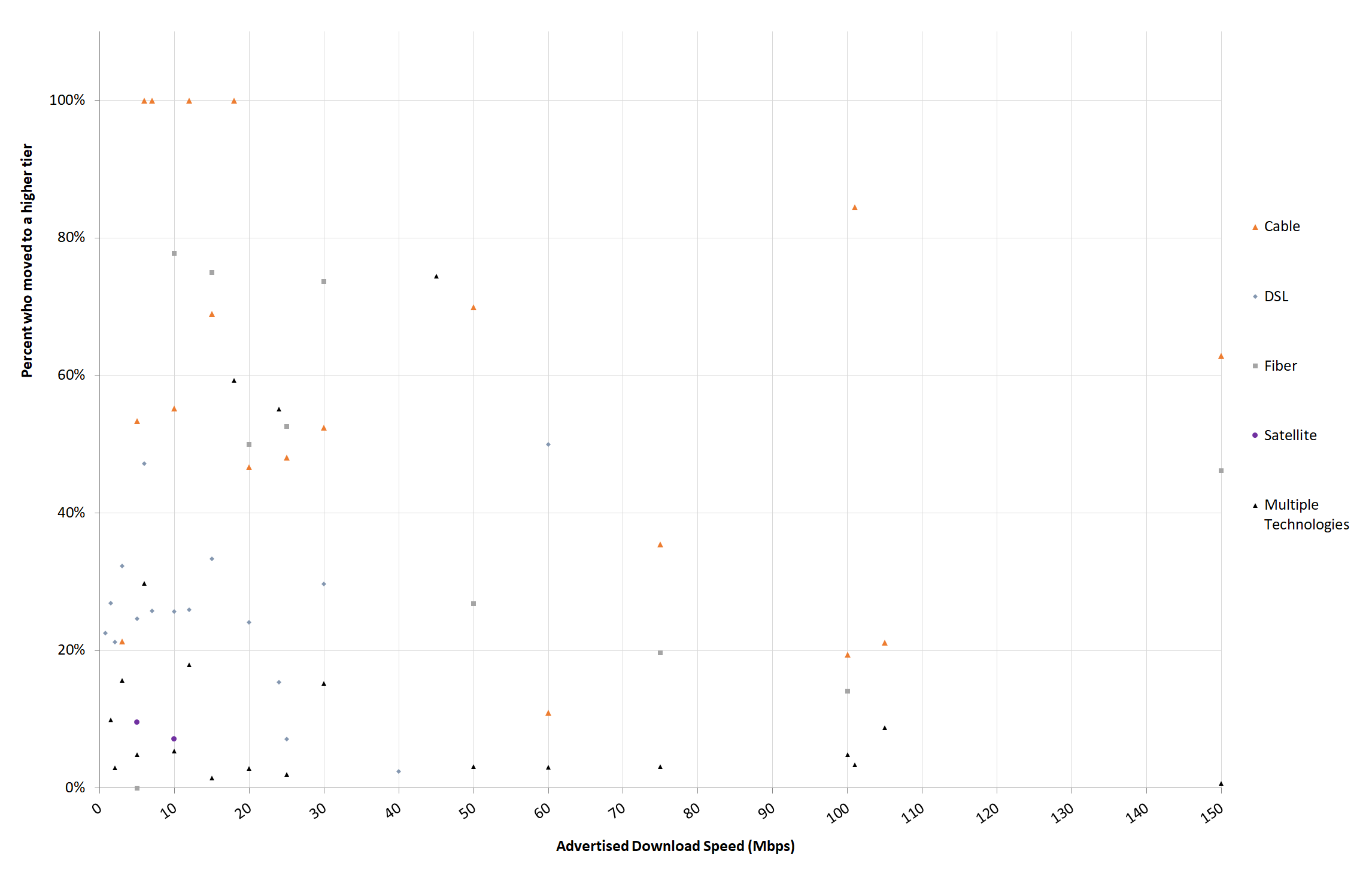

- Chart 2: Consumer migration to higher advertised download speeds

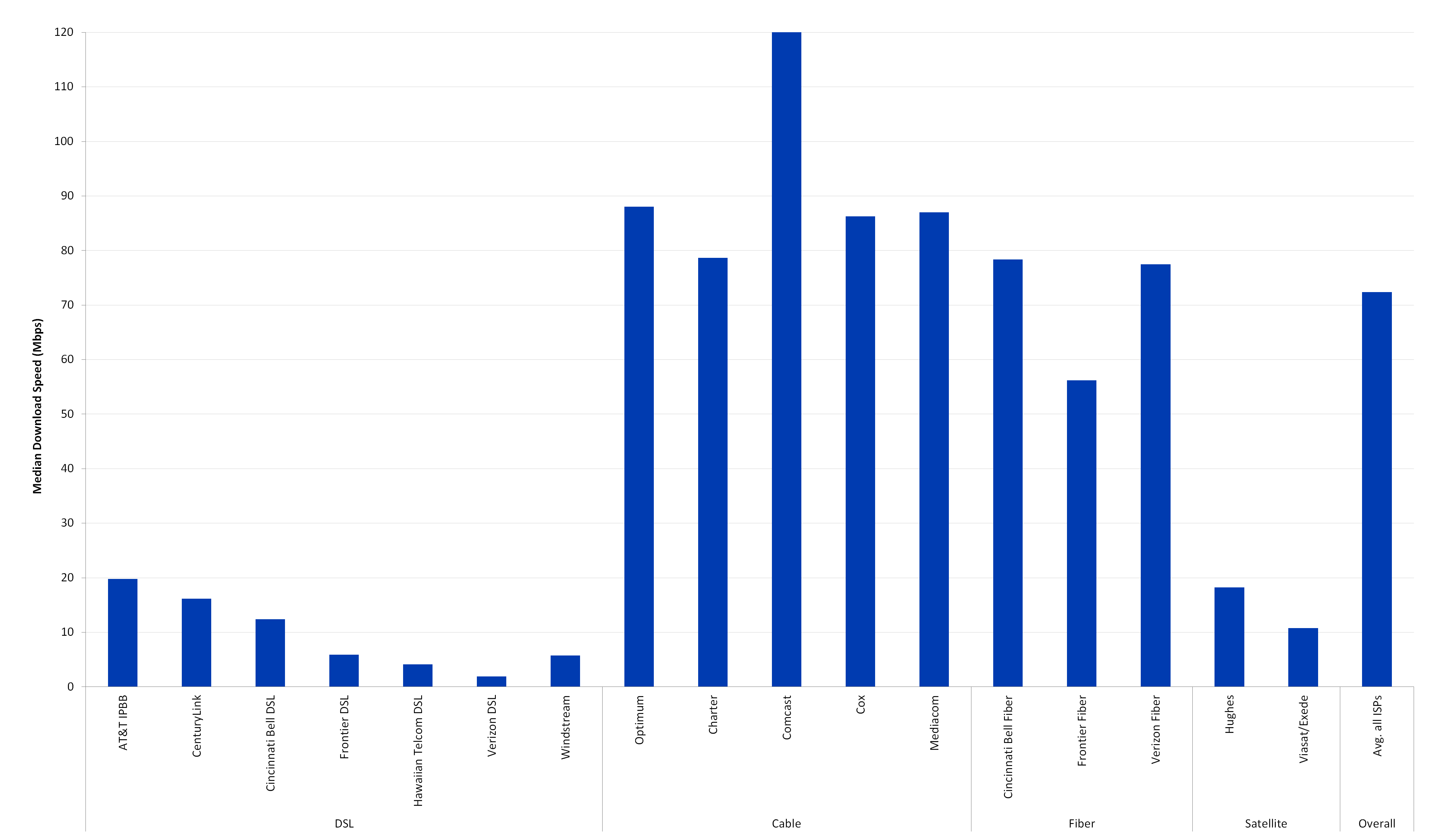

- Chart 3: Median download speeds by ISP

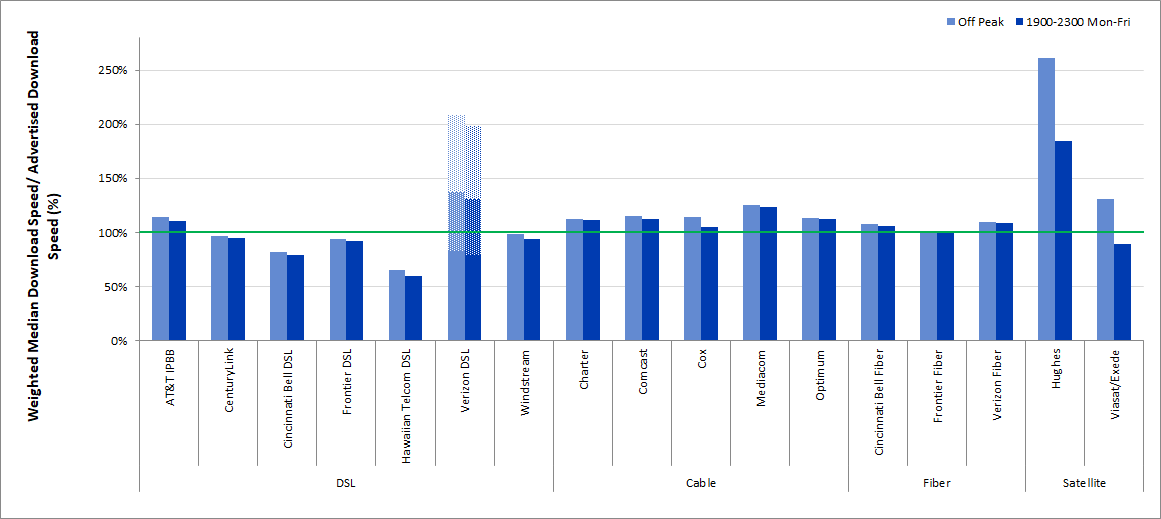

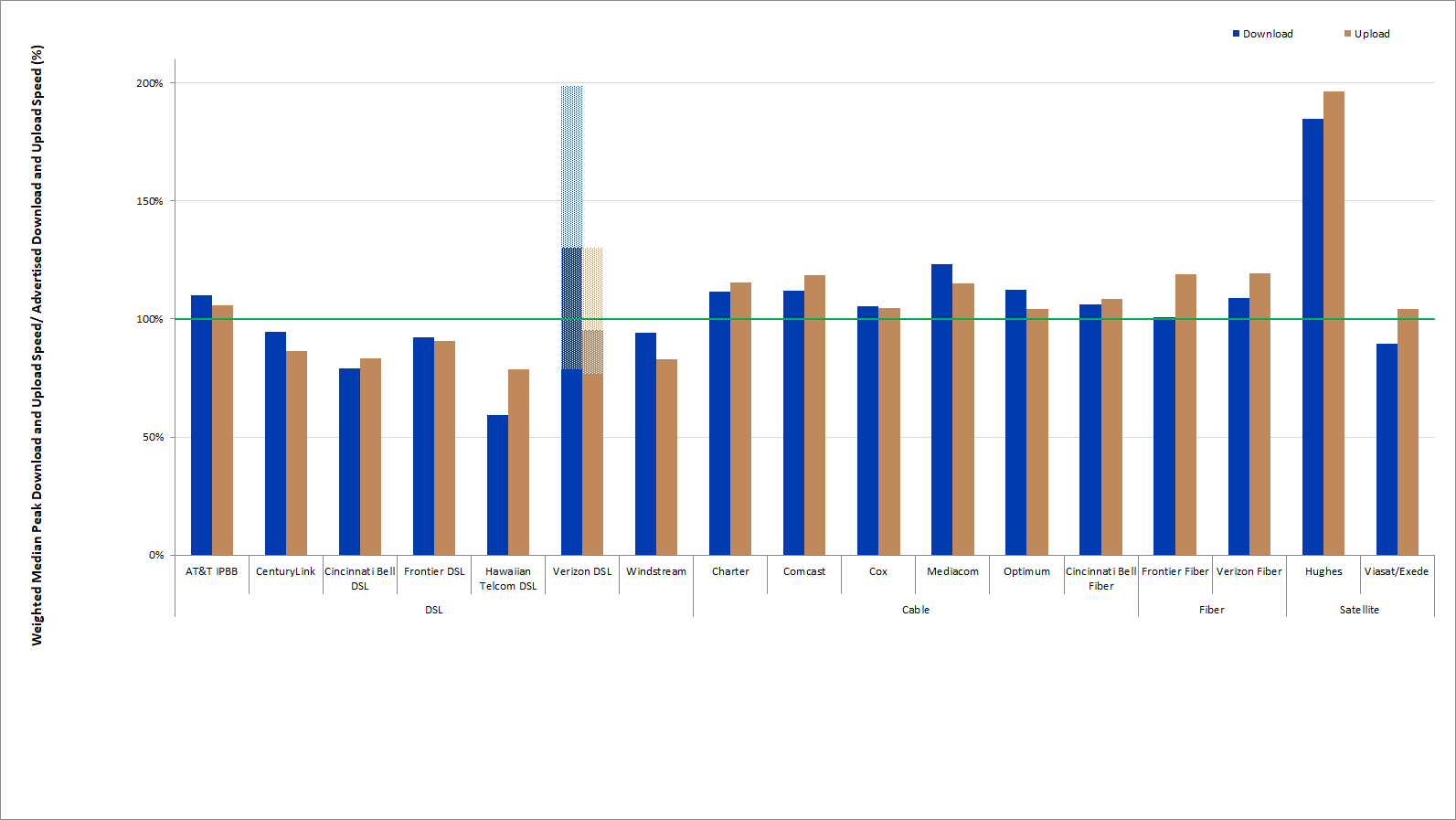

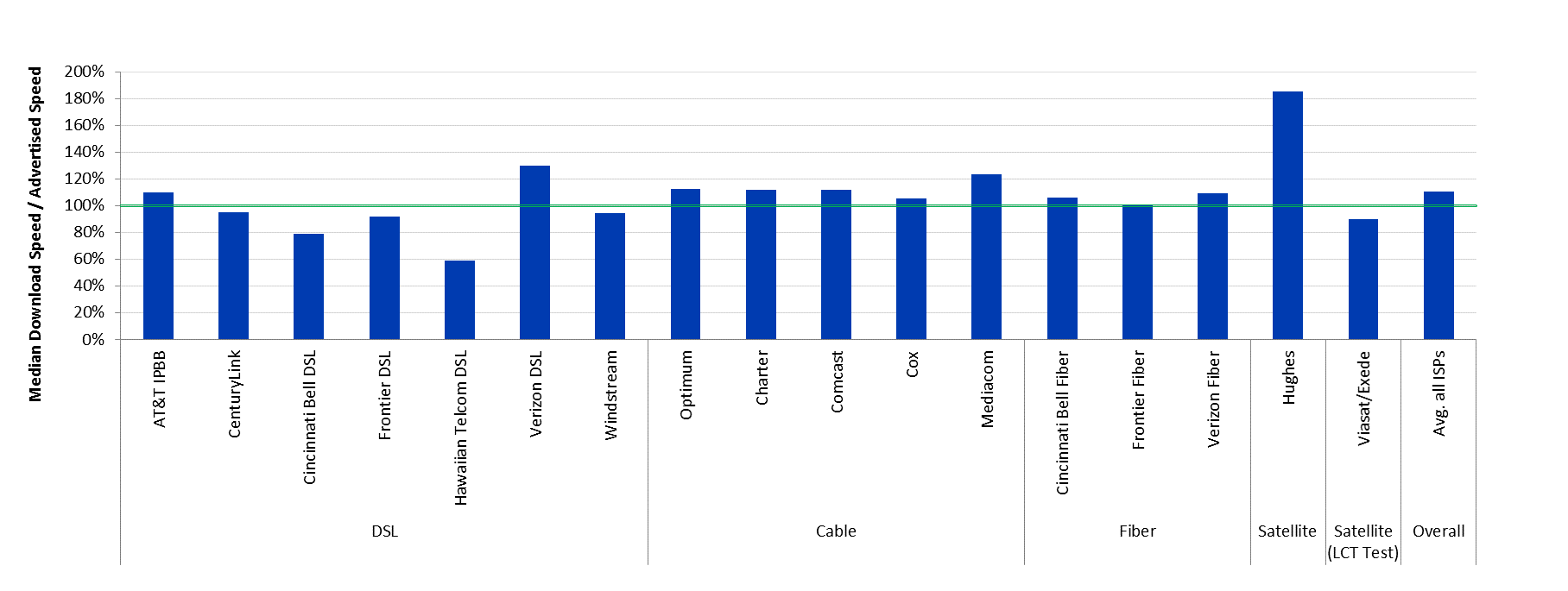

- Chart 4: The ratio of weighted median speed to advertised speed for each ISP

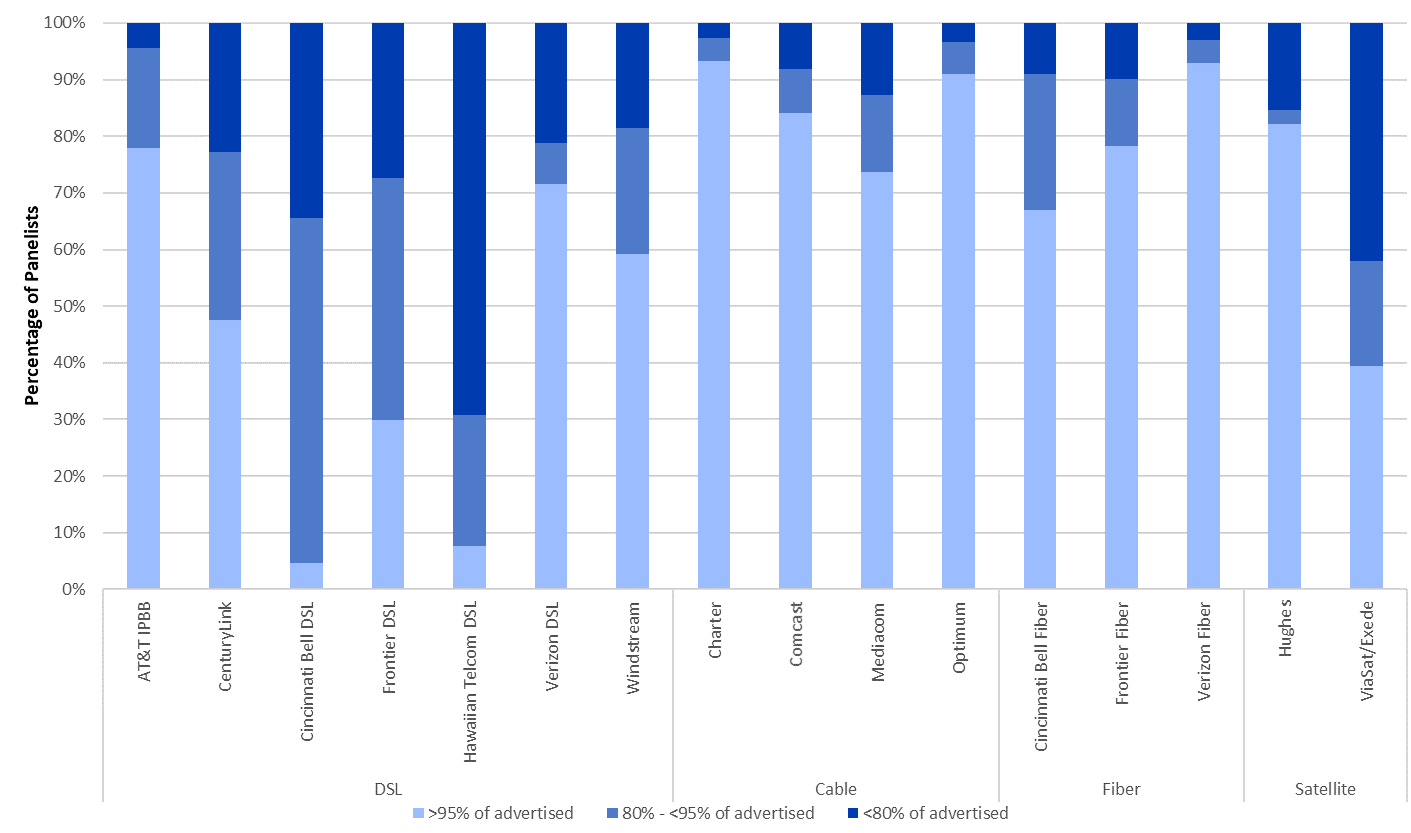

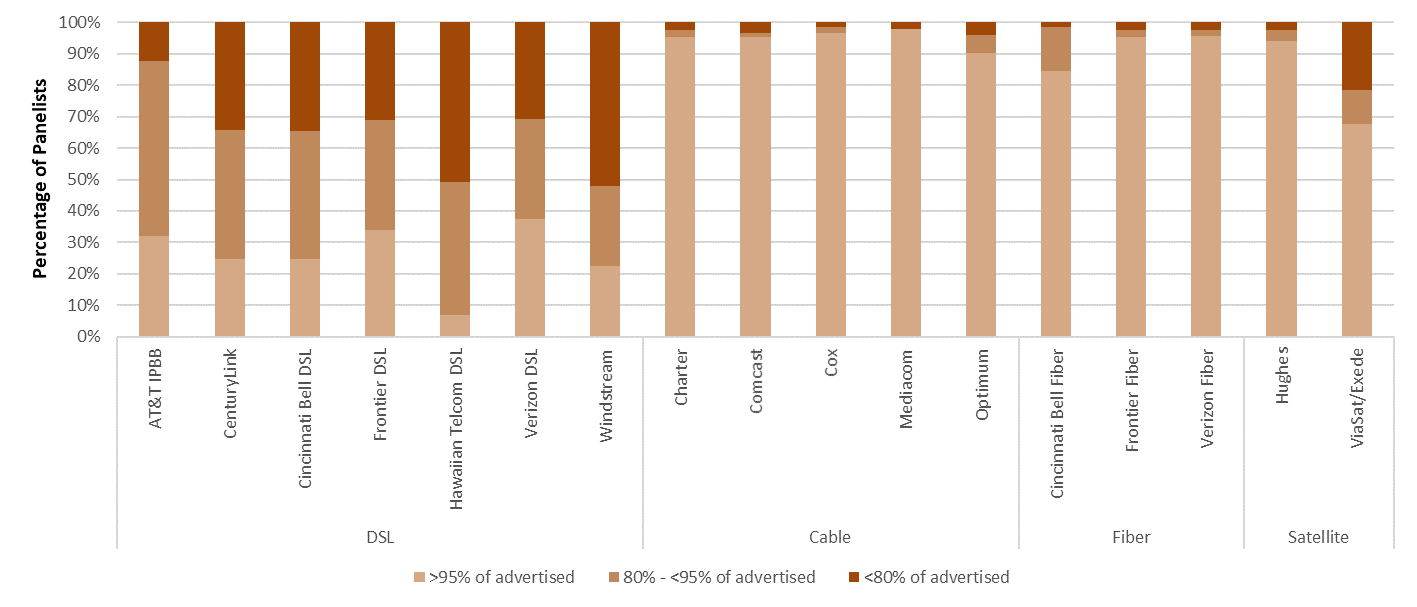

- Chart 5: The percentage of consumers whose median download speed was greater than 95%, between 80% and 95%, and less than 80% of the advertised download speed

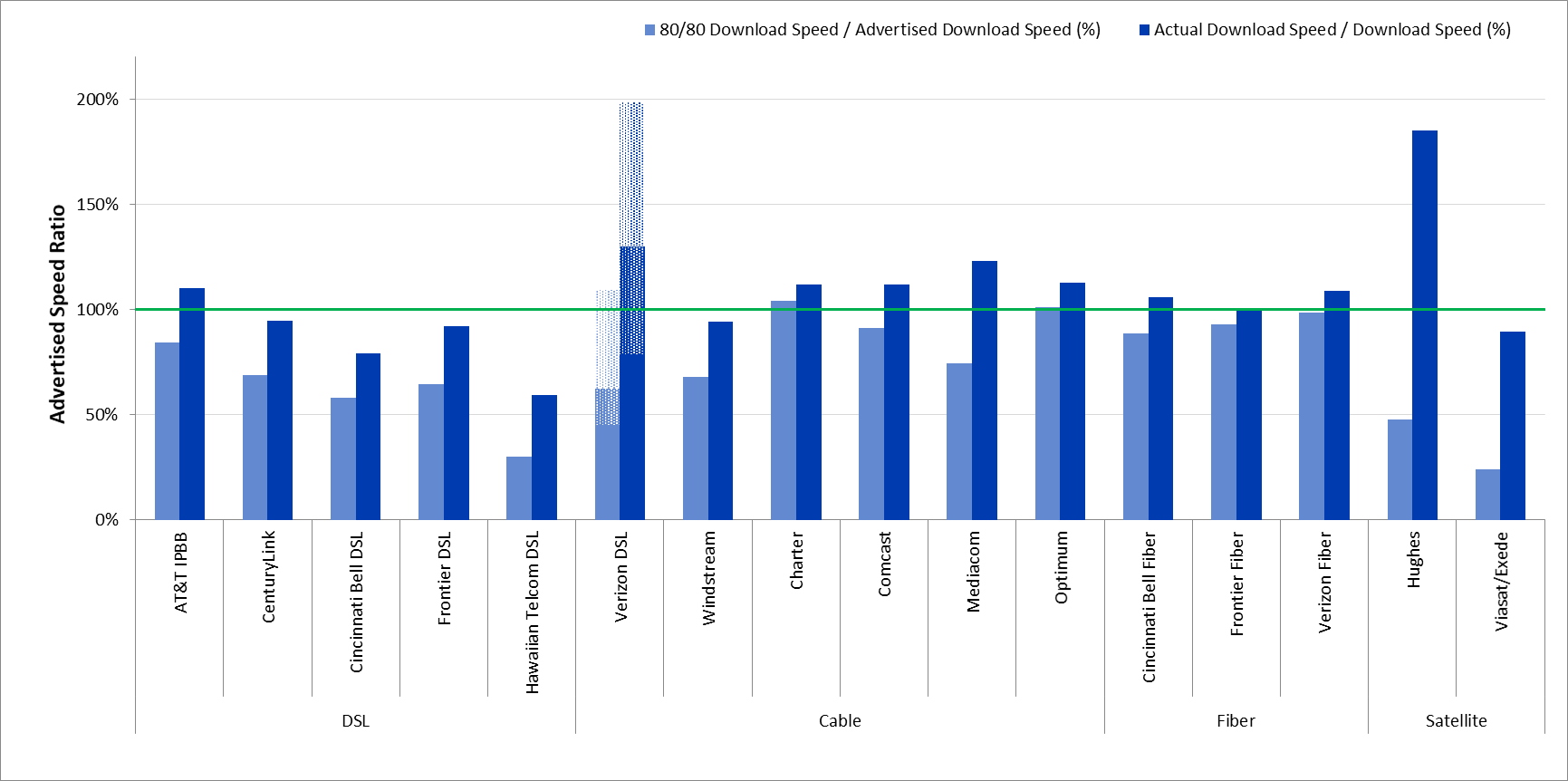

- Chart 6: The ratio of 80/80 consistent median download speed to advertised download speed

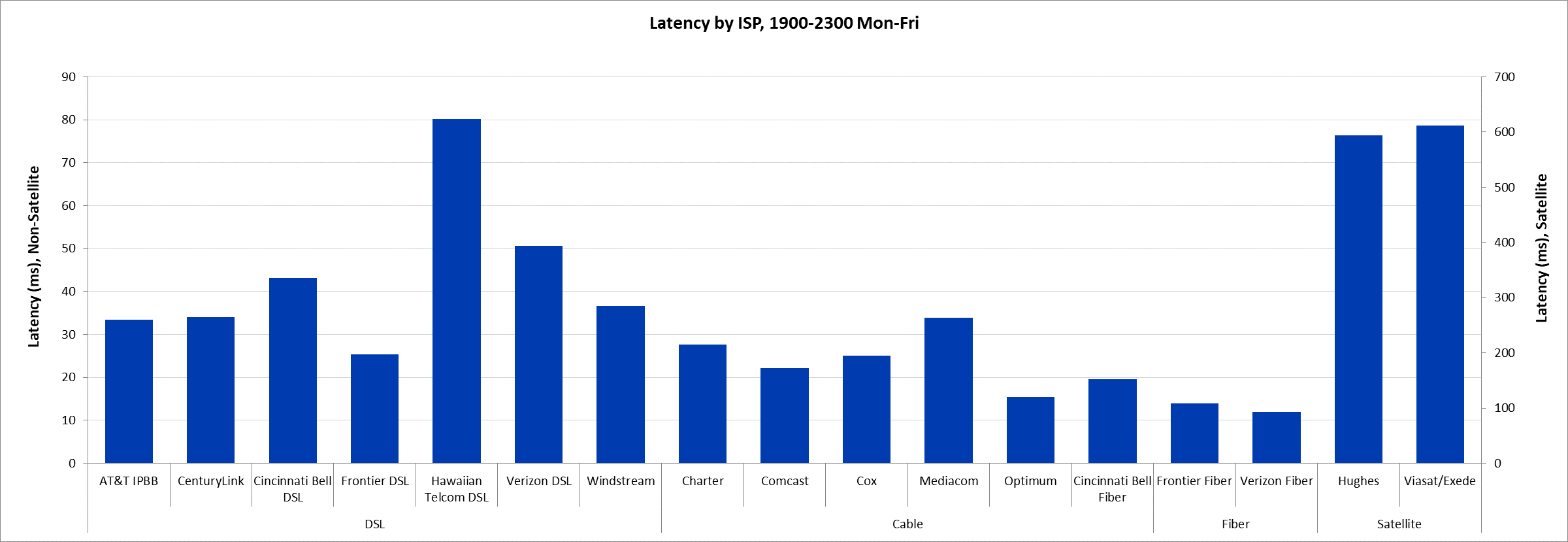

- Chart 7: Latency by ISP

- Chart 8: Percentage of consumers whose peak-period Packet loss was less than 0.4%, between 0.4% to 1% and greater than 1% by ISP

- Chart 9: Average webpage download time, by advertised download speed

- Chart 10: Maximum advertised upload speed among the measured service tiers

- Chart 11: Median upload speeds by ISP

- Chart 12: Median download and upload speeds by technology

- Chart 13.1: The ratio of median download speed to advertised download speed

- Chart 13.2: The ratio of median upload speed to advertised upload speed

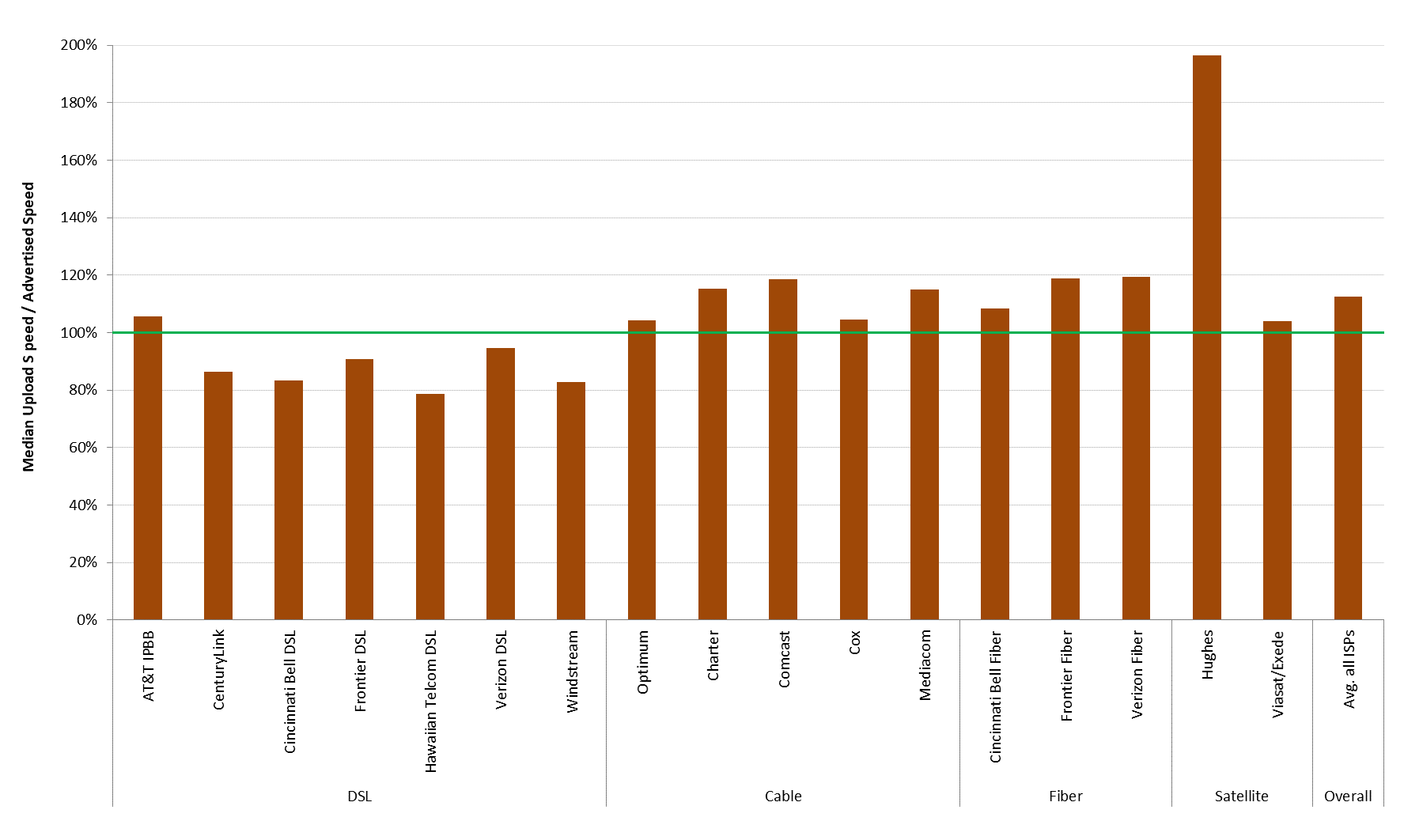

- Chart 14: The percentage of consumers whose median upload speed was greater than 95%, between 80% and 95%, and less than 80% of the advertised upload speed

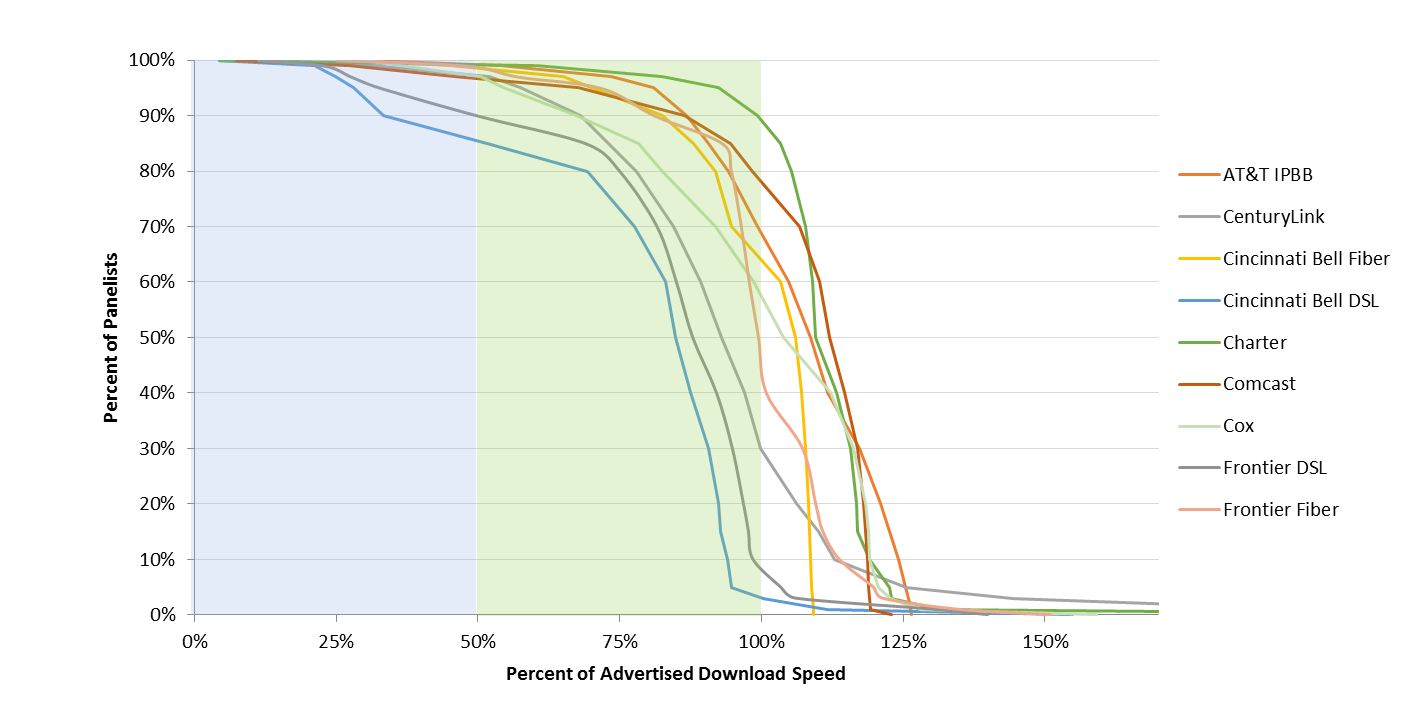

- Chart 15.1: Complementary cumulative distribution of the ratio of median download speed to advertised download speed

- Chart 15.2: Complementary cumulative distribution of the ratio of median download speed to advertised download speed (continued)

- Chart 15.3: Complementary cumulative distribution of the ratio of median download speed to advertised download speed, by technology

- Chart 15.4: Complementary cumulative distribution of the ratio of median upload speed to advertised upload speed

- Chart 15.5: Complementary cumulative distribution of the ratio of median upload speed to advertised upload speed (continued)

- Chart 15.6: Complementary cumulative distribution of the ratio of median upload speed to advertised upload speed, by technology

- Chart 16.1: The ratio of median download speed to advertised download speed, peak versus off-peak

- Chart 16.2: The ratio of median upload speed to advertised upload speed, peak versus off-peak

- Chart 17.1: The ratio of median download speed to advertised download speed, M-F 2 hour time blocks, terrestrial ISPs

- Chart 17.2: The ratio of median download speed to advertised download speed, M-F 2 hour time blocks, satellite ISPs

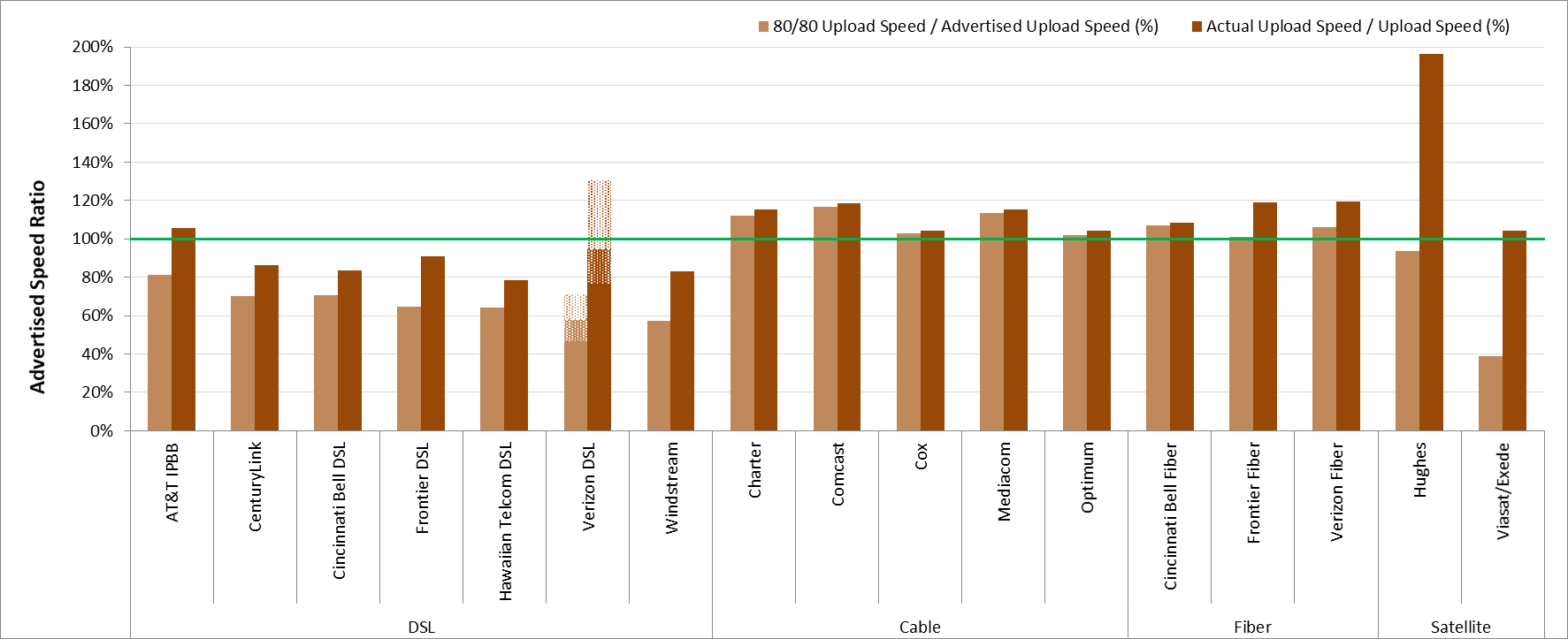

- Chart 18.1: The ratio of 80/80 consistent upload speed to advertised upload speed

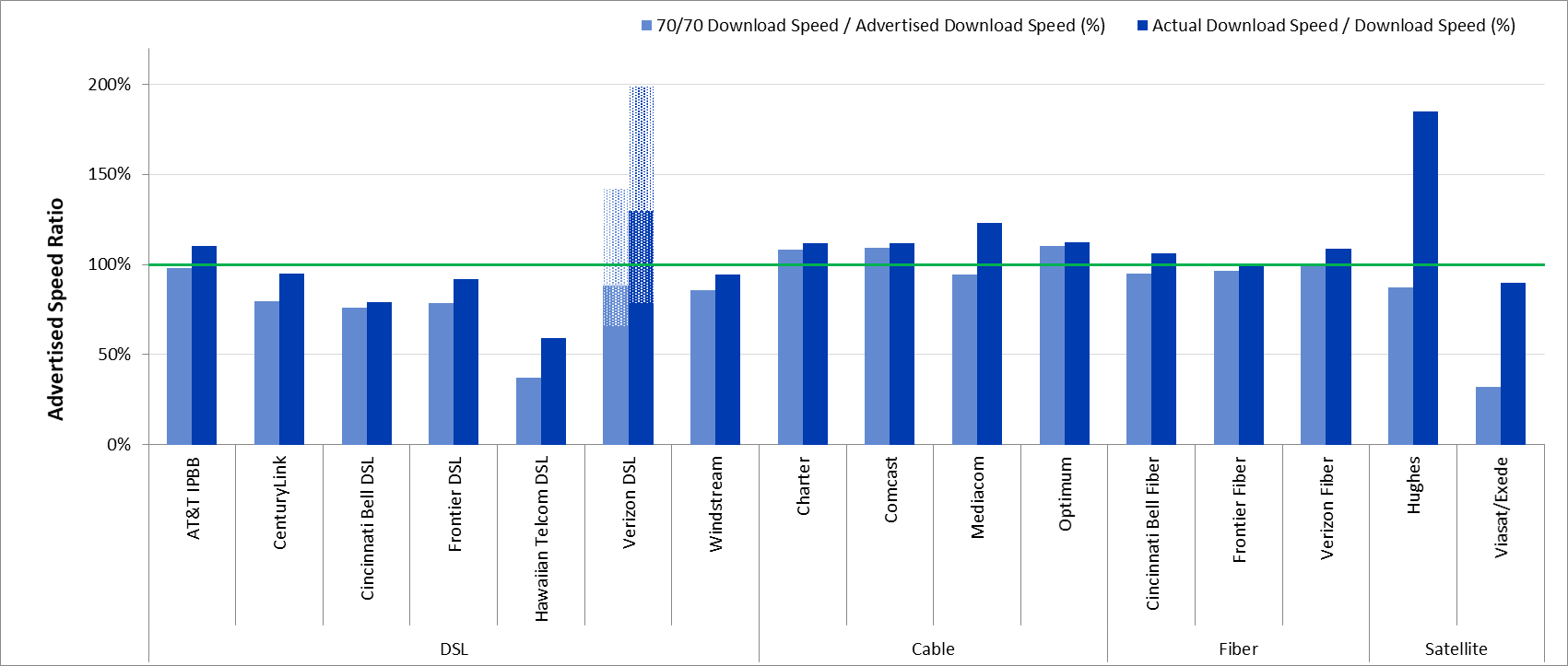

- Chart 18.2: The ratio of 70/70 consistent download speed to advertised download speed

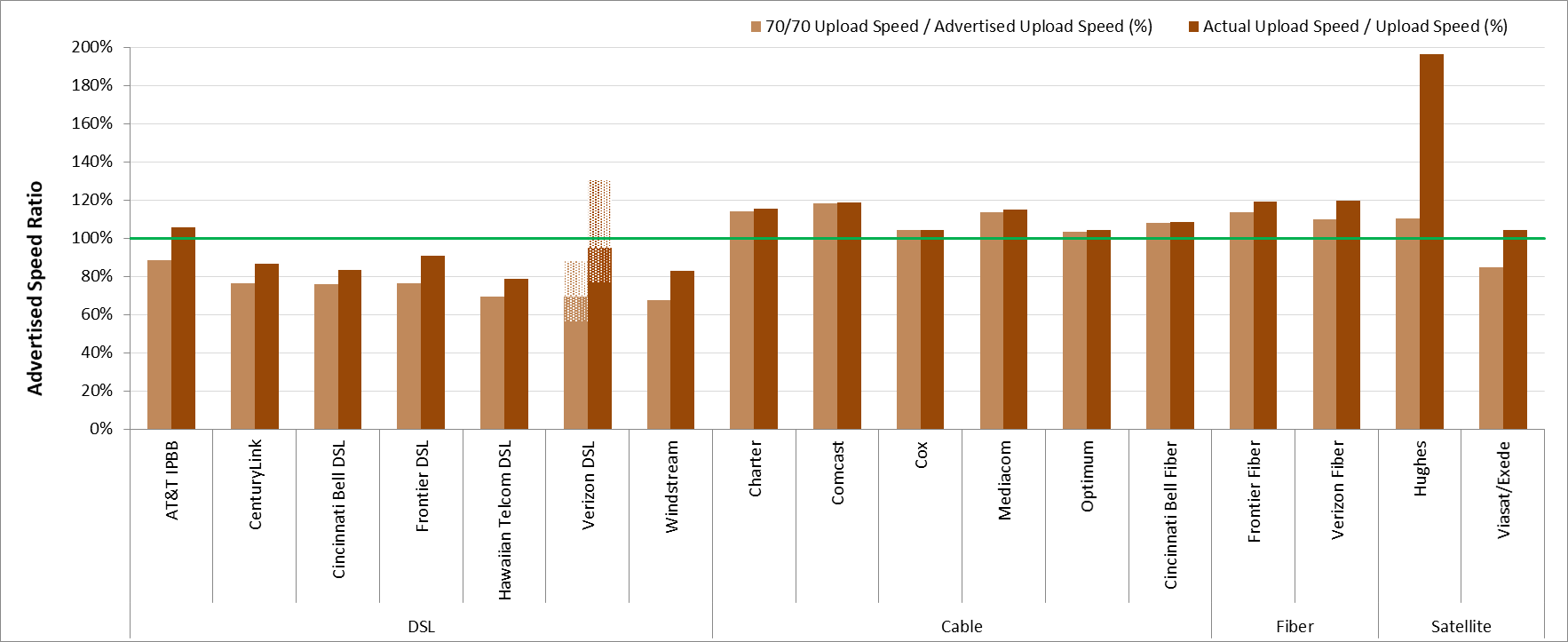

- Chart 18.3: The ratio of 70/70 consistent upload speed to advertised upload speed

- Chart 19: Latency, by technology and by advertised download speed

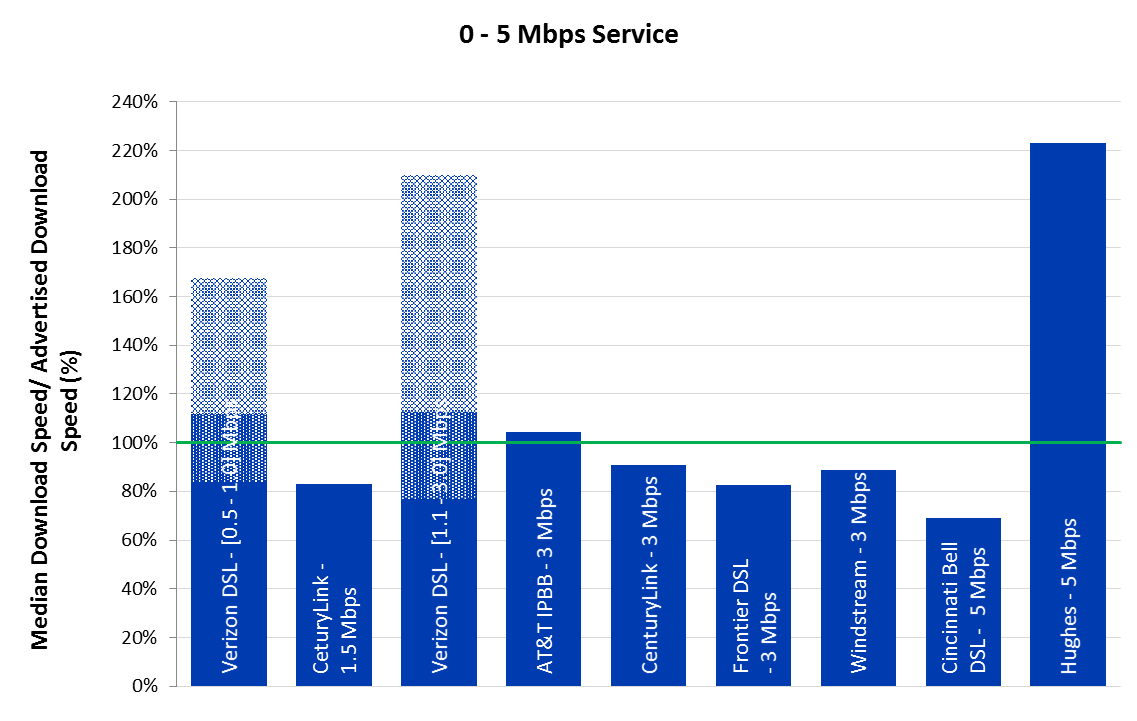

- Chart 20.1: The ratio of median download speed to advertised download speed, by ISP (0-5 Mbps

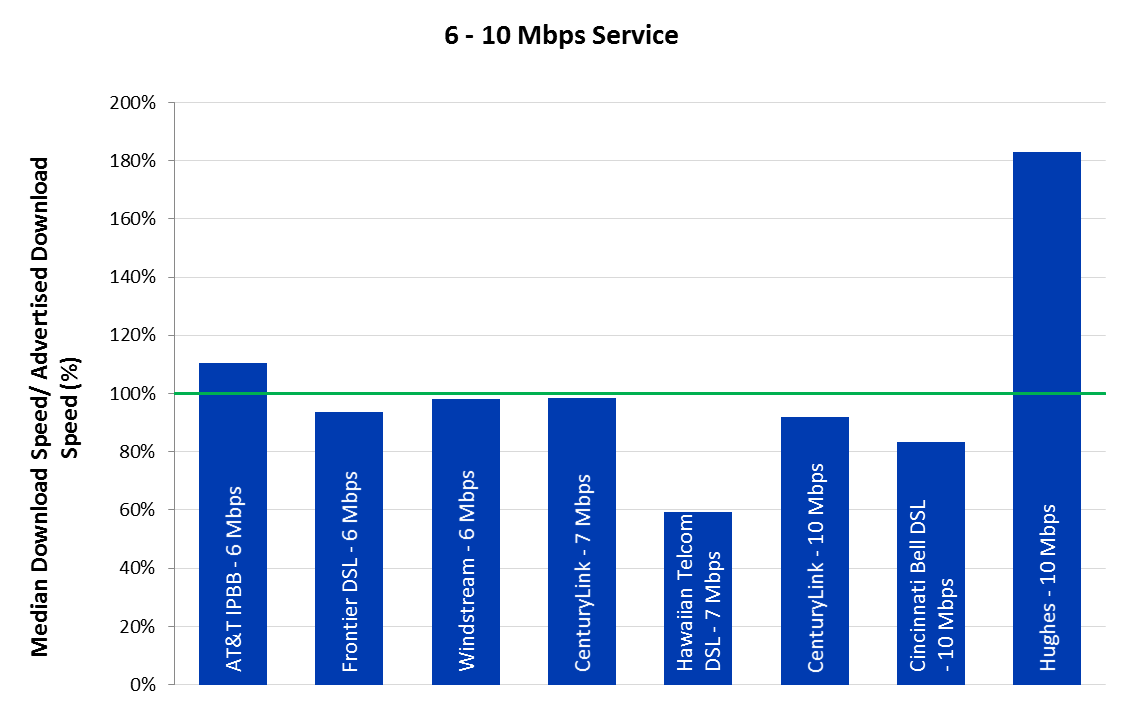

- Chart 20.2: The ratio of median download speed to advertised download speed, by ISP (6-10 Mbps)

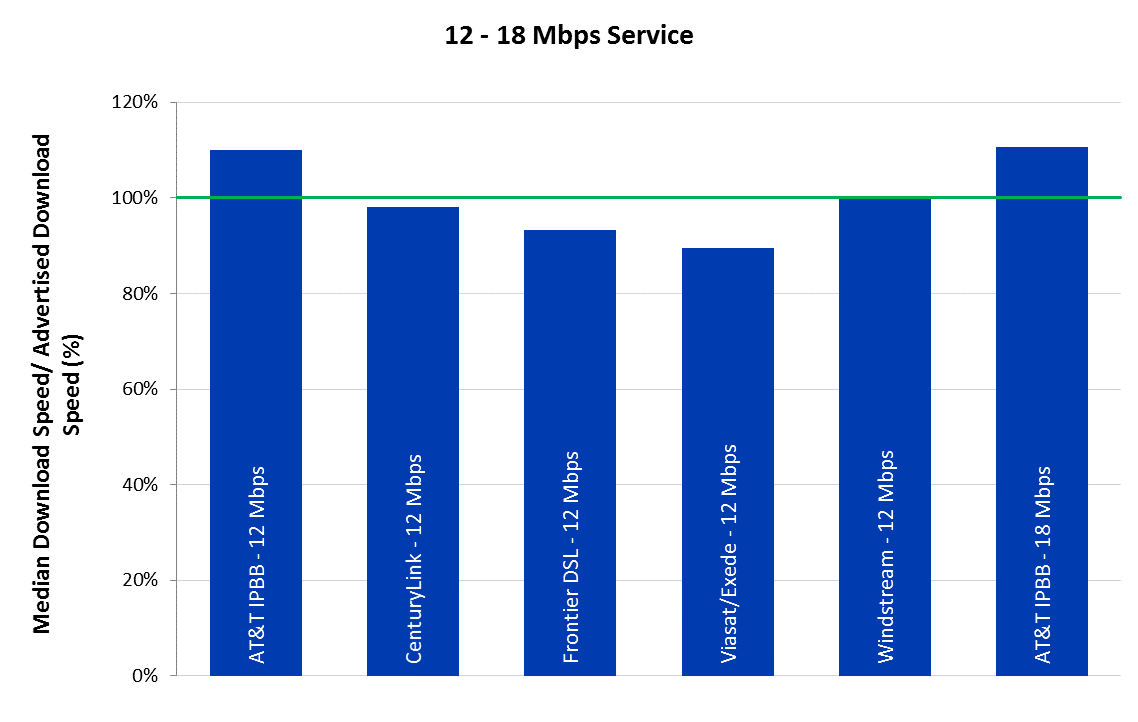

- Chart 20.3: The ratio of median download speed to advertised download speed, by ISP (12-18 Mbps)

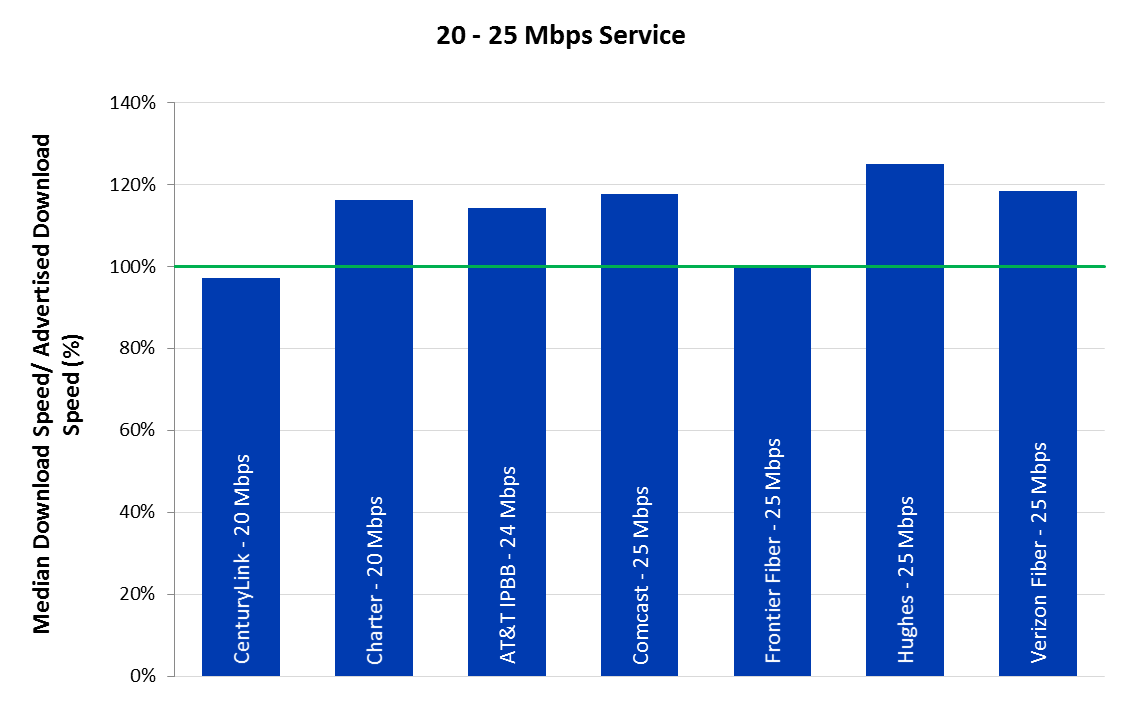

- Chart 20.4: The ratio of median download speed to advertised download speed, by ISP (20-25 Mbps)

- Chart 20.5: The ratio of median download speed to advertised download speed, by ISP (30-50 Mbps)

- Chart 20.6: The ratio of median download speed to advertised download speed, by ISP (60-75 Mbps)

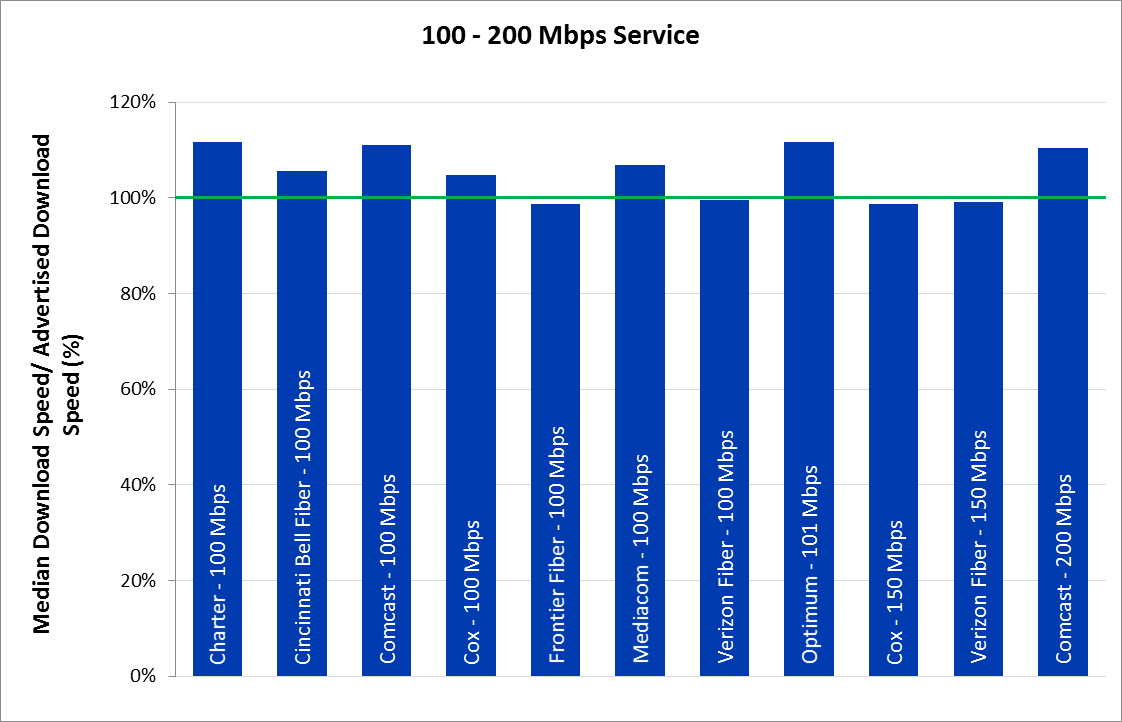

- Chart 20.7: The ratio of median download speed to advertised download speed, by ISP (100-200 Mbps)

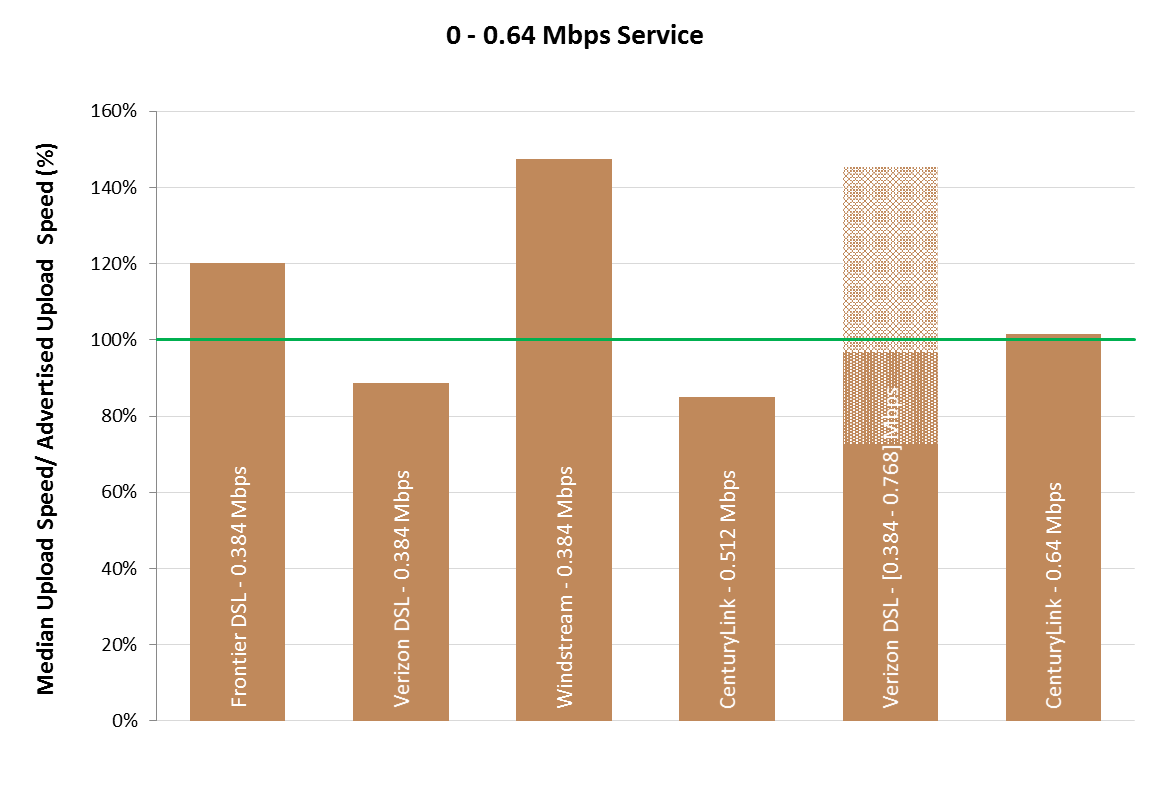

- Chart 21.1: The ratio of median upload speed to advertised upload speed, by ISP (0-0.64 Mbps)

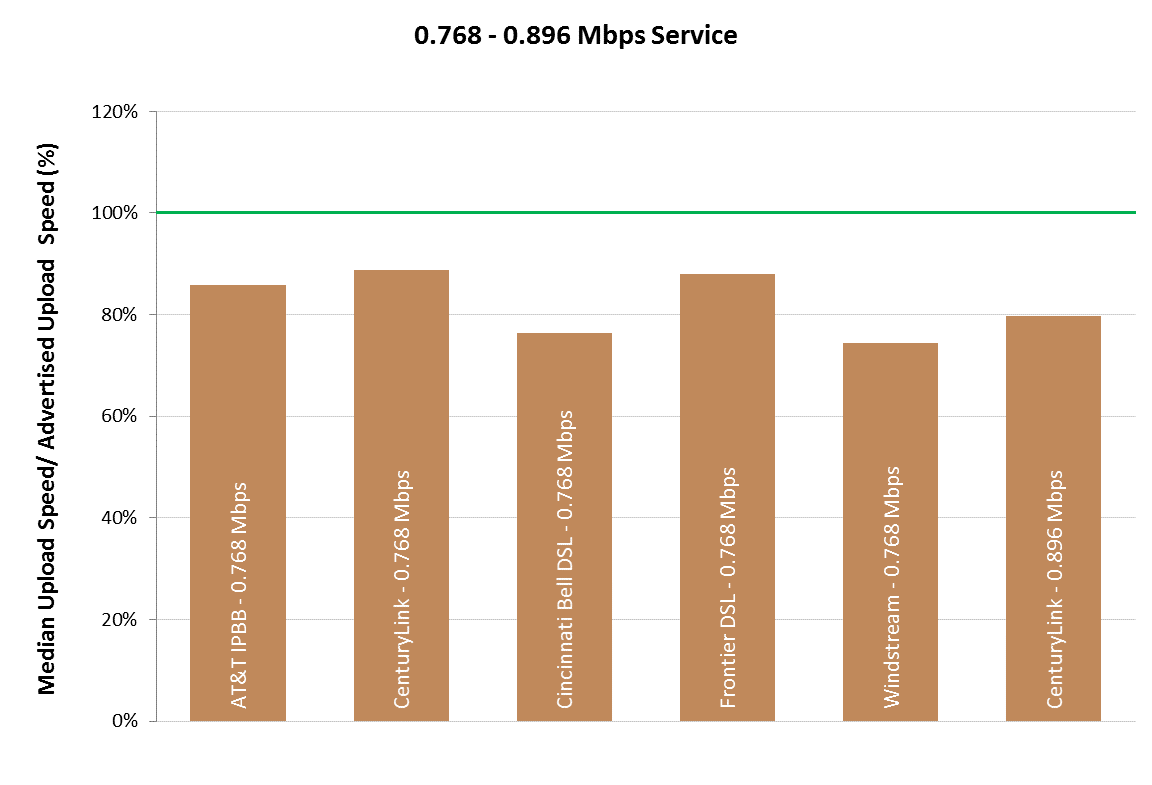

- Chart 21.2: The ratio of median upload speed to advertised upload speed, by ISP (0.768-0.896 Mbps)

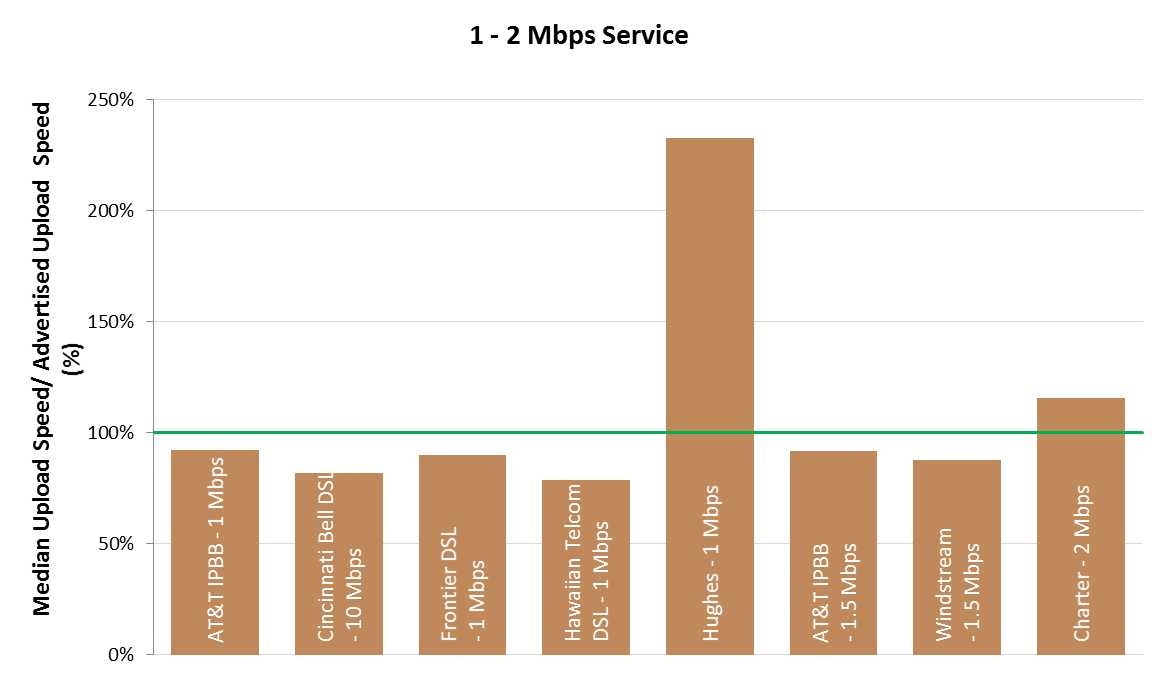

- Chart 21.3: The ratio of median upload speed to advertised upload speed, by ISP (1-2 Mbps)

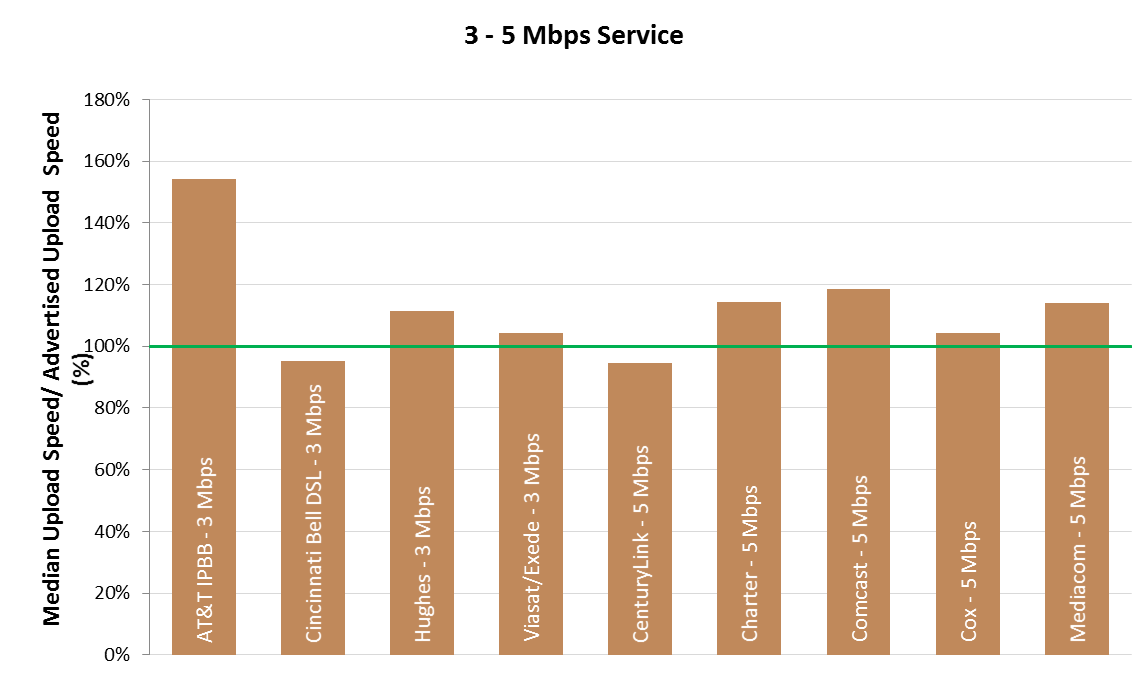

- Chart 21.4: The ratio of median upload speed to advertised upload speed, by ISP (3-5 Mbps)

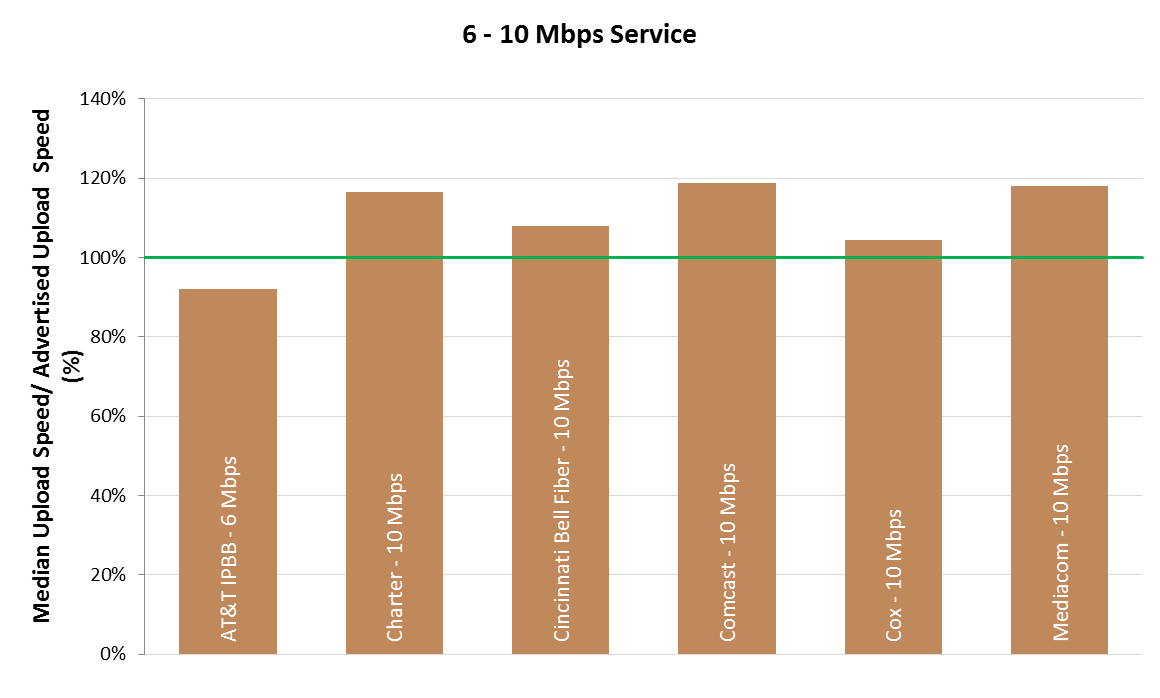

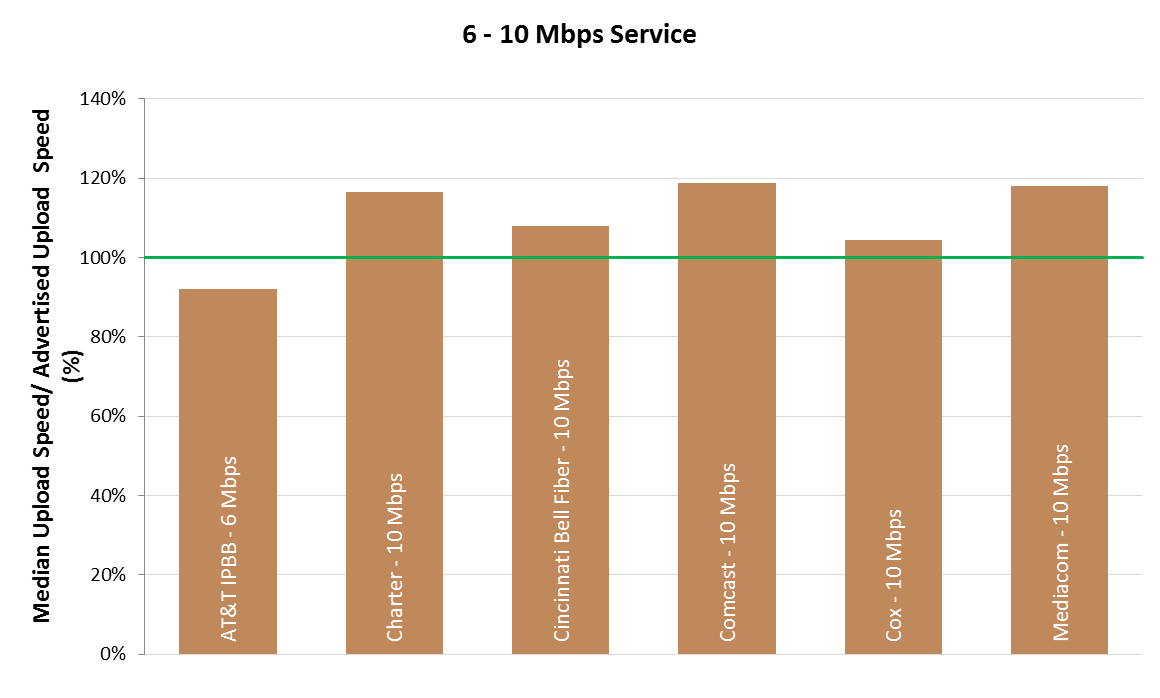

- Chart 21.5: The ratio of median upload speed to advertised upload speed, by ISP (6-10 Mbps)

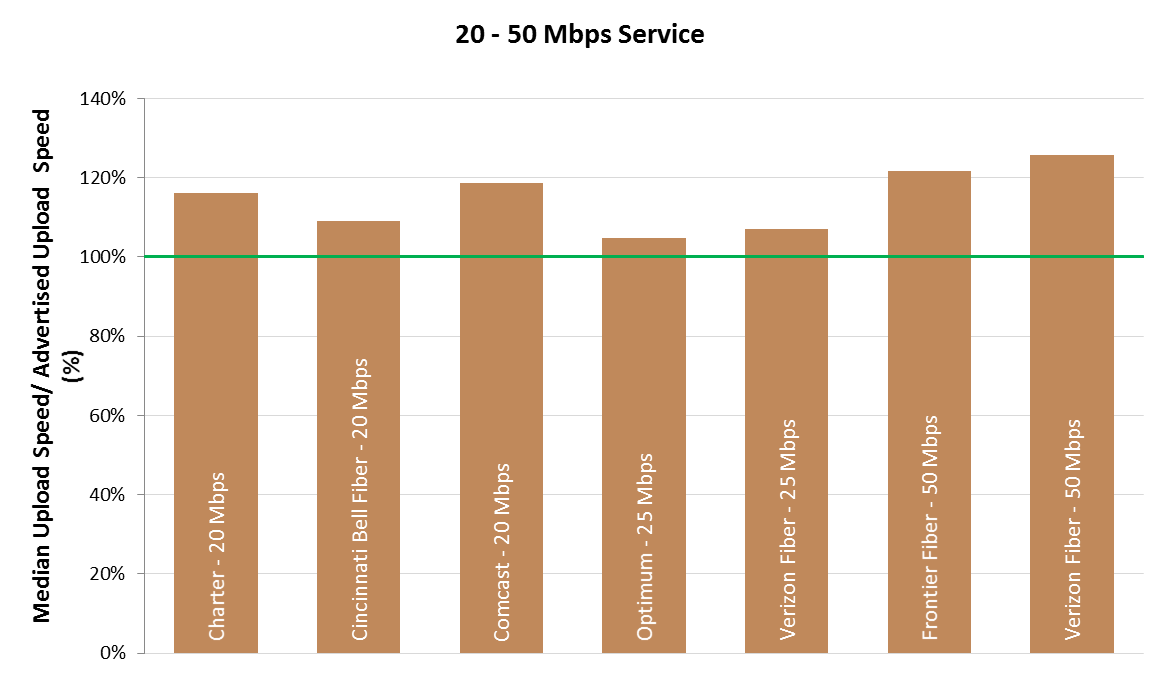

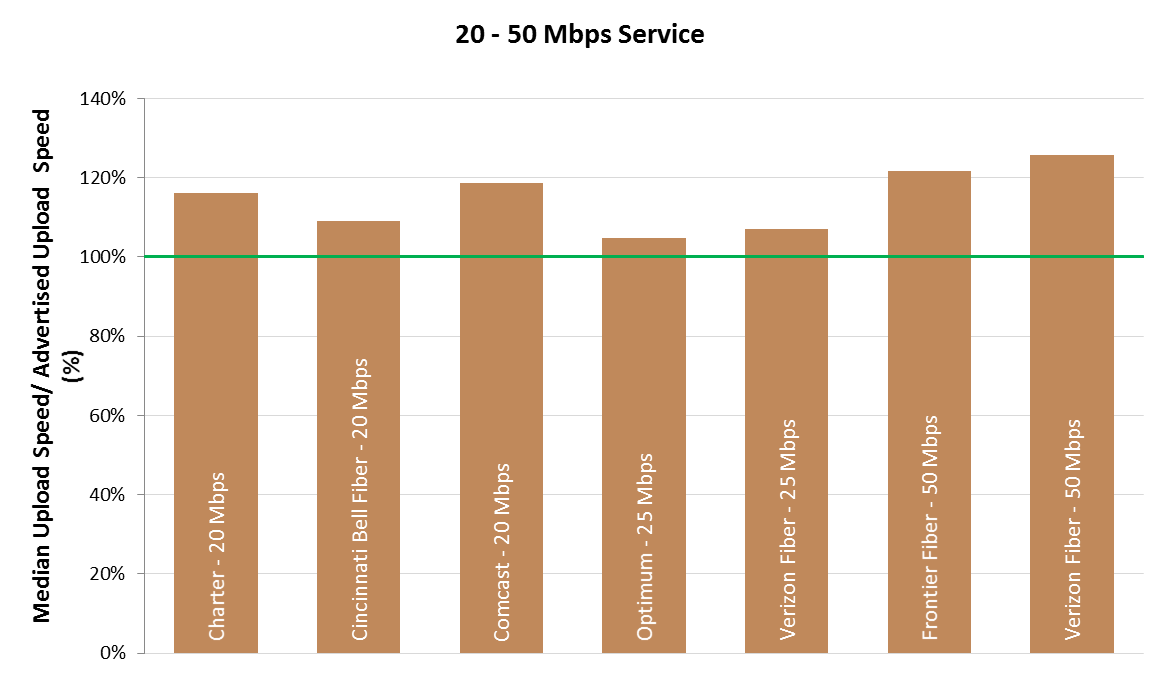

- Chart 21.6: The ratio of median upload speed to advertised upload speed, by ISP (20-50 Mbps)

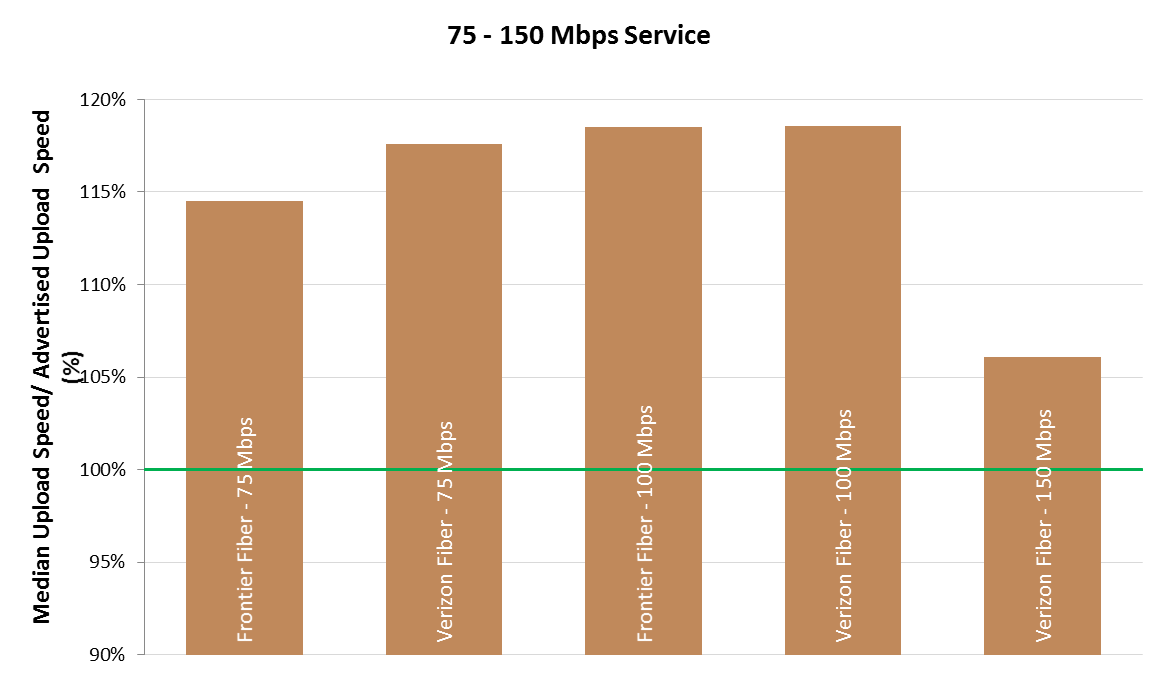

- Chart 21.7: The ratio of median upload speed to advertised upload speed, by ISP (75-150 Mbps)

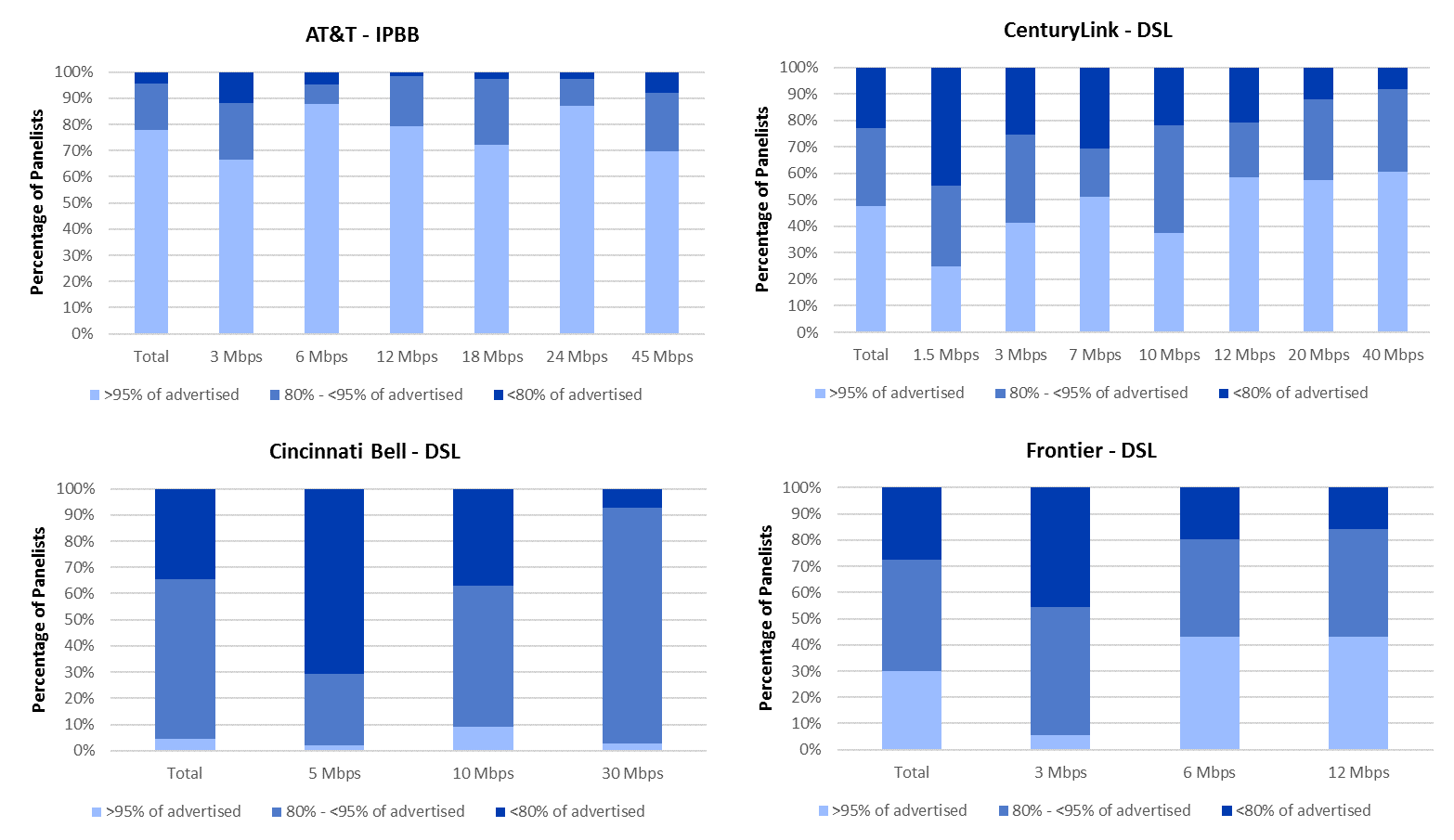

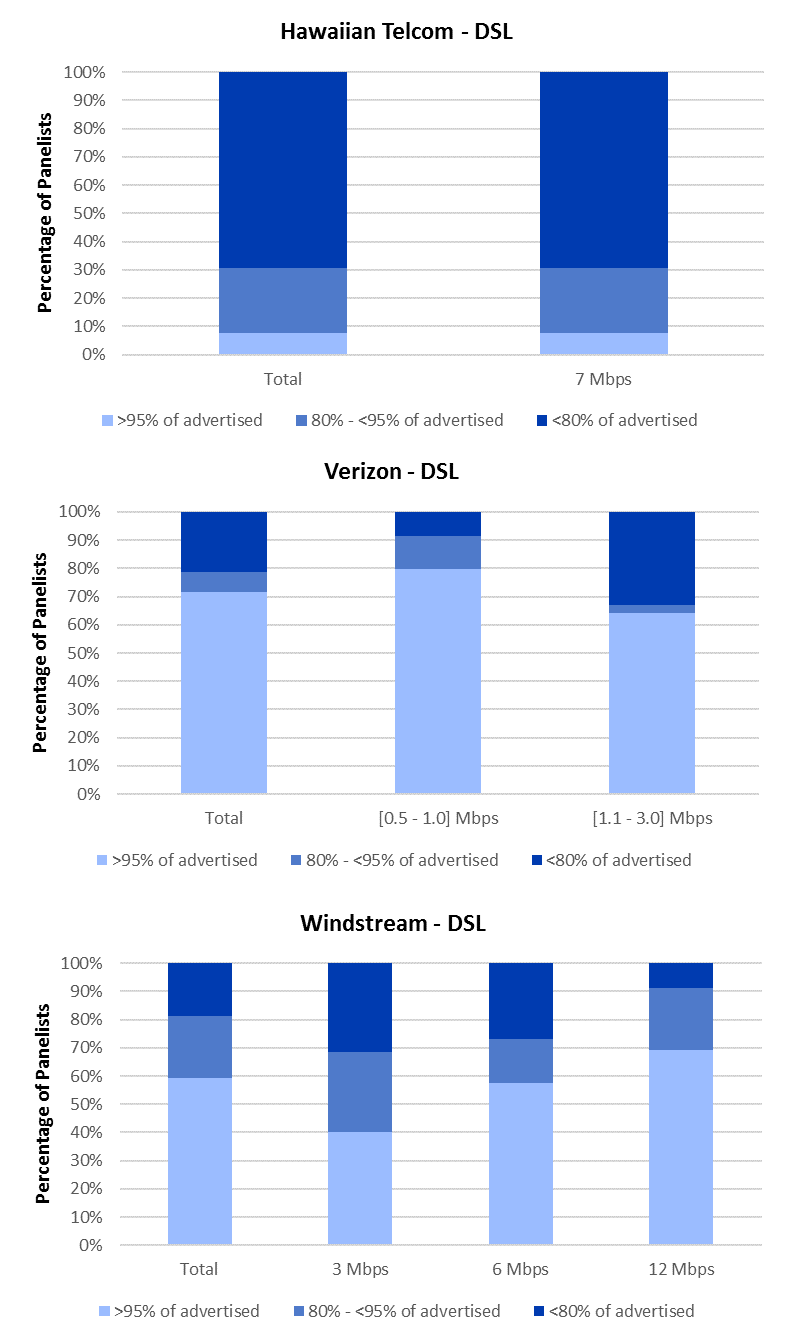

- Chart 22.1: The percentage of consumers whose median download speed was greater than 95%, between 80% and 95%, and less than 80% of the advertised download speed, by service tier (DSL)

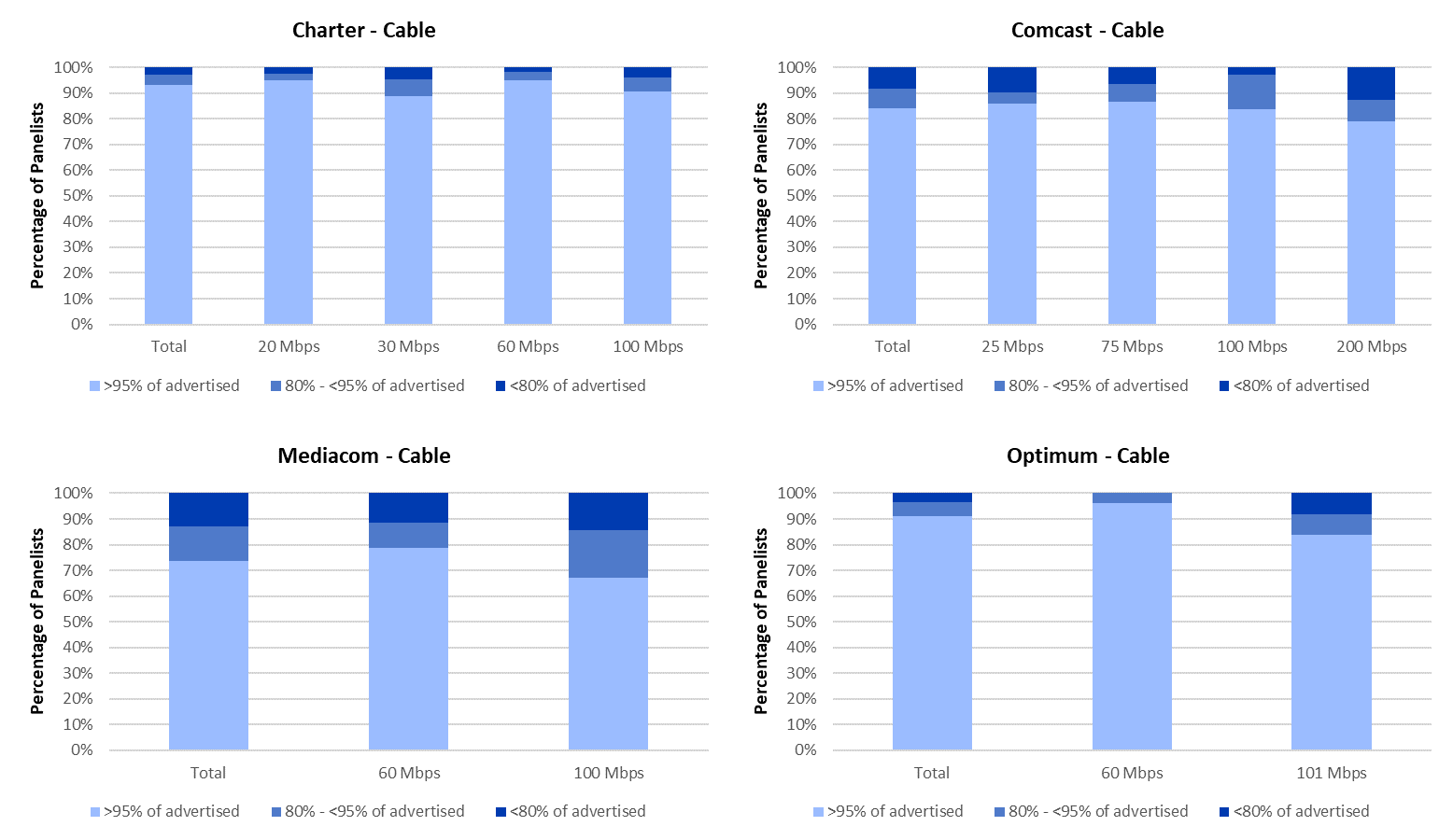

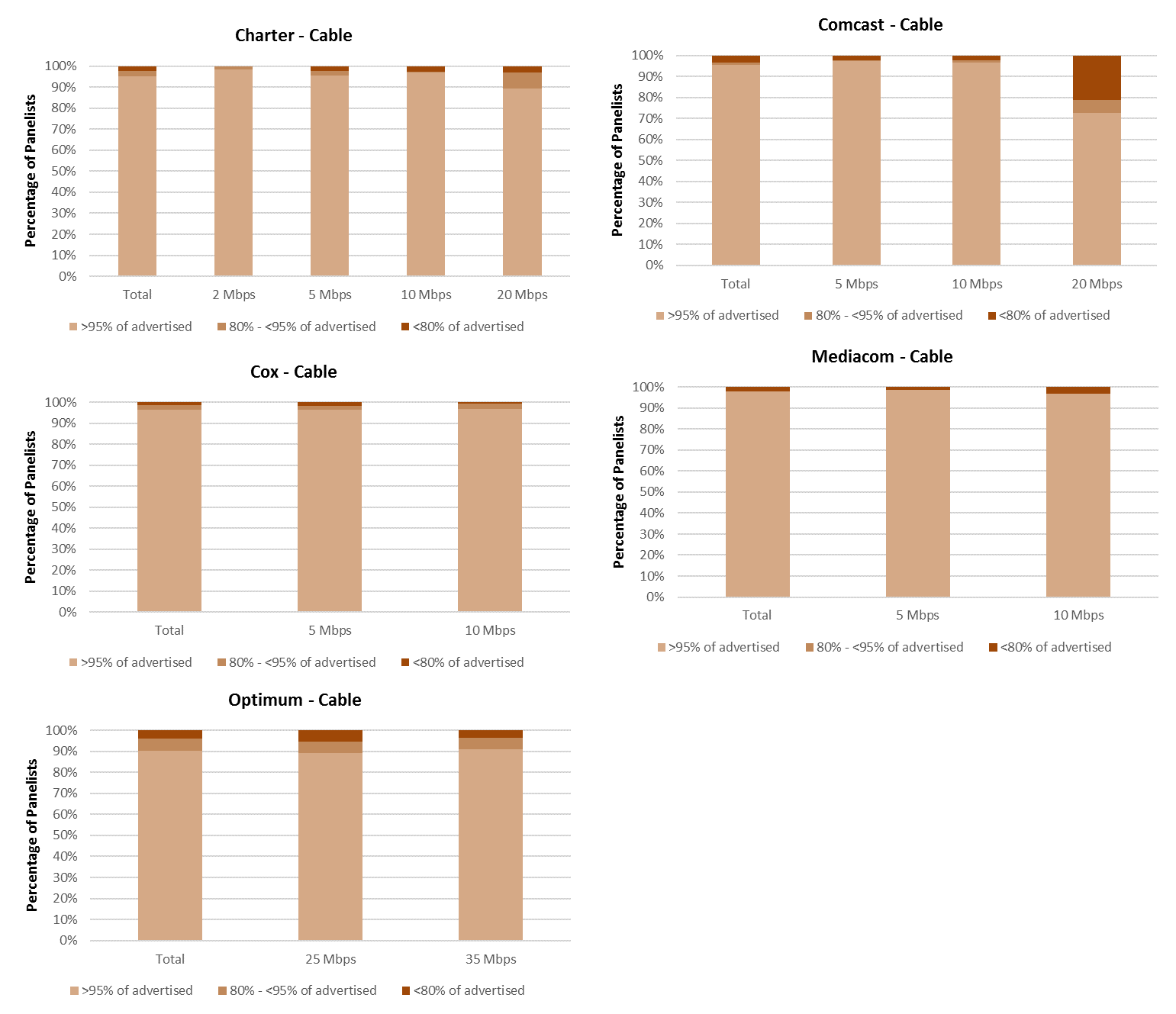

- Chart 22.2: The percentage of consumers whose median download speed was greater than 95%, between 80% and 95%, and less than 80% of the advertised download speed (cable)

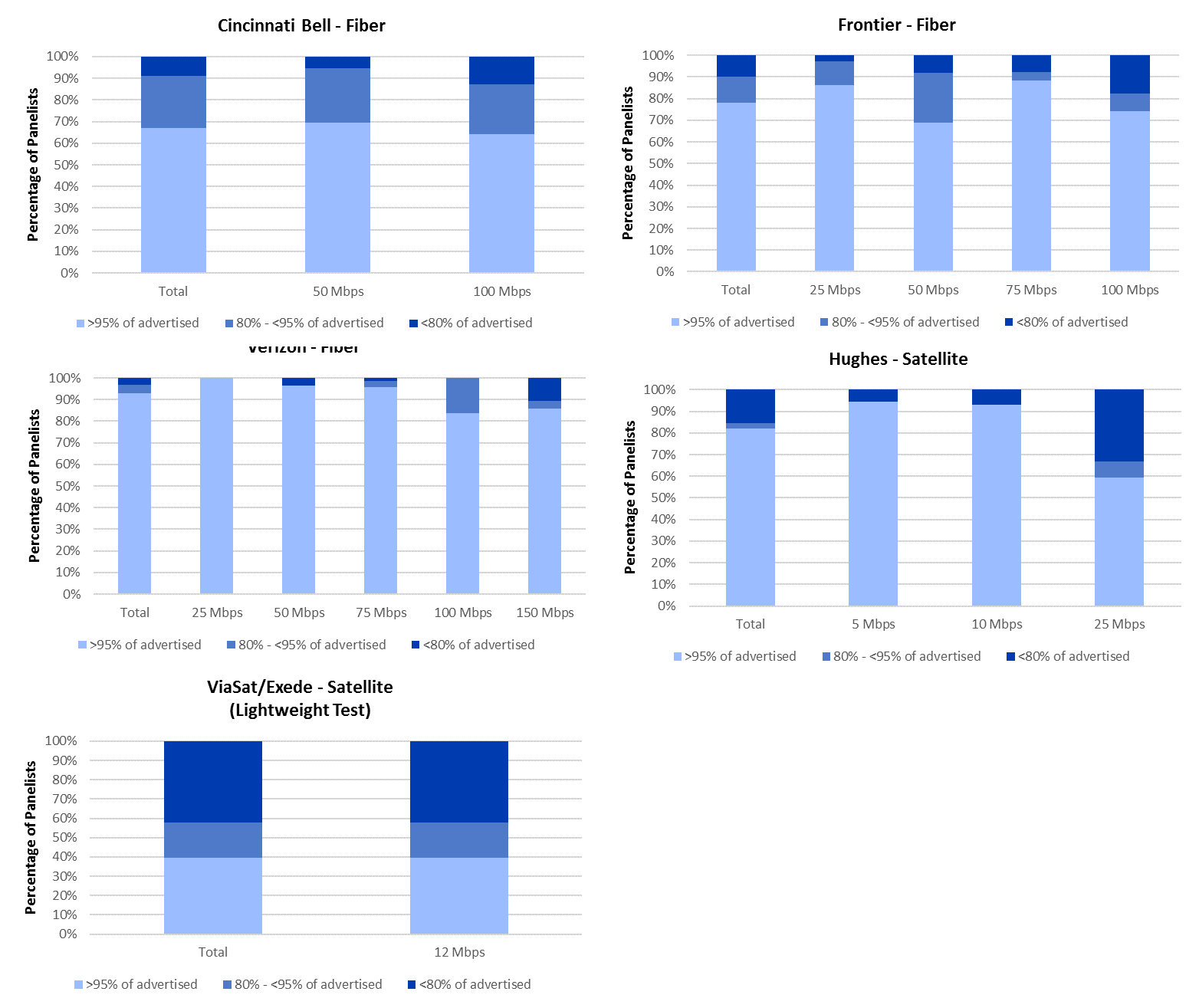

- Chart 22.3: The percentage of consumers whose median download speed was greater than 95%, between 80% and 95%, and less than 80% of the advertised download speed (fiber and satallite).

- Chart 23.1: The percentage of consumers whose median upload speed was greater than 95%, between 80% and 95%, and less than 80% of the advertised upload speed (DSL)

- Chart 23.2: The percentage of consumers whose median upload speed was greater than 95%, between 80% and 95%, and less than 80% of the advertised upload speed (cable)

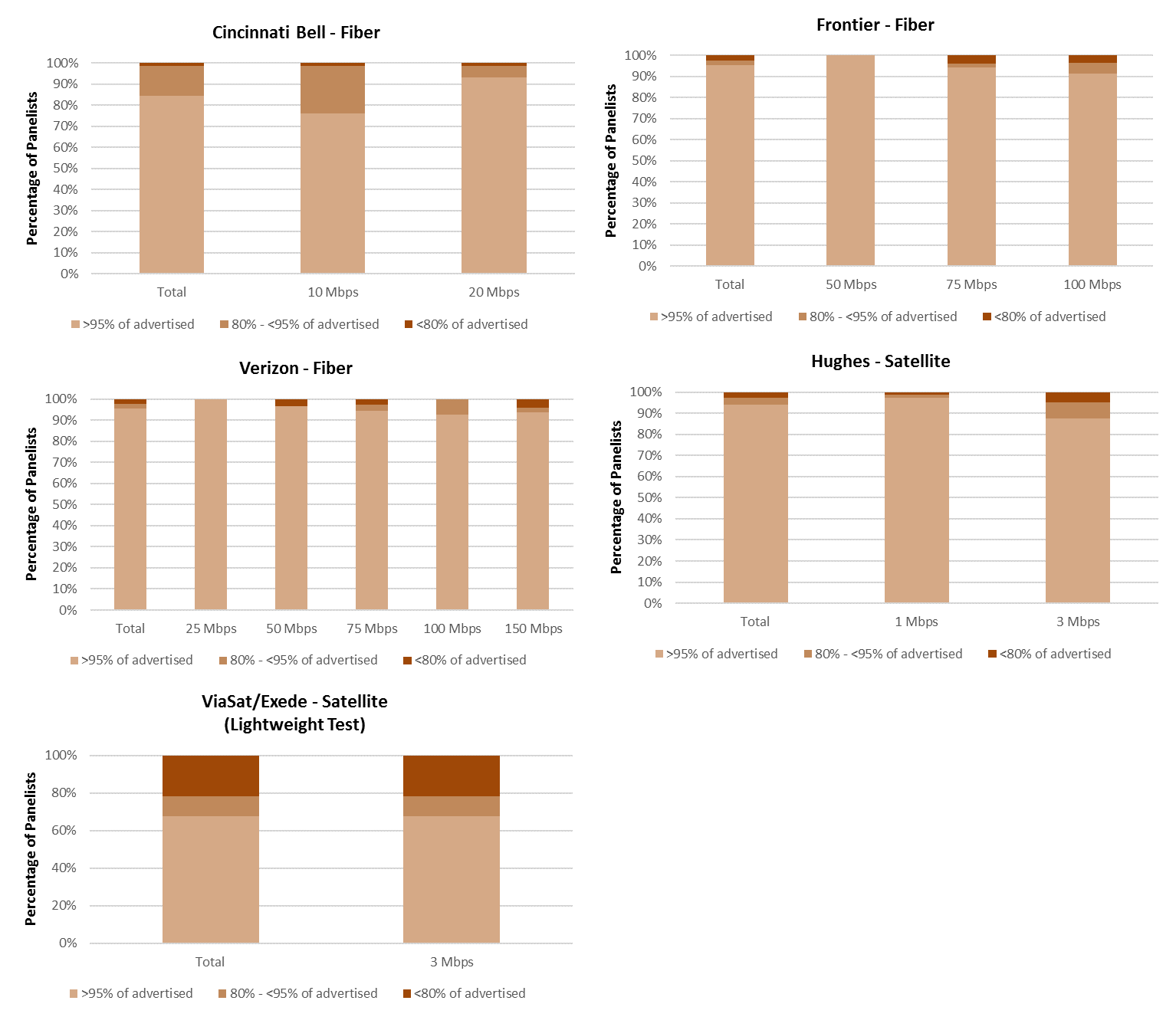

- Chart 23.3: The percentage of consumers whose median upload speed was greater than 95%, between 80% and 95%, and less than 80% of the advertised upload speed (fiber and satallite)

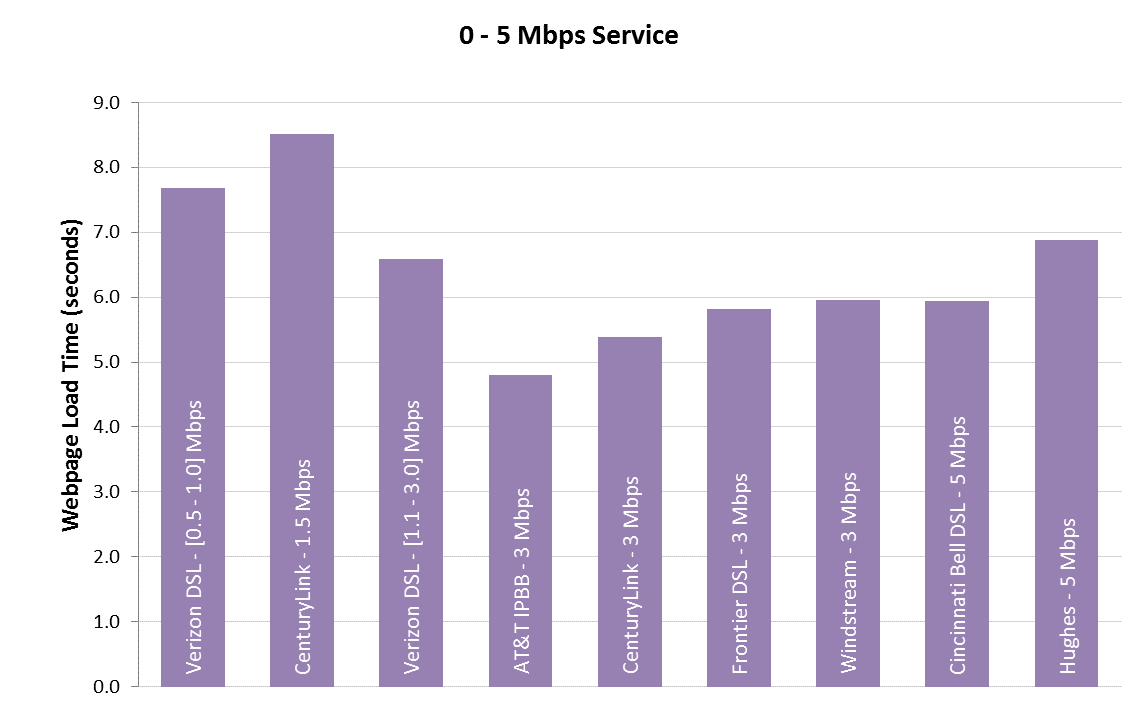

- Chart 24.1: Average webpage download time, by ISP (0-5 Mbps)

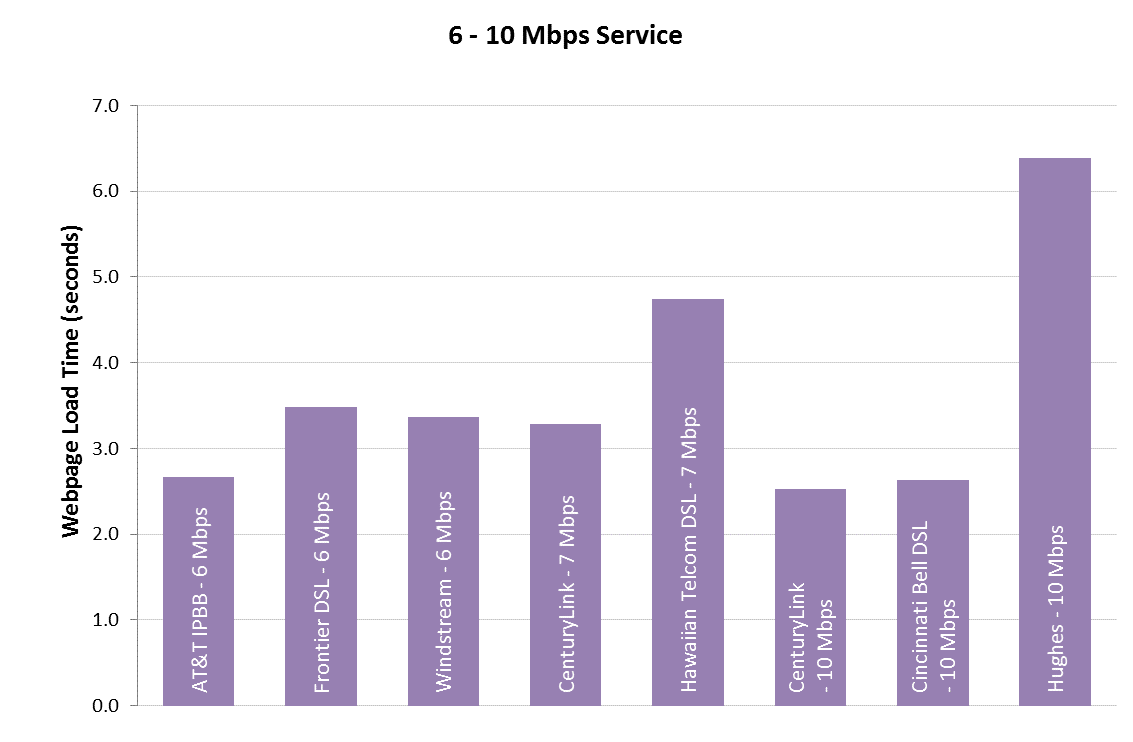

- Chart 24.2: Average webpage download time, by ISP (6-10 Mbps)

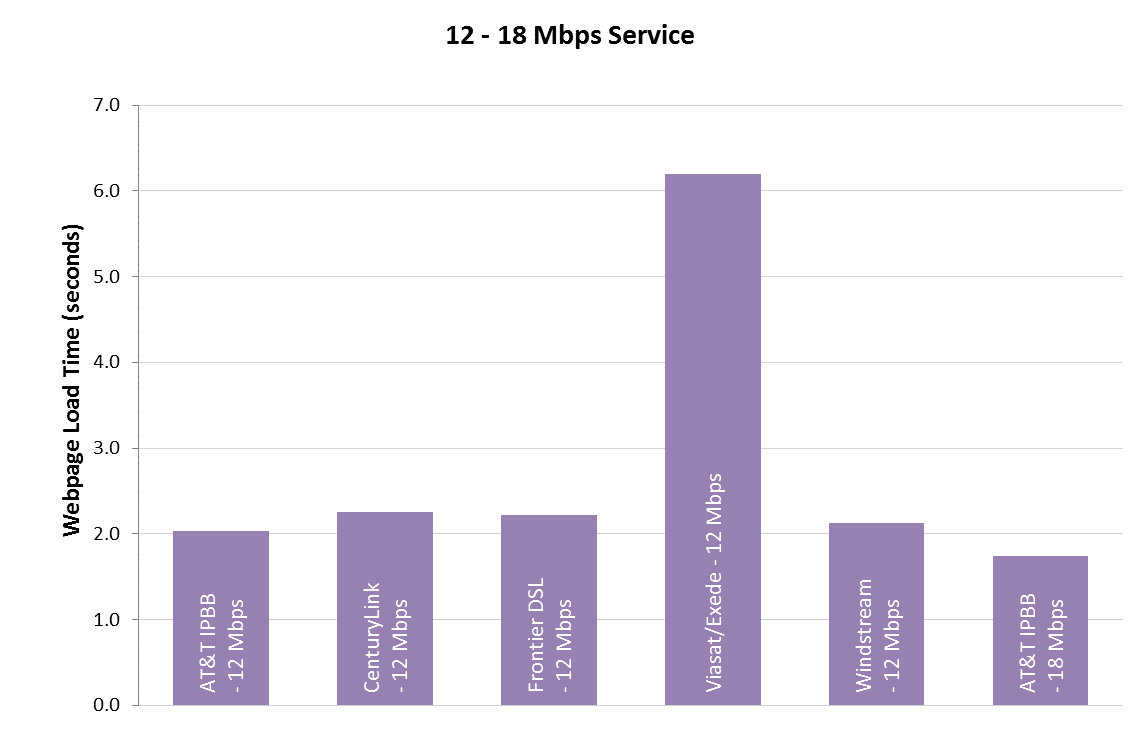

- Chart 24.3: Average webpage download time, by ISP (12-18 Mbps)

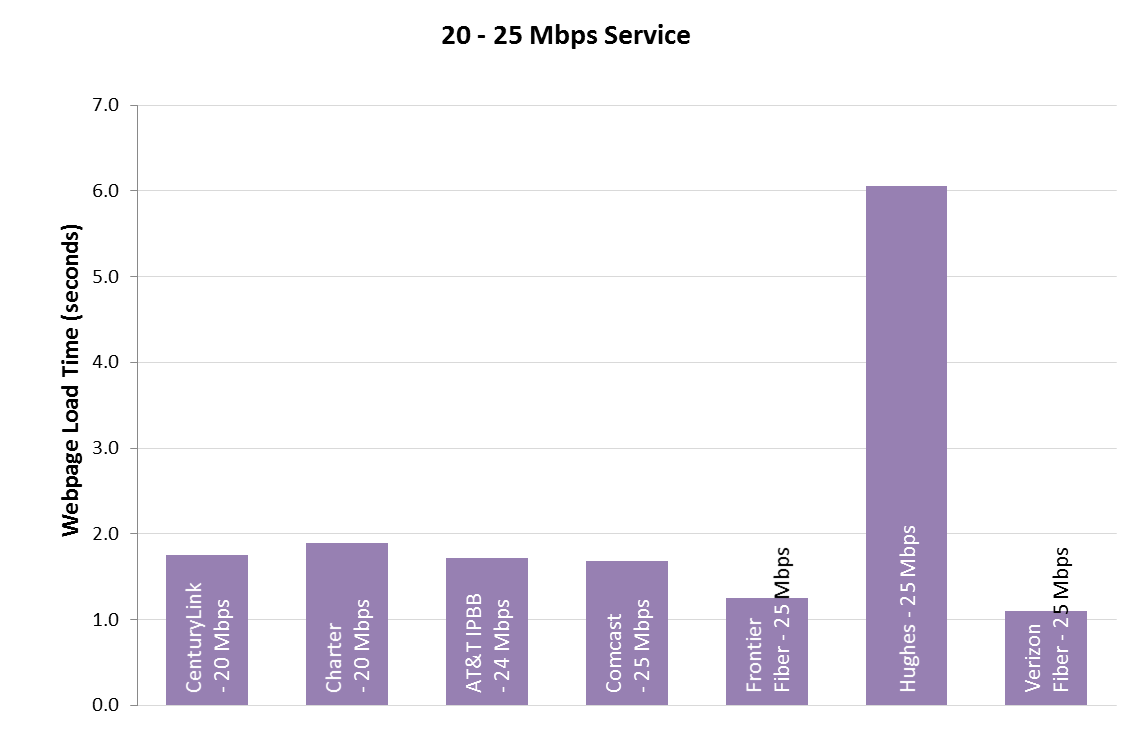

- Chart 24.4: Average webpage download time, by ISP (20-25 Mbps)

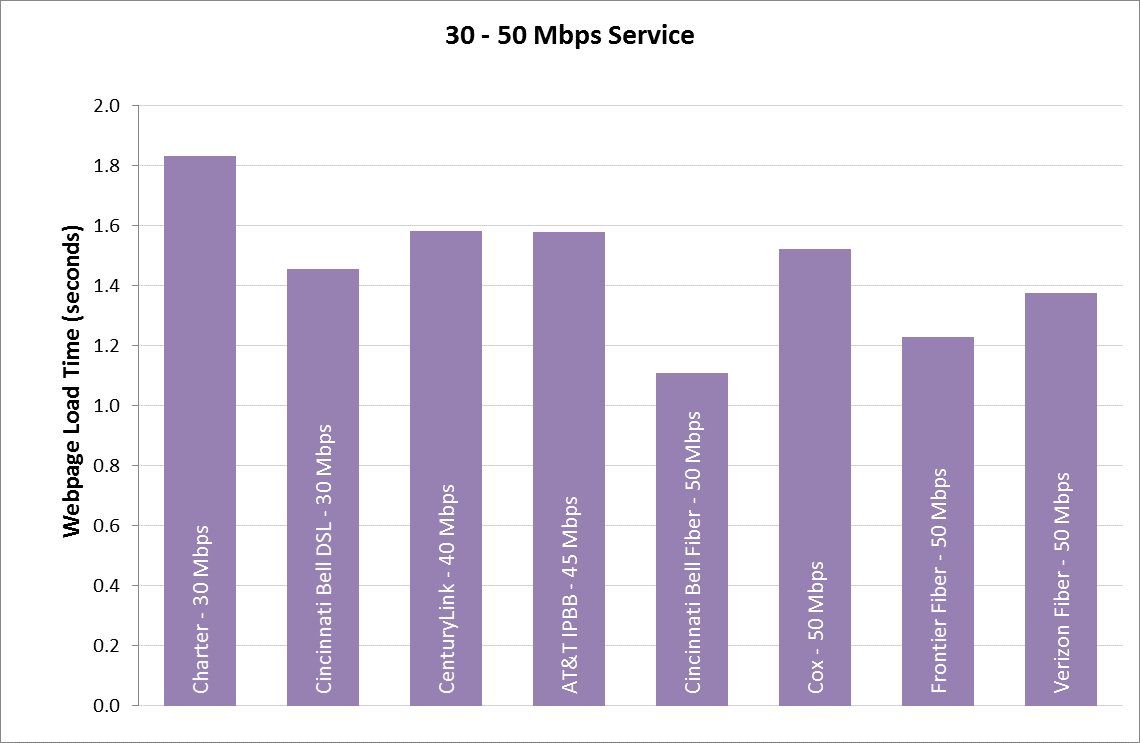

- Chart 24.5: Average webpage download time, by ISP (30-50 Mbps)

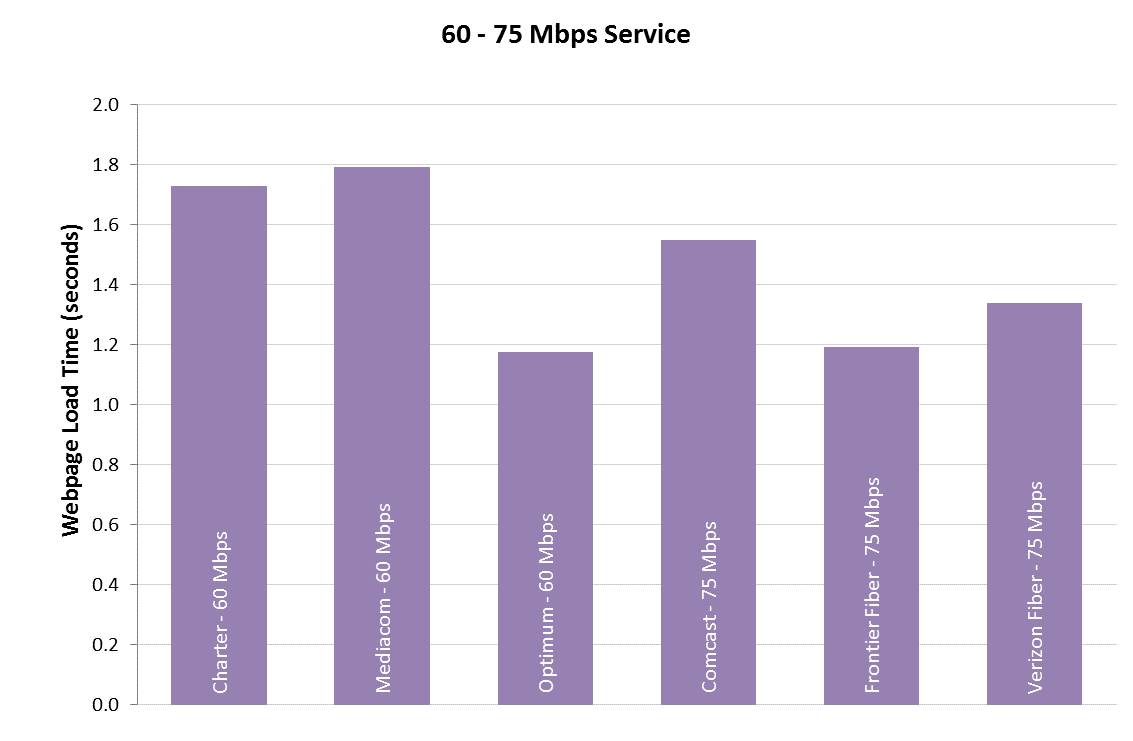

- Chart 24.6: Average webpage download time, by ISP (60-75 Mbps)

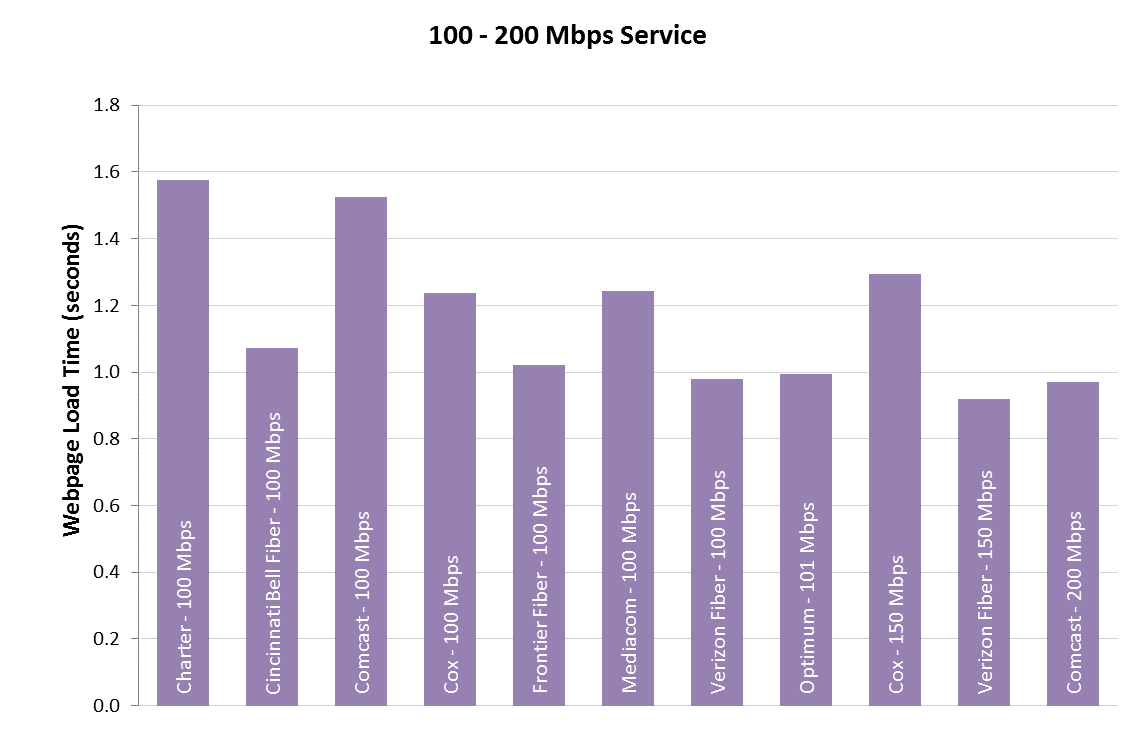

- Chart 24.7: Average webpage download time, by ISP (100-200 Mbps)

- Table 1: List of ISP service tiers whose broadband performance was measured in this report

- Table 2: Peak Period Median download speed, by ISP

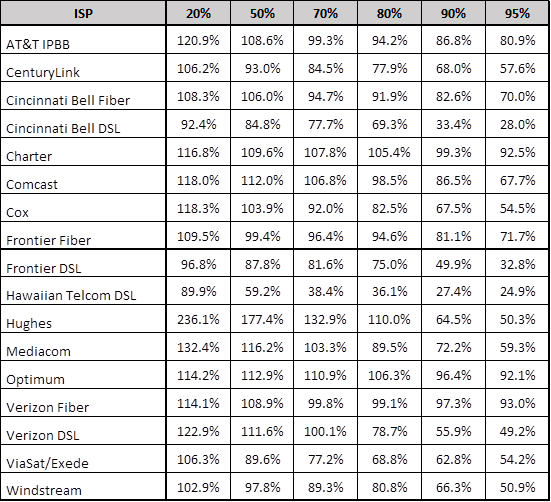

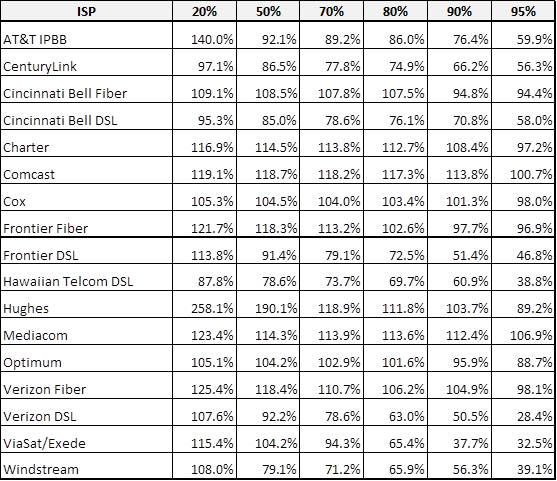

- Table 3: Complementary cumulative distribution of the ratio of median download speed to advertised download speed, by technology, by ISP

- Table 4: Complementary cumulative distribution of the ratio of median upload speed to advertised upload speed, by technology, by ISP

1. Executive Summary

The Eighth Measuring Broadband America Fixed Broadband Report (“Eighth Report” or “Report”) contains validated data collected in September 2017[1] from fixed Internet Service Providers (ISPs) as part of the Federal Communication Commission’s (FCC) Measuring Broadband America (MBA) program. This program is an ongoing, rigorous, nationwide study of consumer broadband performance in the United States. We measure the network performance delivered on selected service tiers to a representative sample set of the population. The thousands of volunteer panelists are drawn from subscribers of Internet service providers serving over 80% of the residential marketplace[2].

The initial Measuring Broadband America Fixed Broadband Report was published in August 2011,[3] and presented the first broad-scale study of directly measured consumer broadband performance throughout the United States. As part of an open data program, all methodologies used in the program are fully documented and all data collected is published for public use without restriction. Including this current Report, eight reports have now been issued.[4] These reports provide a snapshot of fixed broadband Internet access service performance in the United States. These reports present analysis of broadband information in a variety of ways and have evolved to make the information more understandable and useful, as well as, to reflect the evolving applications supported by the nation’s broadband infrastructure.

A. MAJOR FINDINGS OF THE EIGHT REPORT

The key findings of this report are:

- The maximum advertised download speeds amongst the service tiers measured by the FCC were between 3-200 Mbps for the period covered by this report.

- The median speed experienced by subscribers of the participating ISPs was 72 Mbps.

- For most of the major broadband providers that were tested, measured download speeds were 100% or better of advertised speeds during the peak hours (7 p.m. to 11 p.m. local time).

- Fourteen ISPs were evaluated in this report. Of these AT&T, Cincinnati Bell, Frontier and Verizon employed multiple different broadband technologies across the USA. Overall 17 different ISP/technology configurations were evaluated in this report. Out of these only two performed below 90% for actual-to-advertised download speed.

- In addition to providing download and upload speed measurements of ISPs, this report also presents a measure of how consistently ISPs provide their advertised speed with the use of our “80/80” metric. The 80/80 metric measures the minimum speed that at least 80% of subscribers experience at least 80% of the time over peak periods.

These and other findings are described in greater detail within this report.

B. USE OF MEDIAN SPEEDS AND SUBSCRIBER-WEIGHTED SPEEDS

The Eighth Report retains two changes that were first made in the 2016 Report (Sixth Report) and were also included in the Seventh report. These changes affect how the median speeds and subscriber-weighted speeds are calculated and presented. First, we continue to present ISP broadband performance as a median,[5] rather than a mean (average), of speeds experienced by panelists within a specific service tier.[6] Our focus in these reports is on the most common service tiers used by an ISP’s subscribers.[7]

Second, consistent with the Sixth and Seventh Reports, we continue to compute ISP performance by weighting the median for each service tier by the number of subscribers in that tier. Similarly, in calculating the overall average speed of all ISPs in a specific year, the median speed of each ISP is used and weighted by the number of subscribers of that ISP as a fraction of the total number of subscribers across all ISPs.

In calculating weighted medians, we have drawn on two sources for determining the number of subscribers per service tier. ISPs can voluntarily contribute their data per surveyed service tier as the most recent and authoritative data. Many ISPs have chosen to do so.[8] When such information has not been provided by an ISP, we rely on the FCC’s Form 477 data.[9] All facilities-based broadband providers are required to file data with the FCC twice a year (Form 477) regarding deployment of broadband services, including subscriber counts. For this report, we used the June 2017 Form 477 data. It should be noted that the Form 477 subscriber data values are for a month that generally lags the reporting month, and therefore, there are likely to be small inaccuracies in the tier ratios. It is for this reason that we encourage ISPs to provide us with subscriber numbers for the measurement month.

C. USE OF OTHER PERFORMANCE METRICS

As in our previous reports, we found that for most ISPs, the actual speeds experienced by subscribers either nearly met or exceeded advertised service tier speeds. However, since we started our MBA program, consumers have changed their Internet usage habits. In 2011, consumers mainly browsed the web and downloaded files; thus, we reported average broadband speeds since these were likely to closely mirror user satisfaction. By contrast, in September 2017 (the measurement period for this report) consumer internet usage had become dominated by video consumption, with consumers regularly streaming video for entertainment and education.[10] Both the median measured speed and how consistently the service performs are likely to influence the perception and usefulness of Internet access service and we have expanded our network performance analytics to better capture this.

Specifically, we use two kinds of metrics to reflect the consistency of service delivered to the consumer: First, we report the minimum actual speed experienced by at least 80% of panelists during at least 80% of the daily peak usage period (“80/80 consistent speed” measure). Second, we show what fraction of consumers obtains median speeds greater than 95%, between 80% and 95%, and less than 80% of advertised speeds.

Although download and upload speeds remain the network performance metric of greatest interest to the consumer, we also spotlight two other key network performance metrics in this report: latency and packet loss. These metrics can significantly affect the overall quality of Internet applications.

Latency (or delay) is the time it takes for a data packet to travel across a network from one point on the network to another. High latencies may affect the perceived quality of some interactive services such as phone calls over the Internet, video chat and video conferencing, or online multiplayer games. All network access technologies have a minimum latency that is largely determined by the technology. In addition, network congestion will lead to an increase in measured latency. Technology-determined latencies are typically small for terrestrial broadband services and are thus unlikely to affect the perceived quality of applications. The higher latencies of geostationary satellite-based broadband services may impair the perceived quality of such highly interactive applications. Not all applications are affected by high latencies; for example, entertainment video streaming applications are tolerant of relatively high latencies.

Packet loss measures the fraction of data packets sent that fail to be delivered to the intended destination. Packet loss may affect the perceived quality of applications that do not request retransmission of lost packets, such as phone calls over the Internet, video chat, some online multiplayer games, and some video streaming. High packet loss also degrades the achievable throughput of download and streaming applications. However, packet loss of a few tenths of a percent are unlikely to significantly affect the perceived quality of most Internet applications and are common. During network congestion, both latency and packet loss typically increase.

The Internet is continuing to evolve in its architectures, performances, and services. Accordingly, we will continue to adapt our measurement and analysis methodologies to help consumers understand the performance characteristics of their broadband Internet access service, and thus make informed choices about their use of such services.

2. Summary of Key Findings

A. MOST POPULAR ADVERTISED SERVICE TIERS

A list of the offered ISP download and upload service tiers that were measured in this report are shown in Table 1. It should be noted that while upload and downloads speeds are measured independently and shown separately, they are typically offered by an ISP in a paired configuration. Together, these plans serve the majority of Internet users of the participating ISPs. Generally, a service tiers becomes added to this report when five percent or more of an ISP’s customers subscribe to that tier and there are at least 30,000 subscribers in that tier. Each tier requires a certain number of panelists to meet the program’s target sample size, and it becomes difficult and costly to recruit panelists for tiers with few (i.e., less than 30,000) subscribers or across a very large number of tiers.

Table 1: List of ISP service tiers whose broadband performance was measured in this report

|

Technology |

Company |

Speed Tiers (Download) |

Speed Tiers (Upload) |

|||||||||||

|

DSL |

AT&T IPBB |

|

3 |

6 |

12 |

18 |

24 |

45 |

|

0.768 |

1 |

1.5 |

3 |

6 |

|

CenturyLink |

1.5 |

3 |

7 |

10 |

12 |

20 |

40 |

0.512 |

0.64 |

0.768 |

0.896 |

5 |

|

|

|

Cincinnati Bell DSL |

5 |

10 |

30 |

|

|

|

|

|

0.768 |

1 |

3 |

|

|

|

|

Frontier DSL |

3 |

6 |

12 |

|

|

|

|

0.384 |

0.768 |

1 |

|

|

|

|

|

Hawaiian Telcom DSL |

7 |

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

Verizon DSL |

(0.5 - 1) |

(1.1-3) |

|

|

|

|

|

0.384 |

(0.384 - 0.768) |

|

|

|

|

|

|

Windstream |

3 |

6 |

12 |

|

|

|

|

0.384 |

0.768 |

1.5 |

|

|

|

|

|

Cable |

Optimum |

60 |

101 |

|

|

|

|

|

25 |

|

|

|

|

|

|

Charter |

20 |

30 |

60 |

100 |

|

|

|

2 |

5 |

10 |

20 |

|

|

|

|

Comcast |

25 |

75 |

100 |

200 |

|

|

|

5 |

10 |

20 |

|

|

|

|

|

Cox |

50 |

100 |

150 |

|

|

|

|

5 |

10 |

|

|

|

|

|

|

Mediacom |

60 |

100 |

|

|

|

|

|

5 |

10 |

|

|

|

|

|

|

Fiber |

Cincinnati Bell Fiber |

50 |

100 |

|

|

|

|

|

10 |

20 |

|

|

|

|

|

Frontier Fiber |

25 |

50 |

75 |

100 |

|

|

|

50 |

75 |

100 |

|

|

|

|

|

Verizon Fiber |

25 |

50 |

75 |

100 |

150 |

|

|

25 |

50 |

75 |

100 |

150 |

|

|

|

Satellite |

Hughes |

5 |

10 |

25 |

|

|

|

|

1 |

3 |

|

|

|

|

|

ViaSat |

12 |

|

|

|

|

|

|

3 |

|

|

|

|

|

|

*Tiers that lack sufficient panelists to meet the program’s target sample size.

Chart 1 (below) displays the maximum advertised download speeds among the measured service tiers for each participating ISP for September 2017, grouped by the access technology used to offer the broadband Internet access service (DSL, cable, fiber, or satellite). In September 2017, the weighted average maximum advertised download speed was 117 Mbps among the measured service tiers.

Maximum advertised download speed among the measured service tiers varies both by ISP and technology.

Chart 1: Maximum advertised download speed among the measured service tiers[11]

The maximum offered download speed tier included in this report for ISPs using satellite technology is between 12-25 Megabits per second (Mbps). Similarly, the maximum download speed offered by DSL providers ranges between 3-45 Mbps. In contrast, ISPs using Cable and Fiber technology offer much higher maximum download speeds. The maximum download speeds included in this report for ISPs using Cable technology are between 100-200 Mbps. Among participating broadband ISPs, only Cincinnati Bell, Frontier, and Verizon use fiber as the access technology for a substantial number of their customers and their maximum speed offerings included in this report are between 100-150 Mbps. A key difference between the fiber vendors and other technology vendors is that two of the fiber vendors offer symmetric maximum upload and download speeds. This is in sharp contrast to the asymmetric offerings for all the other technologies where the maximum upload speeds offered are typically 5 to 10 times below the maximum download speeds offered.

Chart 2 plots the migration of panelists to a higher service tier based on their access technology.[12] Specifically, the horizontal axis of Chart 2 partitions the September 2016 panelists by the advertised download speed of the service tier to which they were subscribed. For each such set of panelists who also participated in the September 2017 collection of data,[13] the vertical axis of Chart 2 displays the percentage of panelists that migrated by September 2017 to a service tier with a higher advertised download speed. There are two ways that such a migration could occur: (1) if a panelist changed their broadband plan during the intervening year to a service tier with a higher advertised download speed, or (2) if a panelist did not change their broadband plan but the panelist’s ISP increased the advertised download speed of the panelist’s subscribed plan.[14]

Chart 2: Consumer migration to higher advertised download speeds

B.MEDIAN DOWNLOAD SPEEDS

Advertised download speeds may differ from the speeds that subscribers actually experience. Some ISPs more consistently meet network service objectives than others or meet them unevenly across their geographic coverage area. Also, speeds experienced by a consumer may vary during the day if the network cannot carry the aggregate user demand during busy hours. Unless stated otherwise, all actual speeds were measured only during peak usage periods, which we define as 7 p.m. to 11 p.m. local time.

To compute the average ISP performance, we weigh the median speed for each tier by its subscriber count. Subscriber counts for the weightings were provided from the ISPs themselves or, if unavailable, from FCC Form 477 data.

Chart 3 shows the median download speeds experienced by the subscribers of the ISPs participating in MBA, averaged across all analyzed service tiers, geography, and time, for 2017. The median download speed, averaged across all participating ISPs, was approximately 72 Mbps in September 2017. As can be seen in this chart there is considerable variance of median speed by both ISP and by technology. While cable and fiber providers had median speeds ranging from 78 to 120 Mbps (with only one outlier provider with 56 Mbps median speed); the DSL and satellite providers had median speeds that ranged from 2 to 20 Mbps. However, as we observed above while examining advertised download speeds, the increase in median download speed is not uniform across access technologies and ISPs.

Chart 3: Median download speeds by ISP

Chart 4 shows the ratio of the weighted median speeds experienced by an ISP’s subscribers to that ISP’s advertised speeds. The ratios for both download and upload speeds to the advertised download and upload speeds are shown. The actual speeds experienced by most ISPs’ subscribers are close to or exceed the advertised speeds. However, DSL broadband ISPs continue to advertise “up-to” speeds that on average exceed the actual speeds experienced by their subscribers. Verizon, instead, advertises a speed range for DSL performance and has requested that we include this range in relevant charts; we indicate this speed range by shading on all bar charts describing Verizon DSL performance. Out of the 17 ISP/technology configurations shown, 11 met or exceeded their advertised download speed and four reached at least 90% of their advertised download speed. Only Cincinnati-DSL (at 79%) and Hawaiian Telcom (at 59%) performed below 90% of their advertised download speed.

Chart 4: The ratio of weighted median speed (download and upload) to advertised speed for each ISP

C. VARIATIONS IN SPEEDS

As discussed earlier, actual speeds experienced by individual consumers may vary by location and time of day. Chart 5 shows, for each ISP, the percentage of panelists who experienced a median download speed (averaged over the peak usage period during our measurement period) that was greater than 95%, between 80% and 95%, or less than 80% of the advertised download speed.[15]

Chart 5: The percentage of consumers whose median download speed was greater than 95%, between 80% and 95%, or less than 80% of the advertised download speed

Even though the median download speeds experienced by most ISPs’ subscribers nearly met or exceeded the advertised download speeds, there are some customers of each ISP for whom the median download speed fell significantly short of the advertised download speed. Relatively few subscribers of cable or fiber broadband service experienced this. The best performing ISPs, when measured by this metric, are Optimum, Charter and Verizon-Fiber; more than 90% of their panelists were able to attain an actual median download speed of at least 95% of the advertised download speed.

In addition to variation based on a subscriber’s location, speeds experienced by a consumer may fluctuate during the day. This is typically caused by increased traffic demand and the resulting stress on different parts of the network infrastructure. To examine this aspect of performance, we use the term “80/80 consistent speed”. This metric is designed to assess temporal and spatial variations in measured values of a user’s download speed.[16] Consistency of speed is in itself an intrinsically valuable service characteristic and its impact on consumers will hinge on variations in usage patterns and needs.

Chart 6 summarizes, for each ISP, the ratio of 80/80 consistent median download speed to advertised download speed, and, for comparison, the ratio of median download speed to advertised download speed shown previously in Chart 4. The ratio of 80/80 consistent median download speed to advertised download speed is less than the ratio of median download speed to advertised download speed for all participating ISPs due to congestion periods when median download speeds are lower than the overall average. When the difference between the two ratios is small, the median download speed is fairly insensitive to both geography and time. When the difference between the two ratios is large, there is a greater variability in median download speed, either across a set of different locations or across different times during the peak usage period at the same location.

Chart 6: The ratio of 80/80 consistent median download speed to advertised download speed.

Customers of Charter, Comcast, Cincinnati Bell Fiber, Frontier Fiber, Optimum and Verizon Fiber (Fios) experienced median download speeds that were very consistent; with each provider delivering in excess of 90% of the advertised speed to at least 80% of the panelists for at least 80% of the peak usage period. In particular, Charter and Optimum provided 80/80 consistent speeds that were in excess of 100% of the advertised speed. As can be seen in chart 6, cable and fiber ISPs performed better than DSL and satellite ISPs with respect to their 80/80 consistent speeds. For example, for September 2017, the 80/80 consistent download speed for Viasat satellite was 24% of its advertised speed. Similarly, Cincinnati Bell DSL and Hawaiian Telcom DSL had an 80/80 consistent download speed of respectively 58% and 30% of the advertised speed.

D. LATENCY

Latency is the time it takes for a data packet to travel from one point to another in a network. It has a fixed component that depends on the distance, the transmission speed, and transmission technology between the source and destination, and a variable component that increases as the network path congests with traffic. The MBA program measures latency by measuring the round-trip time from the consumer’s home to the closest measurement server and back.

Chart 7 shows the median latency for each participating ISP. In general, higher-speed service tiers have lower latency, as it takes less time to transmit each packet. Satellite technologies inherently experience longer latencies since packets must travel approximately 44,500 miles from an earth station to the satellite and back. Therefore, the median latencies for satellite-based broadband services are much higher, at 594 ms to 612 ms, than those for terrestrial-based broadband services, which range from 12 ms to 37 ms in our measurements (with the exception of Verizon DSL and Hawaiian Telcom DSL with latencies of 51 ms and 80 ms respectively).

Chart 7: Latency by ISP

Among terrestrial technologies, DSL latencies (between 25 ms to 80 ms) were slightly higher than those for cable (15 ms to 34 ms). Fiber ISPs showed the lowest latencies (12 ms to 20 ms). The differences in median latencies among terrestrial-based broadband services are relatively small and are unlikely to affect the perceived quality of highly interactive applications.

E. PACKET LOSS

Packet loss is the percentage of packets that are sent by a source but not received at the intended destination. The most common reason that a packet is not received is that it encountered congestion along the network route. A small amount of packet loss is expected, and indeed packet loss is commonly used by some Internet protocols to infer Internet congestion and to adjust the sending rate to mitigate for the congestion. The MBA program considers a packet lost if the packet’s round-trip latency exceeds 3 seconds.

Chart 8 shows the average peak-period packet loss for each participating ISP, grouped into bins. We have broken the packet loss performance into three bands, allowing a more granular view of the packet loss performance of the ISP network. The breakpoints for the three bins used to classify packet loss have been chosen with an eye towards commonly accepted packet loss standards; provider packet loss Service Level Agreements (SLAs); and various standards. Specifically, the 1% standard for packet loss is referred to in international documents and commonly accepted as the point at which highly interactive applications such as VoIP will experience significant degradation and quality[17]. The 0.4% breakpoint was chosen as a generic breakpoint between the highly desired performance of 0% packet loss described in many documents and the 1% unacceptable limit on the high side. The specific value of 0.4% is based upon a compromise value between those two limits and is generally supported by many network performance and SLAs provided by major ISPs. Indeed, most SLAs support 0.1% to 0.3% SLA packet loss guarantees [18], but these are generally for enterprise level services which generally have more stringent requirements for higher-level performance.

Chart 8: Percentage of consumers whose peak-period packet loss was less than 0.4%, between 0.4% to 1%, and greater than 1%.

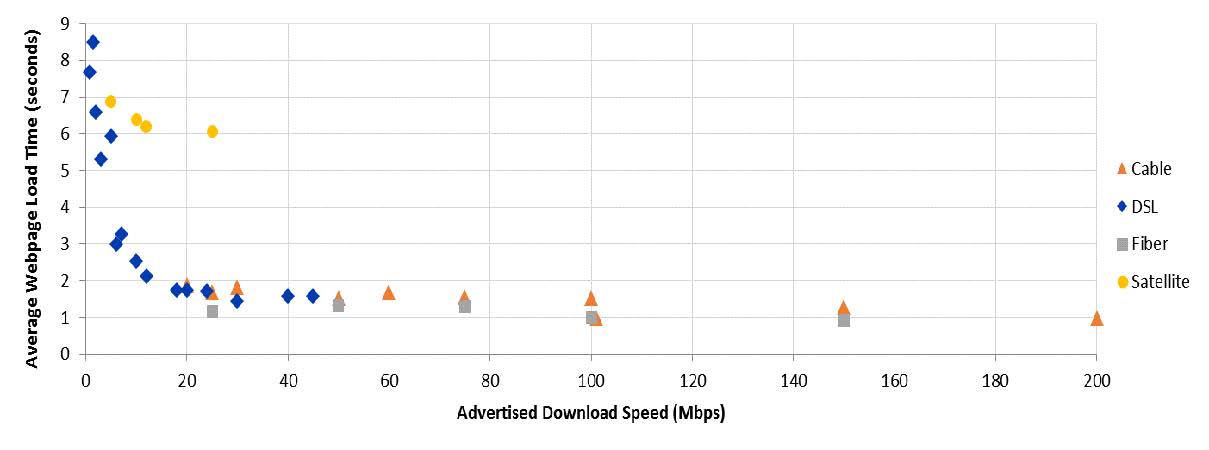

F. WEB BROWSING PERFORMANCE

The MBA program also conducts a specific test to gauge web browsing performance. The web browsing test accesses nine popular websites that include text and images, but not streaming video. The time required to download a webpage depends on many factors, including the consumer’s in-home network, the download speed within an ISP’s network, the web server’s speed, congestion in other networks outside the consumer’s ISP’s network (if any), and the time required to look up the network address of the webserver. Only some of these factors are under control of the consumer’s ISP. Chart 9 displays the average webpage download time as a function of the advertised download speed. As shown by this chart, webpage download time decreases as download speed increases, from about 7.7 seconds at 0.5 Mbps download speed to about 1.7 seconds for 25 Mbps download speed. Subscribers to service tiers exceeding 25 Mbps experience slightly smaller webpage download times decreasing to 1 second at about 200 Mbps. These download times assume that only a single user is using the Internet connection when the webpage is downloaded and does not account for more common scenarios where multiple users within a household are simultaneously using the Internet connection for viewing web pages as well as other applications such as real-time gaming or video streaming.

Chart 9: Average webpage download time, by advertised download speed.

3. Methodology

A. PARTICIPANTS

Thirteen ISPs participated in the Fixed MBA program in September 2017,[19] They were:

- AT&T

- CenturyLink

- Charter Communications

- Cincinnati Bell

- Comcast

- Cox Communications

- Frontier Communications Company

- Hawaiian Telcom

- Hughes Network Systems

- Mediacom Communications Corporation

- Optimum

- Verizon

- Windstream Communications

The methodologies and assumptions underlying the measurements described in this Report are reviewed at meetings that are open to all interested parties and documented in public ex parte letters filed in the GN Docket No. 12-264. Policy decisions regarding the MBA program were discussed at these meetings prior to adoption, and involved issues such as inclusion of tiers, test periods, mitigation of operational issues affecting the measurement infrastructure, and terms-of-use notifications to panelists. Participation in the MBA program is open and voluntary. Participants include members of academia, consumer equipment vendors, telecommunications vendors, network service providers, consumer policy groups as well as our contractor for this project, SamKnows. In 2017-2018, participants at these meetings (collectively and informally referred to as “the broadband collaborative”), included all thirteen participating ISPs and the following additional organizations:

- Center for Applied Data Analysis (CAIDA)

- International Technology and Trade Associates (ITTA)

- Internet Society (ISOC)

- Level 3 Communications (“Level 3”)

- Massachusetts Institute of Technology (“MIT”)

- M-Lab

- NCTA – The Internet and Television Association

- New America Foundation

- Princeton University

- United States Telecom Association (“US Telecom”)

- University of California - Santa Cruz

Participants have contributed in important ways to the integrity of this program and have provided valuable input to FCC decisions for this program. Initial proposals for test metrics and testing platforms were discussed and critiqued within the broadband collaborative. M-Lab and Level 3 contributed their core network testing infrastructure, and both parties continue to provide invaluable assistance in helping to define and implement the FCC testing platform. We thank all the participants for their continued contributions to the MBA program.

B. MEASUREMENT PROCESS

The measurements that provided the underlying data for this report relied both on measurement clients and measurement servers. The measurement clients (i.e., whiteboxes) resided in the homes of 6,034 panelists who received service from one of the 13 participating ISPs plus Viasat. The participating ISPs collectively accounted for over 80% of U.S. residential broadband Internet connections. After the measurement data was processed (as described in greater detail in the Technical Appendix) test results from 4,378 panelists were used in this report.

The measurement servers were hosted by M-Lab and Level 3 Communications, and were located in ten cities across the United States near a point of interconnection between the ISP’s network and the network on which the measurement server resided.

The measurement clients collected data throughout the year, and this data is available as described below. However, only data collected from September 1 through 6 and September 28 through October 21, 2017, referred to throughout this report as the “September 2017” reporting period, were used to generate the charts in this Report.[20]

Broadband performance varies with the time of day. At peak hours, more people are attempting to use their broadband Internet connections, giving rise to a greater potential for network congestion and degraded user performance. Unless otherwise stated, this Report focuses on performance during peak usage period, which is defined as weeknights between 7:00 p.m. to 11:00 p.m. local time at the subscriber’s location. Focusing on peak usage period provides the most useful information because it demonstrates the performance users can expect when the Internet in their local area is experiencing the highest demand from users.

Our methodology focuses on the network performance of each of the participating ISPs. The metrics discussed in this Report are derived from traffic flowing between a measurement client, located within the modem or router within a panelist’s home, and a measurement server, located outside the ISP’s network. For each panelist, the tests automatically choose the measurement server that has the lowest latency to the measurement client. Thus, the metrics measure performance along a path within each ISP’s network, through a point of interconnection between the ISP’s network and the network on which the chosen measurement server resides.

However, the service performance that a consumer experiences could differ from our measured values for several reasons. First, as noted, we measure performance only to a single measurement server rather than to multiple servers, following the approach chosen by most network measurement tools. ISPs, in general, attempt to maintain consistent performance throughout their network. However, at times, some paths or interconnection points within an ISP’s network may be more congested than others and this can affect a specific consumer’s service.

Congestion beyond an ISP’s network is not measured in our study and can affect the overall performance a consumer experiences with their service. A consumer’s home network, rather than the ISP’s network, may be the bottleneck with respect to network congestion. We measure the performance of the ISP’s service delivered to the consumer’s home network, but this connection is often shared simultaneously among multiple users and applications within the home. In-home networks, which typically includes Wi-Fi, may not have sufficient capacities to support peak loads.[21]

In addition, consumers typically experience performance through the set of applications that they utilize, not as raw speed, latency or packet loss. The overall performance of an application depends not only on the network performance but also on the application’s architecture and implementation and on the operating system and hardware on which it runs. While network performance is considered in this Report, application performance is generally not.

C. MEASUREMENT TESTS AND PERFORMANCE METRICS

This Report is based on the following measurement tests:

- Download speed: This test measures the download speed of each whitebox over a 10-second period, once per hour during peak hours (7 p.m. to 11 p.m.) and once during each of the following periods: midnight to 6 a.m., 6 a.m. to noon, and noon to 6 p.m. The measurement results from each whitebox are then averaged across the measurement month; and the median value for these average speeds across the entire set of whiteboxes is used to determine the median download speed for a service tier. The overall ISP download speed is computed as the weighted median for each service tier, using the subscriber counts for the tiers as weights.

- Upload speed: This test measures the upload speed of each whitebox over a 10-second period, (the same measurement interval as the download speed). The speed measured in the last five seconds of the 10-second interval is retained, the results of each whitebox are then averaged over the measurement period, and the median value for the average speed taken over the entire set of whiteboxes is used to determine the median upload speed for a service tier. The ISP upload speed is computed in the same manner as the download speed.

- Latency and packet loss: These tests measure the round-trip times for approximately 2,000 packets per hour sent at randomly distributed intervals. Response times less than three seconds are used to determine the mean latency. If the whitebox does not receive a response within three seconds, the packet is counted as lost.

- Web browsing: The web browsing test measures the total time it takes to request and receive webpages, including the text and images, from nine popular websites and is performed once every hour. The measurement includes the time required to translate the web server name (URL) into the webserver’s network (IP) address.

This Report focuses on three key performance metrics of interest to consumers of broadband Internet access service, as they are likely to influence how well a wide range of consumer applications work: download and upload speed, latency, and packet loss. Download and upload speeds are also the primary network performance characteristic advertised by ISPs. However, as discussed above, the performance observed by a user in any given circumstance depends not only on the actual speed of the ISP’s network, but also on the performance of other parts of the Internet and on that of the application itself.

The standard speed tests use TCP with 8 concurrent TCP sessions. This year we also introduced a single TCP speed test (termed as Lightweight tests), which ran less frequently and thereby provided less strain on consumer accounts that are data-capped. The Lightweight tests were used exclusively to provide broadband performance results for Viasat. The Technical Appendix to this Report describes each test in more detail, including additional tests not contained in this Report.

D. AVAILABILITY OF DATA

The Validated Data Set[22] which this Report is based, as well as the full results of all tests, are available at http://www.fcc.gov/measuring-broadband-america. To encourage additional research, we also provide raw data for the reference month and other months. Previous reports of the MBA program, as well as the data used to produce them, are also available there.

Both the Commission and SamKnows, the Commission’s contractor for this program, recognize that, while the methodology descriptions included in this document provide an overview of the project, interested parties may be willing to contribute to the project by reviewing the software used in the testing. SamKnows welcomes review of its software and technical platform, consistent with the Commission’s goals of openness and transparency for this program.[23]

4. Test Results

A. MOST POPULAR ADVERTISED SERVICE TIERS

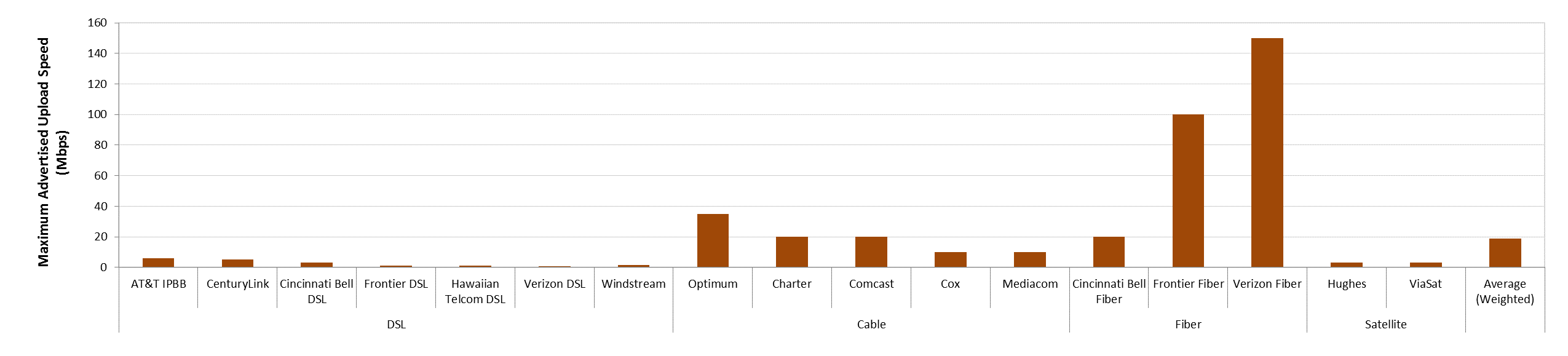

Chart 1 above summarized the maximum advertised download speeds among the measured service tiers[24] for each participating ISP, for September 2017, grouped by the access technology used to offer the broadband Internet access service (DSL, cable, fiber, or satellite). Chart 10 below shows the corresponding maximum advertised upload speeds among the measured service tiers. As shown in Chart 10, the maximum upload speed of ISPs using DSL and satellite technology lags ISPs using cable and fiber technologies. The maximum advertised upload speed is between 0.8 to 6 Mbps for ISPs using DSL technology, and 3 Mbps for ISPs using satellite technology. In contrast, among cable-based broadband providers, the maximum advertised upload speeds among the measured service tiers is 10 to 35 Mbps. Similarly, for ISPs using fiber technology the maximum upload speed ranged from 20 to 150 Mbps. As noted previously, except for Cincinnati Bell fiber, the upload and download speed offerings for fiber technologies are symmetric. The computed weighted average of the maximum upload speed of all the ISPs is 18 Mbps.

Chart 10: Maximum advertised upload speed among the measured service tiers

B. OBSERVED MEDIAN DOWNLOAD AND UPLOAD SPEEDs

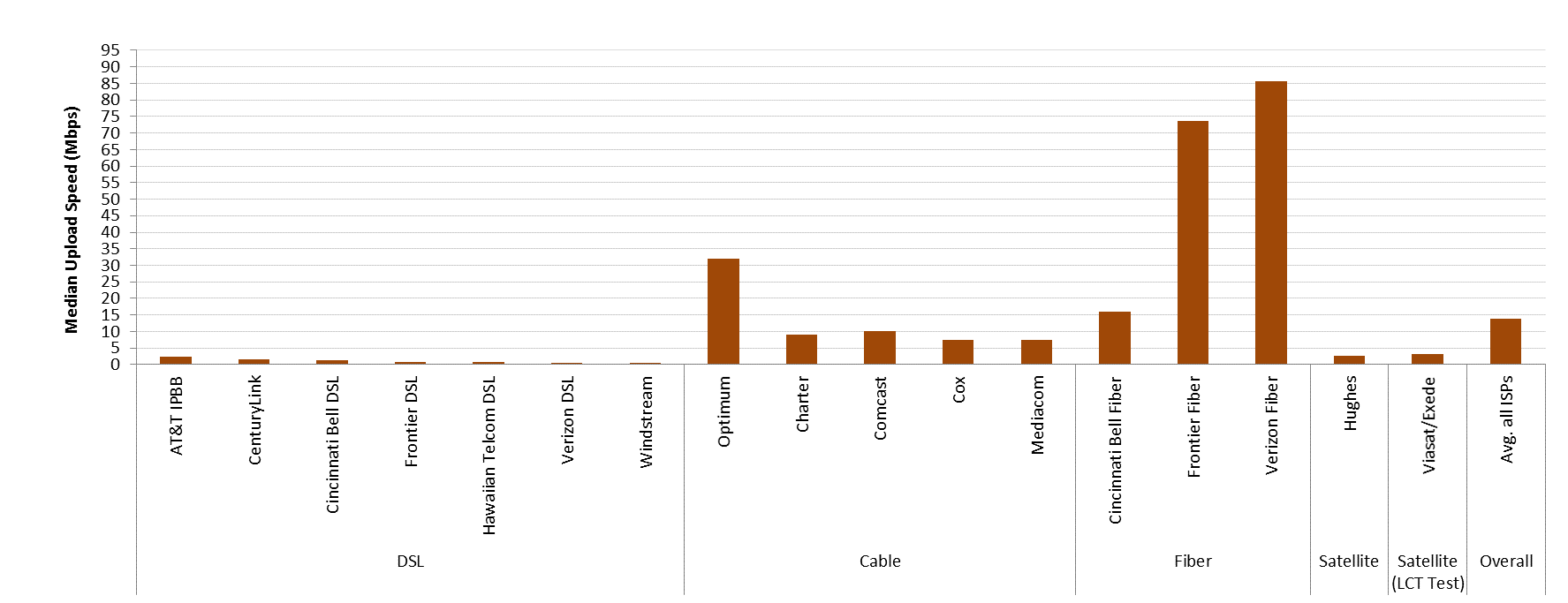

Chart 3 above showed the median download speeds experienced by each ISP’s participating subscribers in September 2017. Chart 11 below shows the corresponding median upload speeds. The median upload speed for this period across all consumers was 14 Mbps.

Chart 11: Median upload speeds by ISP.

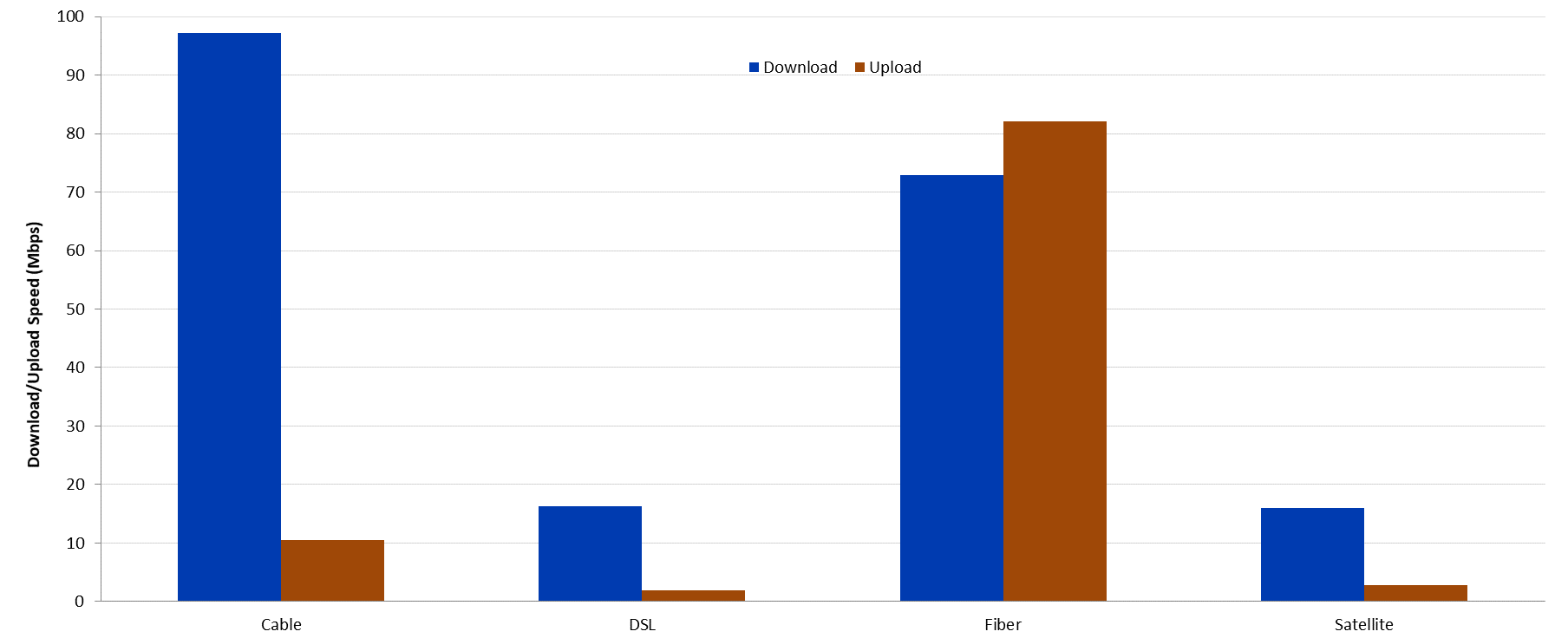

Chart 12 below show the median download and upload speeds by technology for September 2017.

As seen in the chart, the median download speeds for DSL and satellite technologies, which are both 16 Mbps, lag the median download speeds for cable and fiber technologies which are respectively 97 and 73 Mbps. Similarly, the median upload speeds for DSL and satellite technologies, which are respectively 2 to 3 Mbps, lag the median upload speeds of cable and fiber technologies which are respectively 11 and 82 Mbps.

Observing both the download and upload speeds, it is clear that fiber service tiers are generally symmetric in their actual upload and download speeds. This results from the fact that fiber technology has significantly more capacity than other technologies and it can be engineered to have symmetric upload and download speeds. For other technologies with more limited capacity, higher capacity is usually allocated to download speeds than to upload speeds, typically in ratios ranging from 5:1 to 10:1. This resulting asymmetry in download/upload speeds is reflective of actual usage because consumers typically download significantly more data than they upload.

Chart 12: Median download and upload speeds by technology.

Chart 4 (in Section 2.B) showed the ratio in September 2017 of the weighted median of both download and upload speeds of each ISP’s subscribers to advertised speeds. Charts 13.1 and 13.2 below show the same ratios separately for download speed and for upload speed.[25] The median download speeds of most ISPs’ subscribers have been close to, or have exceeded, the advertised speeds. Exceptions to this were the following DSL providers: CenturyLink, Cincinnati Bell, Frontier DSL, Hawaiian Telcom DSL, Windstream and Viasat with respective ratios of 95%, 79%, 92%, 59%, 94% and 90%.

Chart 13.1: The ratio of median download speed to advertised download speed.

Chart 13.2 shows the median upload speed as a percentage of the advertised speed. As was the case with download speeds most ISPs meet or exceed the advertised rates except for a number of DSL providers: CenturyLink, Cincinnati Bell DSL, Frontier DSL, Hawaiian Telcom DSL, Verizon DSL and Windstream which had respective ratios of 87%, 83%, 91%, 79%, 95% and 83%.

C. Variations In Speeds

As noted, median speeds experienced by consumers may vary based on location and time of day. Chart 5 above showed, for each ISP, the percentage of consumers (across the ISP’s service territory) who experienced a median download speed over the peak usage period that was either greater than 95%, between 80% and 95%, or less than 80% of the advertised download speed. Chart 14 below shows the corresponding percentage of consumers whose median upload speed fell in each of these ranges.

Chart 14: The percentage of consumers whose median upload speed was (a) greater than 95%, (b) between 80% and 95%, or (c) less than 80% of the advertised upload speed.

Even though the median upload speeds experienced by most subscribers were close to or exceeded the advertised upload speeds there were some subscribers, for each ISP, whose median upload speed fell significantly short of the advertised upload speed. This issue was most prevalent for ISPs using DSL technology. On the other hand, ISPs using cable and fiber technology generally showed very good consistency based on this metric.

We can learn more about the variation in network performance by separately examining variations across geography and across time. We start by examining the variation across geography within each participating ISP’s service territory. For each ISP, we first calculate the ratio of the median download speed (over the peak usage period) to the advertised download speed for each panelist subscribing to that ISP. We then examine the distribution of this ratio across the ISP’s service territory.

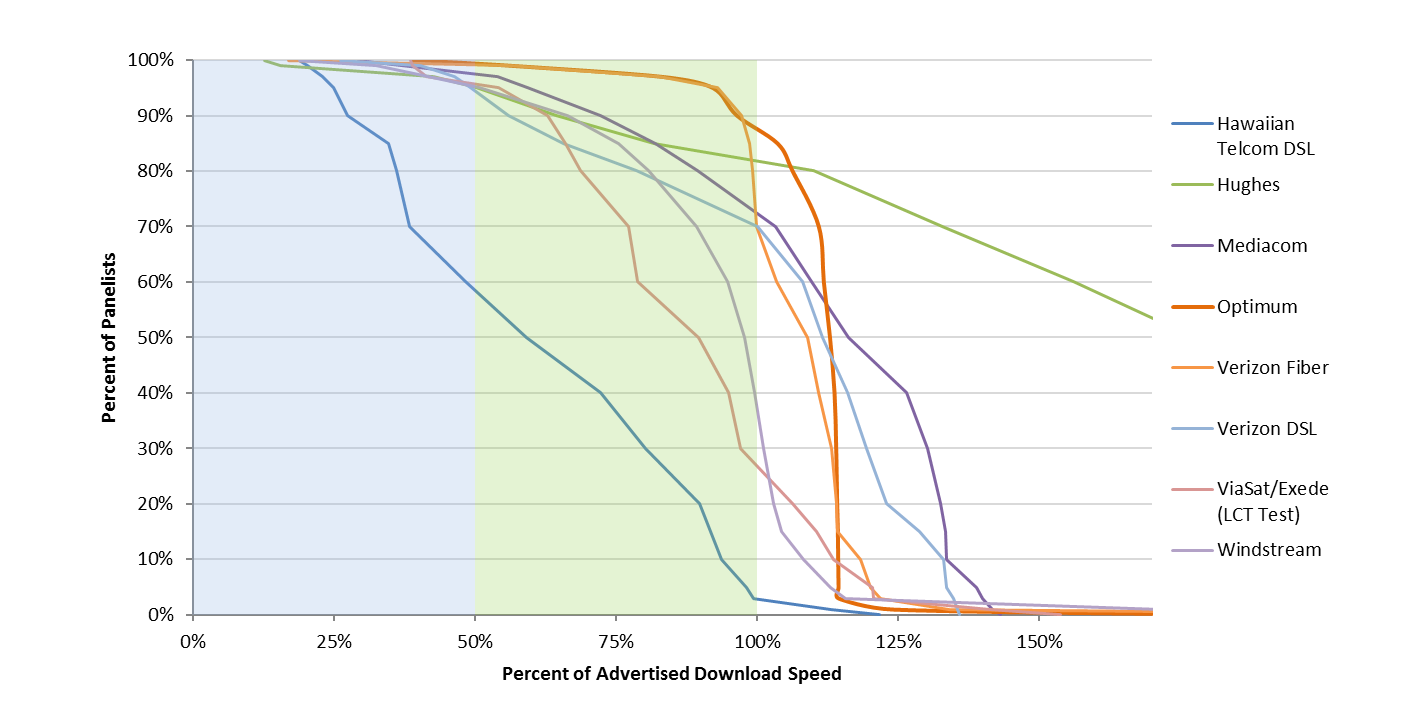

Charts 15.1 and 15.2 show the complementary cumulative distribution of the ratio of median download speed (over the peak usage period) to advertised download speed for each participating ISP. For each ratio of actual to advertised download speed on the horizontal axis, the curves show the percentage of panelists subscribing to each ISP that experienced at least this ratio.[26] For example, the Cincinnati Bell fiber curve in Chart 15.1 shows that 90% of its subscribers experienced a median download speed exceeding 83% of the advertised download speed, while 70% experienced a median download speed exceeding 95% of the advertised download speed, and 50% experienced a median download speed exceeding 106% of the advertised download speed.

Chart 15.1: Complementary cumulative distribution of the ratio of median download speed to advertised download speed.

Chart 15.2: Complementary cumulative distribution of the ratio of median download speed to advertised download speed (continued).

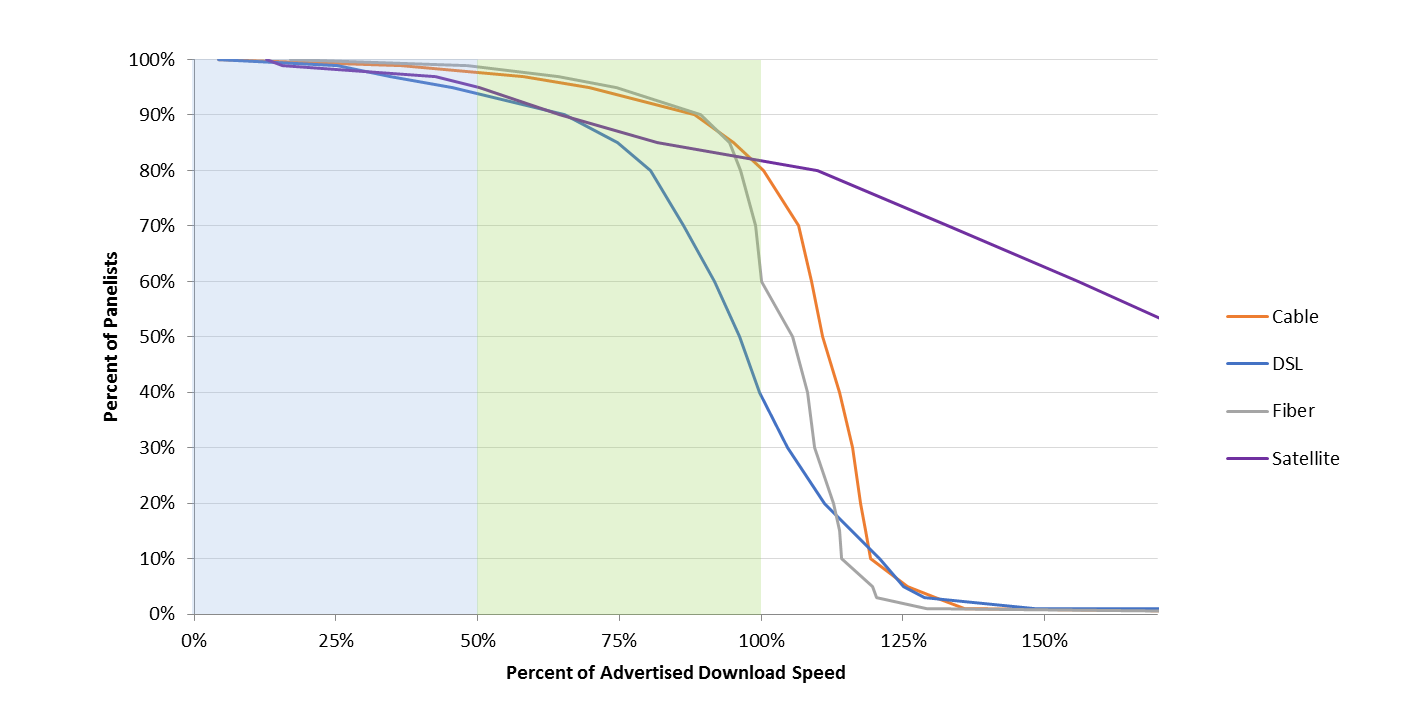

The curves for cable-based broadband and fiber-based broadband are steeper than those for DSL-based broadband and satellite-based broadband. This can be seen more clearly in Chart 15.3, which plots aggregate curves for each technology. Approximately 80% of subscribers to cable and 60% of subscribers to fiber-based technologies experience median download speeds exceeding the advertised download speed. In contrast, only 40% of subscribers to DSL-based services experience median download speeds exceeding the advertised download speed.[27]

Chart 15.3: Complementary cumulative distribution of the ratio of median download speed to advertised download speed, by technology.

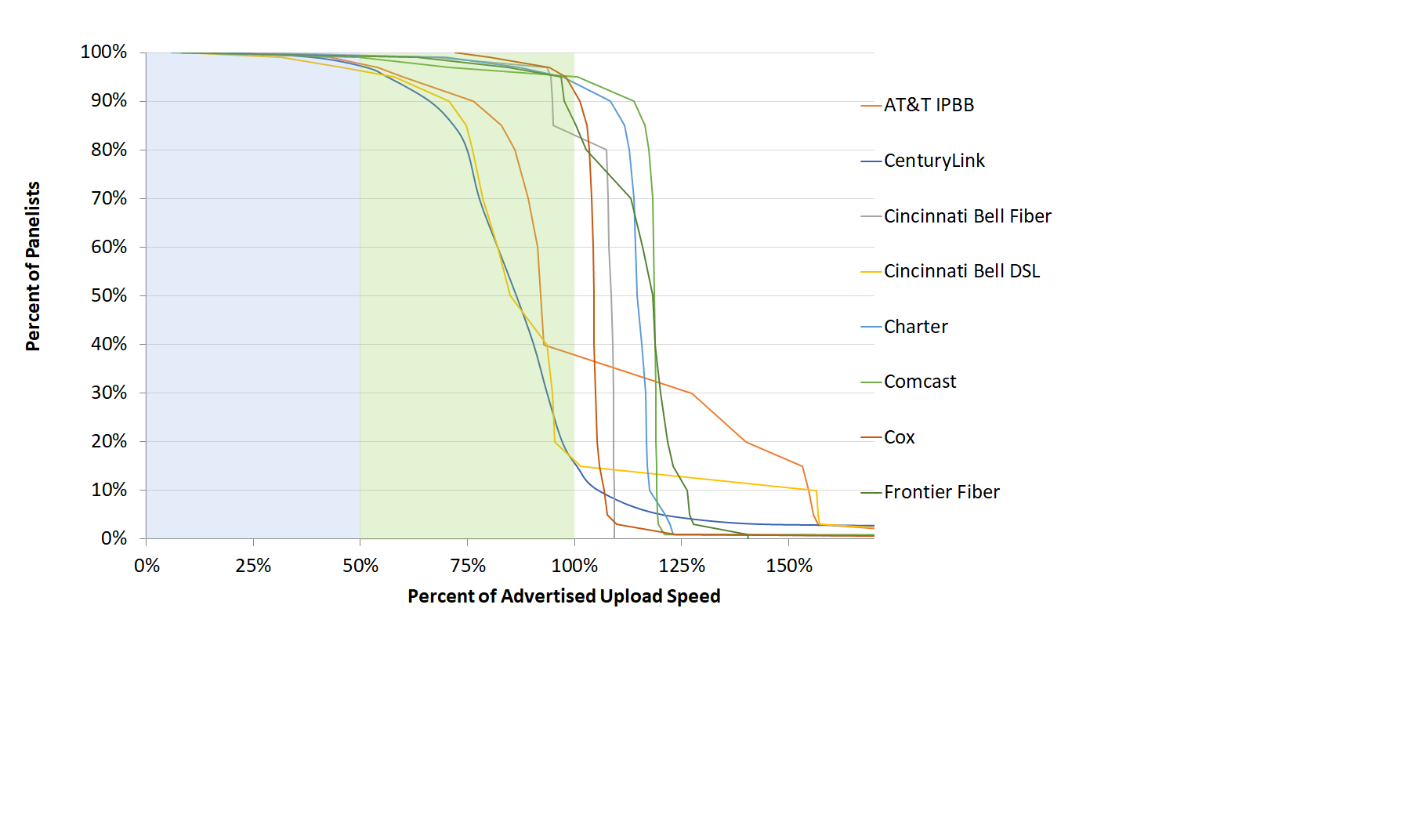

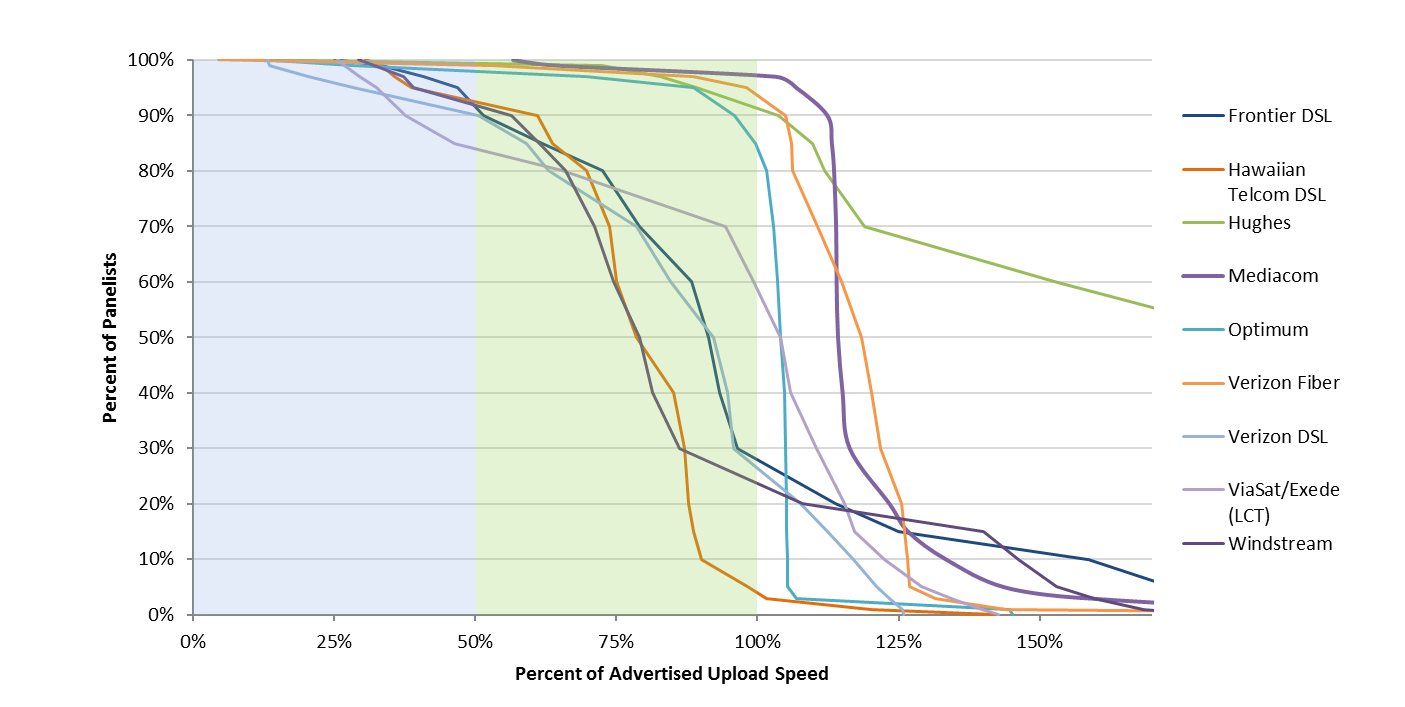

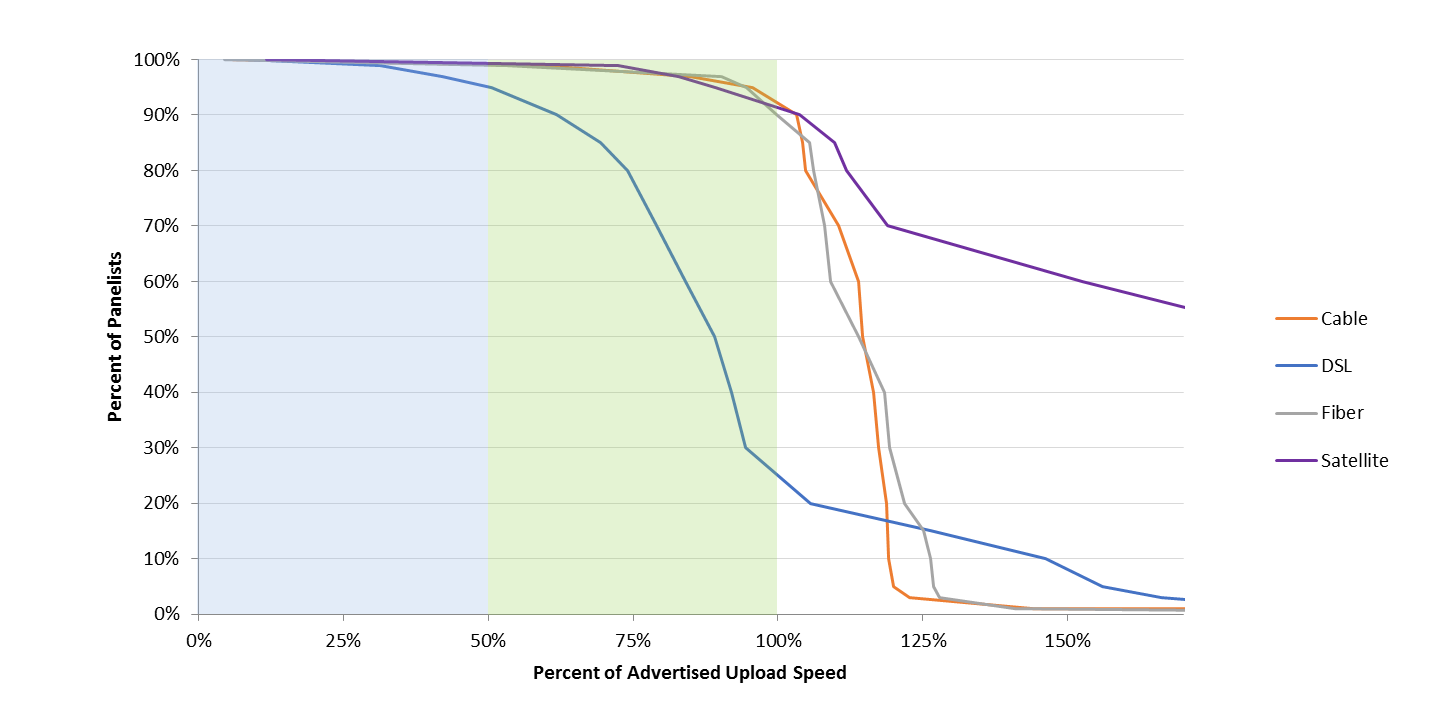

Charts 15.4 to 15.6 show the complementary cumulative distribution of the ratio of median upload speed (over the peak usage period) to advertised upload speed for each participating ISP (Charts 15.4 and 15.5) and by access technology (Chart 15.6).

Chart 15.4: Complementary cumulative distribution of the ratio of median upload speed to advertised upload speed.

Chart 15.5: Complementary cumulative distribution of the ratio of median upload speed to advertised upload speed (continued).

Chart 15.6: Complementary cumulative distribution of the ratio of median upload speed to advertised upload speed, by technology.

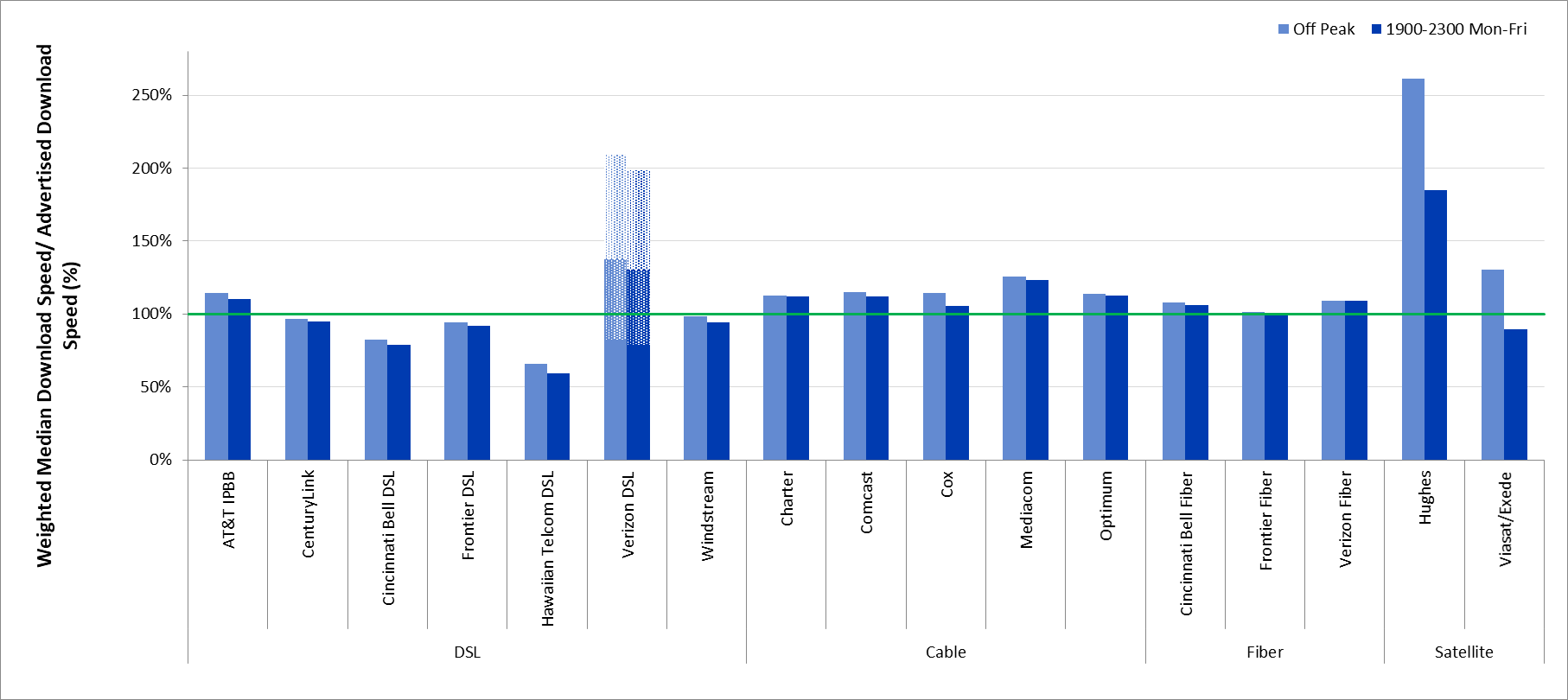

All actual speeds discussed above were measured during peak usage periods. In contrast, Charts 16.1 and 16.2 below compare the ratio of actual speed to advertised speed during peak and off-peak times.[28] Charts 16.1 and 16.2 show that while most ISPs show only a slight degradation from off-peak to peak hour performance, satellite ISPs show a markedly larger degradation. Hughes customers experience a drop from 261% to 185% in the ratio of median download speed to advertised speed from off-peak hours to peak hours. Similarly, ViaSat customers experience a corresponding drop from 131% to 90%.

Chart 16.1: The ratio of weighted median download speed to advertised download speed, peak hours versus off-peak hours.

Chart 16.2: The ratio of weighted median upload speed to advertised upload speed, peak versus off-peak.

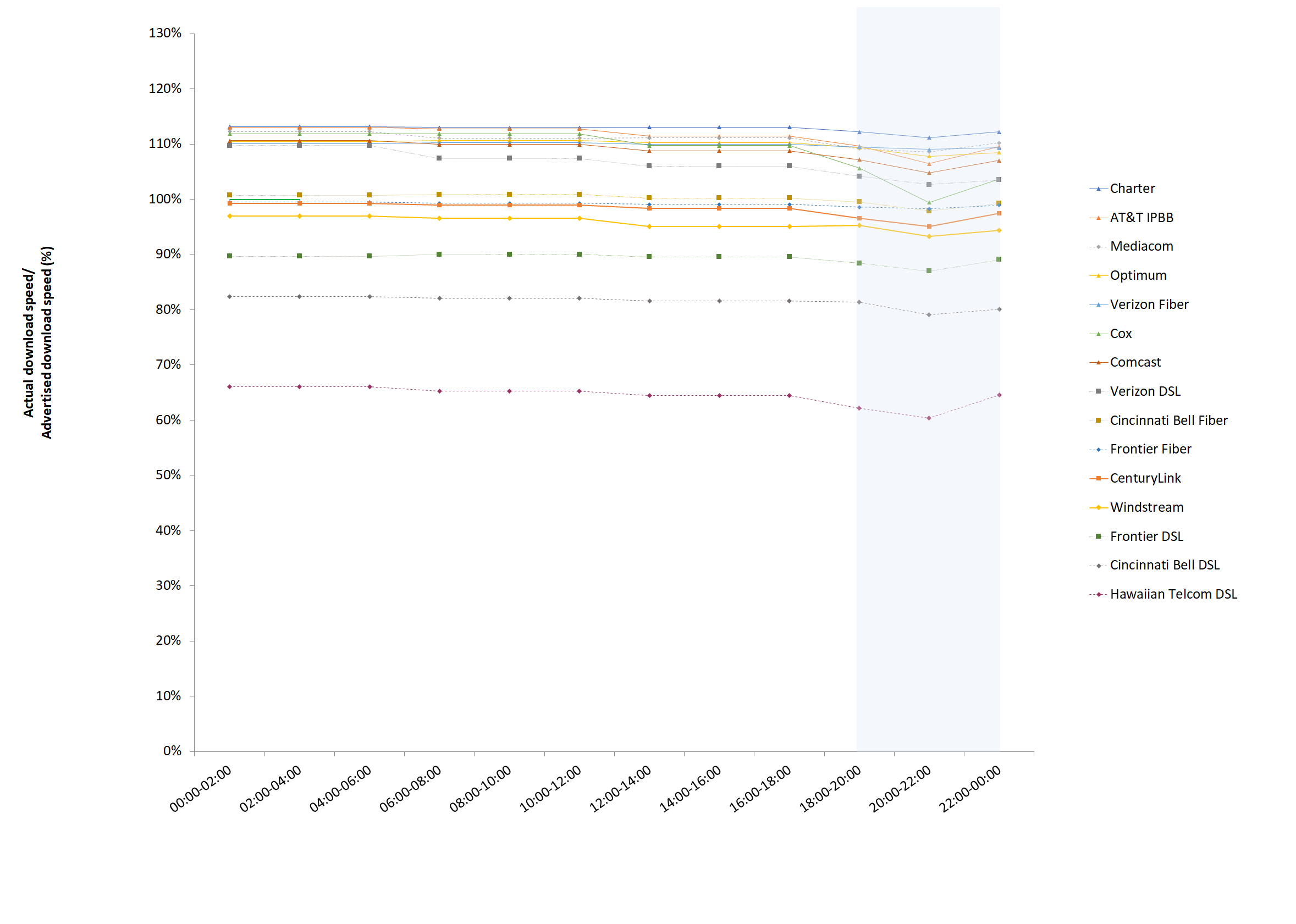

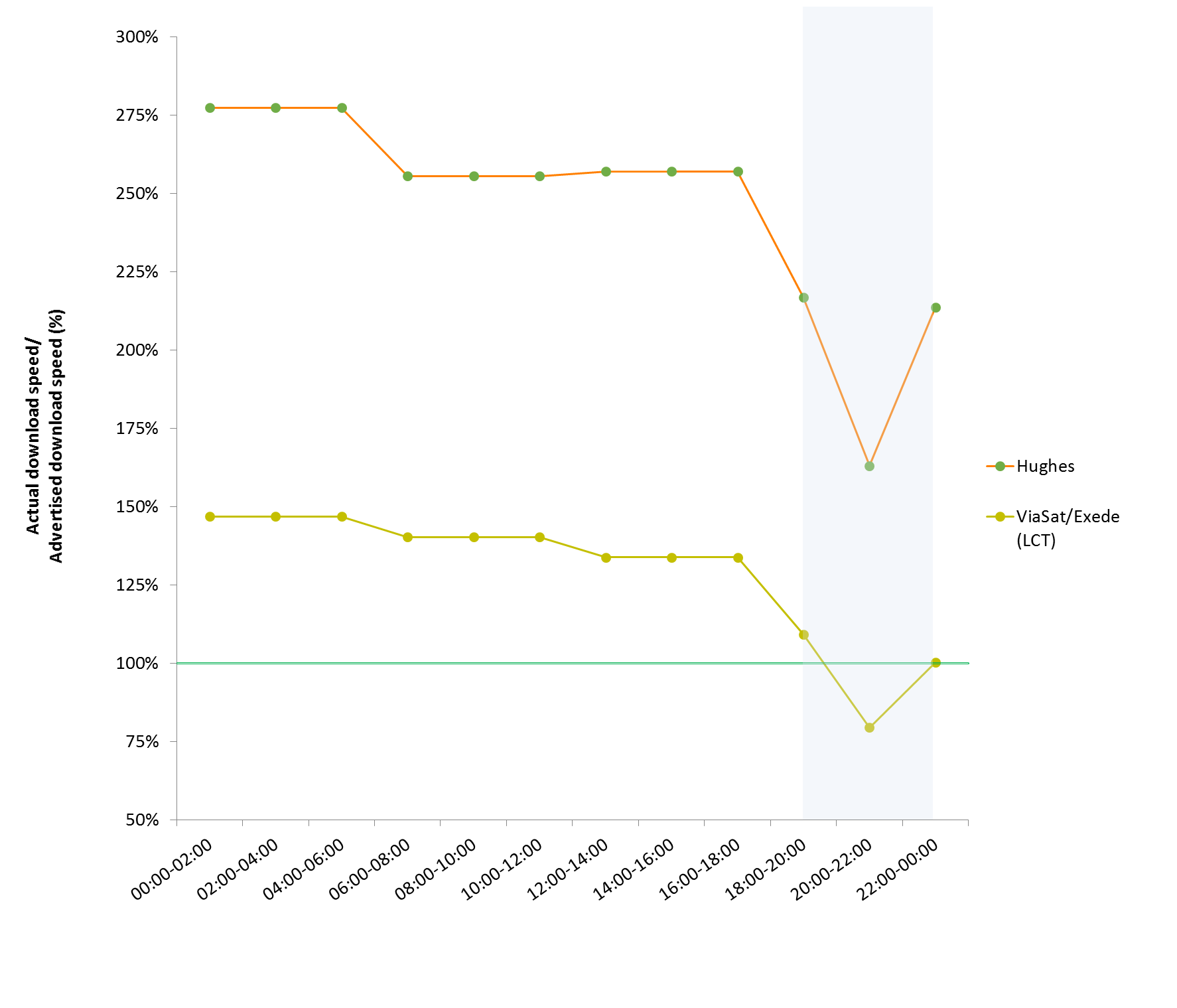

Charts 17.1[29] and 17.2 below show the actual download speed to advertised speed ratio in each two-hour time block during weekdays for each ISP. The ratio is lowest during the busiest four-hour time block (7:00 p.m. to 11:00 p.m.).

Chart 17.1: The ratio of median download speed to advertised download speed, Monday-to-Friday, two-hour time blocks, terrestrial ISPs.

Chart 17.2: The ratio of median download speed to advertised download speed, Monday-to-Friday two-hour time blocks, satellite ISPs.

For each ISP, Chart 6 (in section 2.C) showed the ratio of the 80/80 consistent median download speed to advertised download speed, and for comparison, Chart 4 showed the ratio of median download speed to advertised download speed.

Chart 18.1 illustrates information concerning 80/80 consistent upload speeds. For all ISPs, the upload 80/80 speed is lower than the upload median speed. For most ISPs, the upload 80/80 speed is slightly lower than the upload median speed. However, in the case of Hughes, Via Sat and Verizon DSL, the 80/80 speed was considerably lower than the upload median speed.

Chart 18.1: The ratio of 80/80 consistent upload speed to advertised upload speed.

Charts 18.2 and 18.3 below illustrate similar consistency metrics for 70/70 consistent speeds, i.e., the minimum speed (as a percentage of the advertised speed) experienced by at least 70% of panelists during at least 70% of the peak usage period.[30] The ratios for 70/70 consistent speeds as a percentage of the advertised speed are higher than the corresponding ratios for 80/80 consistent speeds. In fact, for many ISPs, the 70/70 consistent download speed is close to the median download speed. ViaSat and Hawaiian Telcom showed a considerably smaller value for the 70/70 download speed as compared to the download median speed.

Chart 18.2: The ratio of 70/70 consistent download speed to advertised download speed.

Chart 18.3: The ratio of 70/70 consistent upload speed to advertised upload speed.

D. LATENCY

Chart 19 below shows the weighted median latencies, by technology and by advertised download speed for terrestrial technologies. For all terrestrial technologies, latency varied little with advertised download speed. DSL service typically had higher latencies than either cable or fiber.

Chart 19: Latency for Terrestrial ISPs, by technology, and by advertised download speed.

5. Additional Test Results

E. ACTUAL SPEED, BY SERVICE TIER

As shown in Charts 20.1-20.7, peak usage period performance varied by service tier among participating ISPs during the September 2017 period. On average, during peak periods, the ratio of median download speed to advertised download speed for all ISPs was 59% or better, and 90% or better for most ISPs. However, the ratio of median download speed to advertised download speed varies among service tiers. It should be noted that for Verizon-DSL, which advertises a range of speeds, we have calculated a range of values corresponding to its advertised range.

Chart 20.1: The ratio of median download speed to advertised download speed, by ISP (0-5 Mbps).

Chart 20.2: The ratio of median download speed to advertised download speed, by ISP (6-10 Mbps).

Chart 20.3: The ratio of median download speed to advertised download speed, by ISP (12-18 Mbps).

Chart 20.4: The ratio of median download speed to advertised download speed, by ISP (20-25 Mbps).

Chart 20.5: The ratio of median download speed to advertised download speed, by ISP (30-50 Mbps).

Chart 20.6: The ratio of median download speed to advertised download speed, by ISP (60-75 Mbps).

Chart 20.7: The ratio of median download speed to advertised download speed, by ISP (100-200 Mbps).

Charts 21.1 –21.7 depict the ratio of median upload speeds to advertised upload speeds for each ISP by service tier.

Chart 21.1: The ratio of median upload speed to advertised upload speed, by ISP (0-0.64 Mbps).

Chart 21.2: The ratio of median upload speed to advertised upload speed, by ISP (0.768-0.896 Mbps).

Chart 21.3: The ratio of median upload speed to advertised upload speed, by ISP (1-2 Mbps).

Chart 21.4: The ratio of median upload speed to advertised upload speed, by ISP (3-5 Mbps).

Chart 21.5: The ratio of median upload speed to advertised upload speed, by ISP (6-10 Mbps).

Chart 21.6: The ratio of median upload speed to advertised upload speed, by ISP (20-50 Mbps).

Chart 21.7: The ratio of median upload speed to advertised upload speed, by ISP (75-150 Mbps).

Table 2 lists the advertised download service tiers included in this study. For each tier, an ISP’s advertised download speed is compared with the median of the measured download speed results. As in past reports, we note that the download speeds listed here are based on national averages and may not represent the performance experienced by any particular consumer at any given time or place.

Table 2: Peak period median download speed, sorted by actual download speed

|

Advertised Download Speed (Mbps) |

ISP |

Actual Speed / Advertised Speed (%) |

||

|

0.84 |

0.5 - 1 |

Verizon DSL |

83.7 - 167.4 |

|

|

2.31 |

1.1 - 3 |

Verizon DSL |

76.9 - 209.8 |

|

|

1.24 |

1.5 |

CenturyLink |

82.9 |

|

|

3.13 |

3 |

AT&T IPBB |

104.2 |

|

|

2.72 |

3 |

CenturyLink |

90.7 |

|

|

2.48 |

3 |

Frontier DSL |

82.7 |

|

|

2.66 |

3 |

Windstream |

88.7 |

|

|

3.45 |

5 |

Cincinnati Bell DSL |

69.0 |

|

|

11.15 |

5 |

Hughes |

223.0 |

|

|

6.63 |

6 |

AT&T IPBB |

110.6 |

|

|

5.61 |

6 |

Frontier DSL |

93.5 |

|

|

5.88 |

6 |

Windstream |

98.0 |

|

|

6.90 |

7 |

CenturyLink |

98.6 |

|

|

9.18 |

10 |

CenturyLink |

91.8 |

|

|

8.35 |

10 |

Cincinnati Bell DSL |

83.5 |

|

|

18.29 |

10 |

Hughes |

182.9 |

|

|

13.19 |

12 |

AT&T IPBB |

109.9 |

|

|

11.77 |

12 |

CenturyLink |

98.1 |

|

|

11.19 |

12 |

Frontier DSL |

93.3 |

|

|

10.75 |

12 |

ViaSat |

89.6 |

|

|

12.00 |

12 |

Windstream |

100.0 |

|

|

19.89 |

18 |

AT&T IPBB |

110.5 |

|

|

19.45 |

20 |

CenturyLink |

97.3 |

|

|

23.22 |

20 |

Charter |

116.1 |

|

|

27.42 |

24 |

AT&T IPBB |

114.3 |

|

|

29.41 |

25 |

Comcast |

117.6 |

|

|

24.90 |

25 |

Frontier Fiber |

99.6 |

|

|

31.27 |

25 |

Hughes |

125.1 |

|

|

29.60 |

25 |

Verizon Fiber |

118.4 |

|

|

36.66 |

30 |

Charter |

122.2 |

|

|

27.42 |

30 |

Cincinnati Bell DSL |

91.4 |

|

|

39.87 |

40 |

CenturyLink |

99.7 |

|

|

46.74 |

45 |

AT&T IPBB |

103.9 |

|

|

53.17 |

50 |

Cincinnati Bell Fiber |

106.4 |

|

|

54.13 |

50 |

Cox |

108.3 |

|

|

48.20 |

50 |

Frontier Fiber |

96.4 |

|

|

56.84 |

50 |

Verizon Fiber |

113.7 |

|

|

65.37 |

60 |

Charter |

109.0 |

|

|

78.19 |

60 |

Mediacom |

130.3 |

|

|

67.95 |

60 |

Optimum |

113.2 |

|

|

83.11 |

75 |

Comcast |

110.8 |

|

|

81.45 |

75 |

Frontier Fiber |

108.6 |

|

|

81.64 |

75 |

Verizon Fiber |

108.9 |

|

|

111.77 |

100 |

Charter |

111.8 |

|

|

105.58 |

100 |

Cincinnati Bell Fiber |

105.6 |

|

|

111.07 |

100 |

Comcast |

111.1 |

|

|

104.82 |

100 |

Cox |

104.8 |

|

|

98.69 |

100 |

Frontier Fiber |

98.7 |

|

|

106.98 |

100 |

Mediacom |

107.0 |

|

|

99.48 |

100 |

Verizon Fiber |

99.5 |

|

|

112.74 |

101 |

Optimum |

111.6 |

|

|

147.98 |

150 |

Cox |

98.7 |

|

|

148.59 |

150 |

Verizon Fiber |

99.1 |

|

|

221.07 |

200 |

Comcast |

110.5 |

|

F. VARIATIONS IN SPEED

In Section 3.C above, we presen0ted speed consistency metrics for each ISP based on test results averaged across all service tiers. In this section, we provide detailed speed consistency results for each ISP’s individual service tiers. Consistency of speed is important for services such as video streaming. A significant reduction in speed for more than a few seconds can force a reduction in video resolution or an intermittent loss of service.

Charts 22.1 – 22.3 below show the percentage of consumers that achieved greater than 95%, between 85% and 95%, or less than 80% of the advertised download speed for each ISP speed tier.[31] Consistent with past performance, ViaSat/Exede showed low consistency of speed with 52% of consumers experiencing an average service speed of 80% or less of the advertised speed. ISPs using DSL technology also frequently failed to deliver advertised service rates. ISPs quote a single ‘up-to’ speed, but the actual speed of DSL depends on the distance between the subscriber and the serving central office.

Cable companies and fiber-based systems, in general, showed a high consistency of speed.

Chart 22.1: The percentage of consumers whose median download speed was greater than 95%, between 80% and 95%, or less than 80% of the advertised download speed, by service tier (DSL).

Chart 22.2: The percentage of consumers whose median download speed was greater than 95%, between 80% and 95%, or less than 80% of the advertised download speed (cable).

Chart 22.3: The percentage of consumers whose median download speed was greater than 95%, between 80% and 95%, or less than 80% of the advertised download speed (fiber and satellite).

Similarly, Charts 23.1 to 23.3 show the percentage of consumers that achieved greater than 95%, between 85% and 95%, or less than 80% of the advertised upload speed for each ISP speed tier.

Chart 23.1: The percentage of consumers whose median upload speed was greater than 95%, between 80% and 95%, or less than 80% of the advertised upload speed (DSL).

Chart 23.2: The percentage of consumers whose median upload speed was greater than 95%, between 80% and 95%, or less than 80% of the advertised upload speed (cable).

Chart 23.3: The percentage of consumers whose median upload speed was greater than 95%, between 80% and 95%, or less than 80% of the advertised upload speed (fiber and satellite).

In Section 3.C above, we presented complementary cumulative distributions for each ISP based on test results across all service tiers. Below, we provide tables showing selected points on these distributions by each individual ISP. Overall, performance depended less on a specific technology and more on the engineering and marketing choices made by each provider. For example, Optimum and Charter, which are cable-based companies, provided average download speeds over 92% and 93%, respectively, of advertised rates to 95% of their panelists. Cox and Mediacom, also cable-based companies, provided median speeds of at least 55% and 59% of advertised speed to 95% of their panelists. Verizon’s fiber-based service provided speeds of 93% or better to 95% of its panelists whereas Frontier Fiber provided speeds of 72% or better to 95% of its panelists.

Table 3: Complementary cumulative distribution of the ratio of median download speed to advertised download speed by ISP

Table 4: Complementary cumulative distribution of the ratio of median upload speed to advertised upload speed by ISP

G. WEB BROWSING PERFORMANCE, BY SERVICE TIER

Below, we provide the detailed results of the webpage download time for each individual service tier of each ISP. Generally, website loading time decreased steadily with increasing tier speed until a tier speed of 15 Mbp,s and does not change markedly above that speed.

Chart 24.1: Average webpage download time, by ISP (0-5 Mbps).

Chart 24.2: Average webpage download time, by ISP (6-10 Mbps),

Chart 24.3: Average webpage download time, by ISP (12-18 Mbps).

Chart 24.4: Average webpage download time, by ISP (20-25 Mbps).

Chart 24.5: Average webpage download time, by ISP (30-50 Mbps).

Chart 24.6: Average webpage download time, by ISP (60-75 Mbps).

Chart 24.7: Average webpage download time, by ISP (100-200 Mbps).

[1] The actual dates used for measurements for this Eighth Report were September 1-6, 2017 inclusive and September 28-October 21, 2017 inclusive.

[2] This year, at the request of and with the assistance of the Hawaiian Department of Commerce and Consumer Affairs (DCCA) we added the state of Hawaii to the MBA program. The ISPs whose performance were measured in the State of Hawaii were Hawaiian Telcom and Time Warner Oceanic (which is now a part of Charter Spectrum).

[3] All reports can be found at https://www.fcc.gov/general/measuring-broadband-america.

[4] The First Report (2011) was based on measurements taken in March 2011, the Second Report (2012) on measurements taken in April 2012, and the Third (2013) through Seventh (2017) Reports on measurements taken in September of the year prior to the reports’ release dates. In order to avoid confusion between the date of release of the report and the measurement dates we have shifted last year to numbering the reports. Thus, this year’s report is termed the Eighth MBA Report instead of 2018 MBA Report. Going forward we will continue with a numbered approach and the next report will be termed as the Ninth Report.

[5] We first determine the mean value over all the measurements for each individual panelist’s “whitebox.” (Panelists are sent “whiteboxes” that run pre-installed software on off-the-shelf routers that measure thirteen broadband performance metrics, including download speed, upload speed, and latency.) Then for each ISP’s speed tiers, we compute a median of from the set of mean values for all the panelists/whiteboxes. The median is that value separating the top half of values in a sample set with the lower half of values in a sample set; it can be thought of as the middle value in an ordered list of values. For calculations involving multiple speed tiers, we compute the weighted average of the medians for each tier. The weightings are based on the relative subscriber numbers for the individual tiers.

[6] See 2016 Report at https://www.fcc.gov/reports-research/reports/measuring-broadband-america/measuring-fixed-broadband-report-2016.

[7] As described more fully in section 2, a service tier is initially added to this report only if it contains at least 30,000 subscribers and has 5% or more of an ISP’s total number of broadband subscribers.

[8] The ISPs that provided SamKnows, the FCC’s contractor supporting the MBA program, with weights for each of their tiers were: AT&T, Cincinnati Bell, CenturyLink, Charter, Comcast, Cox, Mediacom, Optimum and Verizon.

[9] For an explanation of Form 477 filing requirements and required data see: https://transition.fcc.gov/form477/477inst.pdf (Last accessed 5/2/2018).

[10] Video traffic comprised 73% of Internet traffic in 2016, and some expect it to grow to 82% by 2021. See Cisco Visual Networking Index: Forecast and Methodology, 2016-2021 White Paper, https://www.cisco.com/c/en/us/solutions/collateral/service-provider/vis… (Last accessed July 19, 2018).

[11] Where several technologies are plotted at the same point in the chart, this is identified as “Multiple Technologies.”

[12] Of the 4,545 panelists who participated in the September 2016 collection of data, 4,355 panelists continued to participate in the September 2017 collection of data.

[13] We do not attempt here to distinguish between these two cases.

[14] For a detailed definition and discussion of this metric, please refer to the Technical Appendix.

[15] Charts 5 and 6 exclude Cox due to a sampling issue affecting a subset of test results that understated Cox’s nationwide download speeds. Specifically, a local transit link carrying less than 3% of Cox’s nationwide traffic was used for approximately 54% of Cox’s MBA tests from Arizona, and during two weeks that overlapped with the testing period, a delay in upgrading the transit link negatively affected test results for Arizona panelists from a subset of MBA servers. Other MBA test results for these same panelists and for panelists in all other markets showed higher performance within the same peak period and day when tests were routed over the network paths used by 97% of Cox’s traffic. With respect to Chart 5, omitting the affected test results would show that the percentage of Cox subscribers whose median download speed was greater than 95%, between 80% and 95%, and less than 80% of the advertised download speed was 82%, 10%, and 8%, respectively. Including the affected test results would show that these percentages were 66%, 17%, and 17%, respectively. With respect to Chart 6, omitting the affected test results would show that the 80/80 consistent download speed for Cox was 85% of its advertised download speed, and including the affected test results would show that that figure was 37%. Unless otherwise noted, other charts and tables in this report include the affected test results, but would likely show similar changes if adjusted.

[16] See: https://www.voip-info.org/wiki/view/QoS and http://www.ciscopress.com/articles/article.asp?p=357102

[17] See: http://www.itu.int/dms_pubrec/itu-r/rec/m/r-rec-m.1079-2-200306-i!!msw-e.doc

[18] Viasat, operating under the brand name Exede internet, left the program as a participating ISP this year and consequently no longer provide panelists with an increased data allowance to offset the data used by the MBA measurements. We, however, continue reporting results for ViaSat Exede tiers by using lightweight tests aimed at reducing the data burden on Viasat panelists. These tests are described in greater detail in the accompanying Technical Appendix to this Eighth MBA Report.

[19] The period of September 7-27 2017 was omitted because of hurricanes Harvey and Irma that widespread network congestion in parts of Florida and Texas. Additionally, there were some residual effects of congestion due to Apple’s release of its iOS 11 on September 19. Omitting dates during these periods was done consistent with the FCC’s data collection policy for fixed MBA data. See FCC, Measuring Fixed Broadband, Data Collection Policy, https://www.fcc.gov/general/measuring-broadband-america-measuring-fixed-broadband (explaining that the FCC has developed policies to deal with impairments in the data collection process with potential impact for the validity of the data collected).

[20] Independent research, drawing on the FCC’s MBA test platform [numerous instances of research supported by the fixed MBA test platform are described at https://www.fcc.gov/general/mba-assisted-research-studies], suggests that home networks are a significant source of end-to-end service congestion. See Srikanth Sundaresan et al., Home Network or Access Link? Locating Last-Mile Downstream Throughput Bottlenecks, PAM 2016 - Passive and Active Measurement Conference, at 111-123 (March 2016).

[21] The September 2017 data set was validated to remove anomalies that would have produced errors in the Report. This data validation process is described in the Technical Appendix.

[22] The software that was used for the MBA program will be made available for noncommercial purposes. To apply for noncommercial review of the code, interested parties may contact SamKnows directly at team@samknows.com, with the subject heading “Academic Code Review.”

[23] As discussed previously, measured service tiers were tiers which constituted 5% or more of an ISP’s broadband subscriber base and had at least 30,000 subscribers.

[24] In these charts, we show Verizon’s median speed as a percentage of the mid-point between their lower and upper advertised speed range.

[25] In Reports prior to the 2015 MBA Report, for each ratio of actual to advertised download speed on the horizontal axis, the cumulative distribution function curves showed the percentage of measurements, rather than panelists subscribing to each ISP, that experienced at least this ratio. The methodology used since then, i.e., using panelists subscribing to each ISP, more accurately illustrates ISP performance from a consumer’s point of view.

[26] The speed achievable by DSL depends on the distance between the subscriber and the central office. Thus, the complementary cumulative distribution function will fall slowly unless the broadband ISP adjusts its advertised rate based on the subscriber’s location. (Chart 17 illustrates that the performance during non-busy hours is similar to the busy hour, making congestion less likely as an explanation.)

[27] As described earlier, Verizon DSL download and upload results are shown as a range since Verizon advertises its DSL speed as a range rather than as a specific speed.

[28] In this chart, we have shown the median download speed of Verizon-DSL as a percentage of the midpoint of the advertised speed range for its tier.

[29] In this chart, we have shown the median download speed of Verizon-DSL as a percentage of the midpoint of the advertised speed range for its tier.

[30] Chart 18.2 excludes Cox due to the sampling issue discussed in note 15 above.

[31] Chart 22.2 excludes Cox due to the sampling issue discussed in note 15 above.